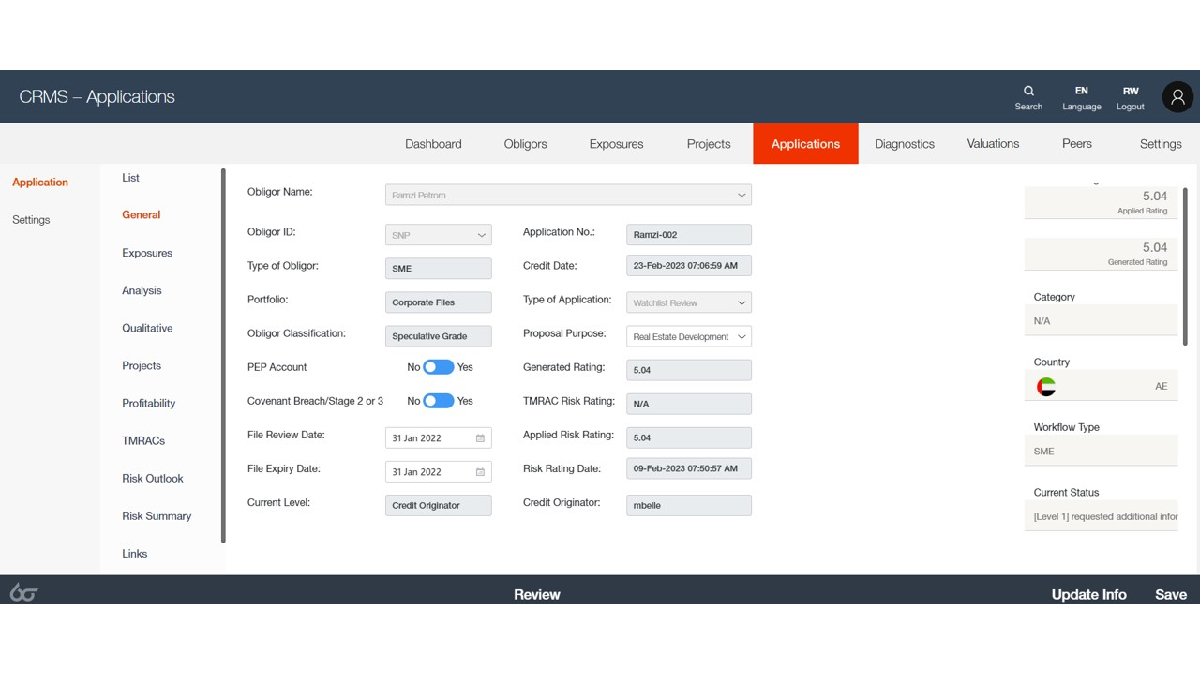

The Credit Application module is fully automated end-to-end credit automation segment of the system where Users can create and submit credit applications for risk rated Obligors.

The Credit Application Module is a fully automated credit application process

The bank can create multiple workflows relating to type of obligor, portfolio, country, type of application, and PEP or Default/Stage 2 and 3 categorization. Approval levels can be singular or multiple with origination having Makers, Checkers and Conditions Precedent flags. Approval levels carry multiple rules including majority, consensus, specific to individuals in case of multiple approving authorities. Reviewer notes provide full disclosure of decision making at all levels. Logs provides full time-line and bottle-neck issues.

Overview

Seamless Capturing of Data

1. Captures data from other CRMS modules automatically

2. Significantly saves time that is normally required for data entry

3. Outlines consolidated exposures at Group, Obligor and Facility levels

Automated Analysis of Data

4. Captures all the necessary data from EMM and blends it into a decision-making frame work.

5. Provides Analysis of financial data that helps users be guided efficiently throughout the process.

6. Provides automatic analysis on Management, Industry and Environment from data entered in the risk rating module, thereby saving time in assessing qualitative data.

7. Displays the deviations in pre-set rules (TMRACs), and applies corresponding risk rating overrides.

8. Allows minimal manual intervention; only the necessary to justify the risk rating and facilities requested (even these can be automated).

Full Administrative Functions

9. Allows for flexible multiple flows with multiple criteria to suite each organization’s requirements.

10. Provides electronic notifications to all concerned in the processing of transactions.

11. Allows for one-pager summary for decision makers to decide on the credit on the fly.

12. Captures and displays comments made by all involved in the decision-making process.

13. Given the automated nature of the process and provision of full logs, provides the bank with useful information relating to time management, and the frequency of modification of credits before being approved.

Resources

Brief Credit Auto 2023

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for 6 Sigma conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |

| Business Resiliency Accreditation | Builder | December 2024 |

| Sustainability Accreditation | Builder | December 2024 |

Interested in the full 6 Sigma report? Click here to buy it now.