6 Sigma Financial Consultancy Ltd

Exposure Management (EMM)

Comprehensive Loan Origination, Credit Administration and Portfolio Caps

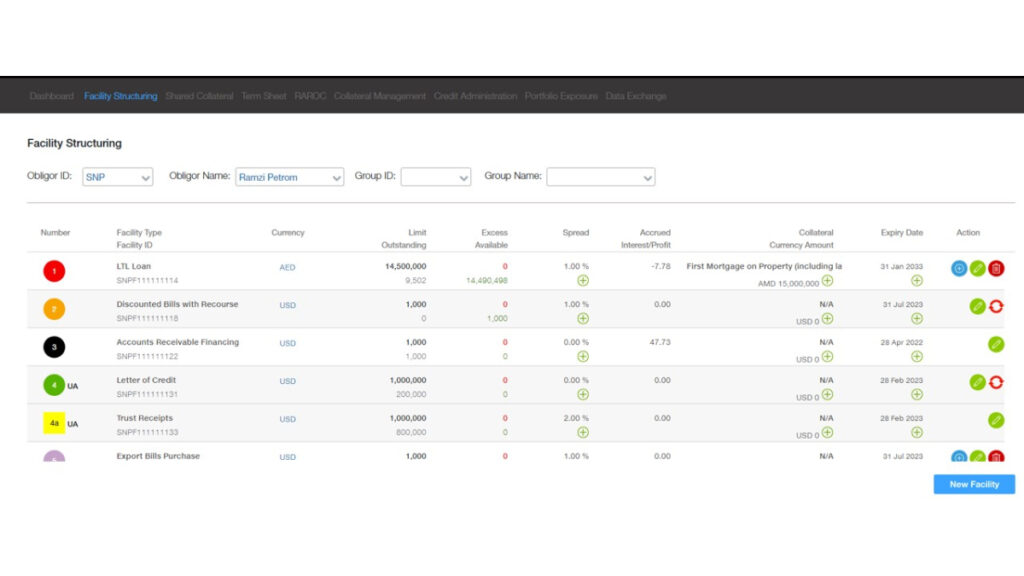

EMM is a module to manage, document and evaluate exposures. It is where facilities can be created for obligors and groups and where Collateral, Repayment and Pricing can be captured. It is also where Credit Admin can control the approval and release of lines, and allow for the capture of draw-downs. It is also for Risk Management to allocate caps on exposures to industries, countries, portfolios, products and collateral types.

Resources

ESG & Enterprise Readiness Assessment Scores for 6 Sigma conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |