Axiology Tokenisation System – Axiology

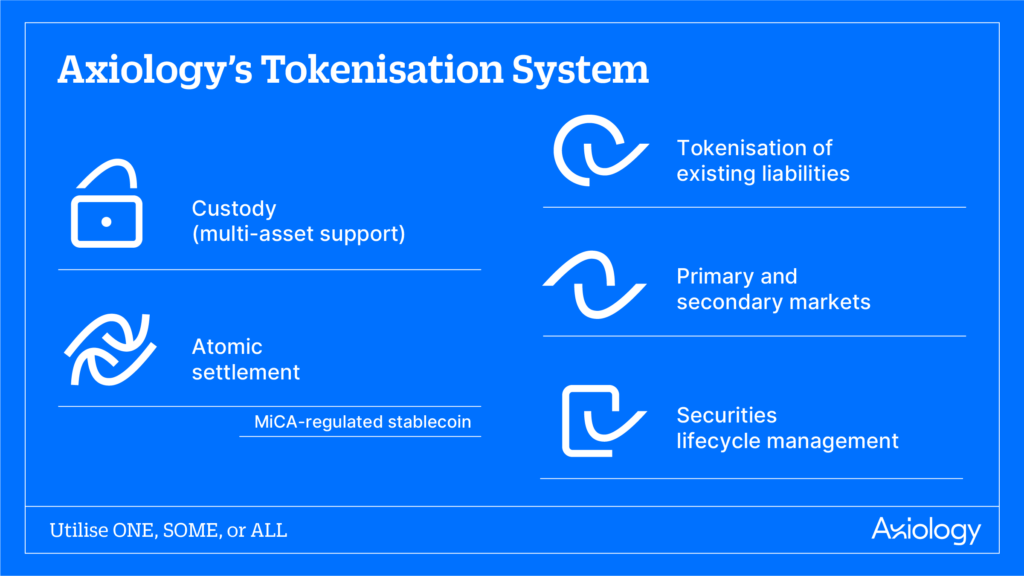

Integrated solution to manage all of your digital regulated liabilities.

Seamless tokenisation. Axiology empowers your financial Institution to work with digital liabilities.

Enhance your current operations by embracing the future with digital regulated liabilities. Our tokenisation system ensures that all digital regulated liabilities, from digital bonds to tokenised deposits, are managed efficiently, whilst maintaining compliance, security, and interoperability with existing systems. Boost operational efficiency and discover new opportunities in asset management with our cutting-edge distributed technology tailored for contemporary financial institutions.