CarbonOS – Triangle

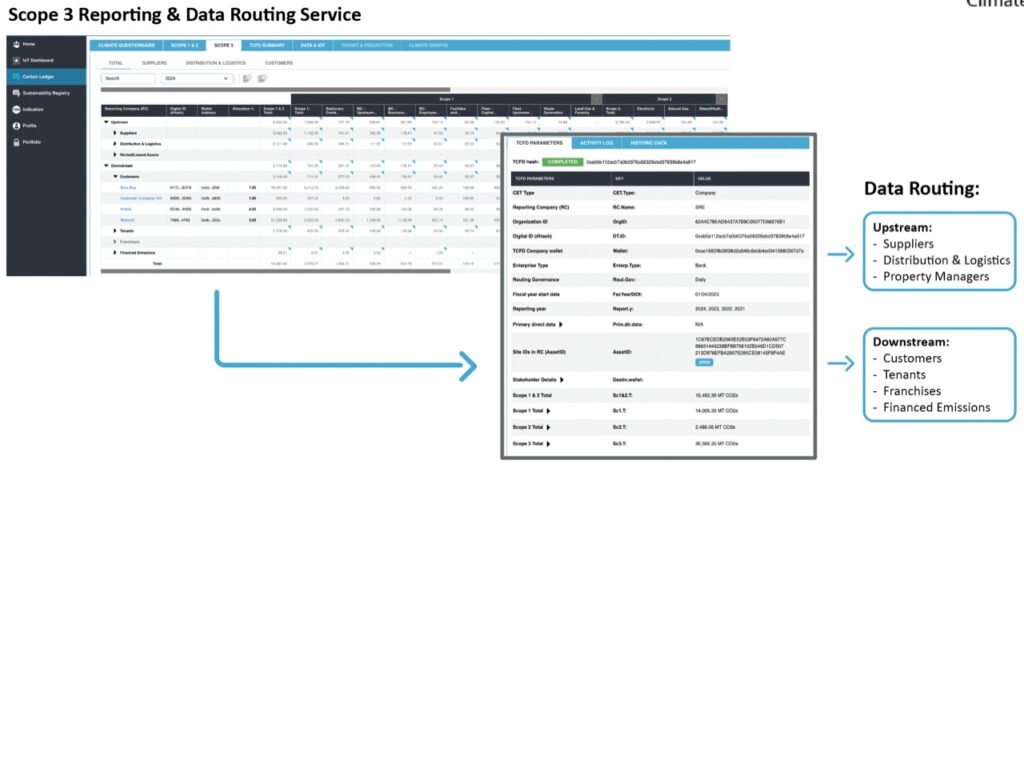

Carbon Finance Platform (Scope 3, Carbon Credits, & Sustainably Linked Lending)

Our Super Power is to solve your Scope 3 needs with an automated, revenue positive carbon finance platform

Our Scope 3 solution aggregates data, automatically, from each client’s unique set of data sources (IOT, billing systems, ERP) allocating the carbon footprint based on the size of the banking relationship. This data can then support sustainability-linked lending (reporting economic, operating and climate performance) and mint carbon credits or RECs, creating financial instruments for custody, collateralization, lending, or trading.