Cash-flow Analysis – Prestatech

Data-driven cash-flow analysis with in-depth insights

Unlock the power of modern cash flow analysis to drive smart decision-making for retail and SME clients.

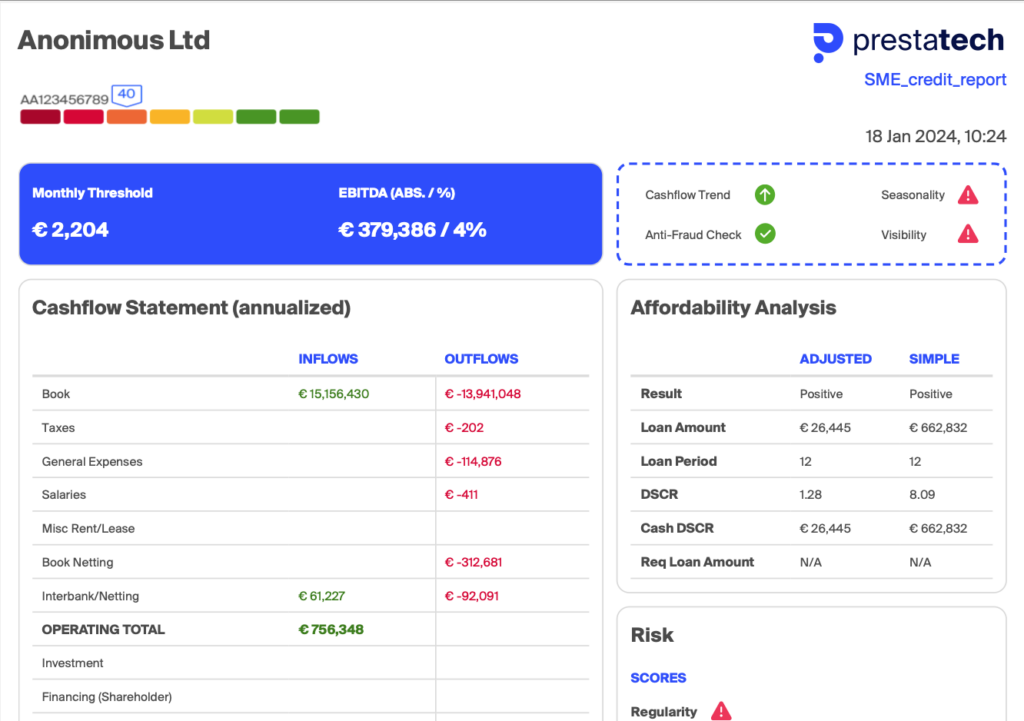

Prestatech’s Crash-flow Analysis Solution offers a powerful tool to perform credit analysis and decisioning by leveraging insights from bank transactions and cash-flow data. By integrating transactional and alternative financial data from various sources, it delivers a comprehensive analysis that covers cash-flow trends, affordability, and the borrower’s financial stability. Available in the UK, US, Germany, and Italy.