End-to-end Collection & Recovery Technology

QUALCO Collections & Recoveries helps banks manage high volumes of non-performing assets effectively and compliantly. The technology uses data-driven analytics to predict customer behaviour and optimise treatment strategies. It manages debt portfolios through the entire lifecycle, from performing accounts to early delinquency and recoveries. The solution supports all banking products, from unsecured debt to mortgages and SME loans and is used by creditors to manage accounts on both an in-house and outsourced basis.

Overview

The Perfect Fit for Temenos Tier 1 & 2 Banks

Our solution ideally fits to Temenos Tier 1 & 2 Banks size and business needs. Secures smooth T24 & Insight integration and evolution of the system.

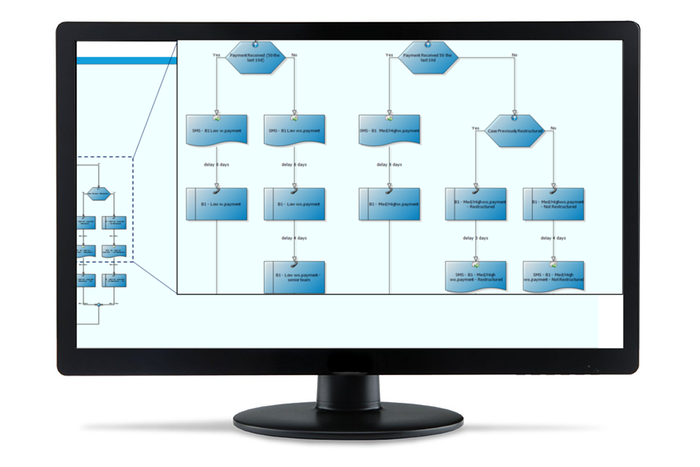

A Highly Sophisticated Decisions Engine

A highly sophisticated Decisions Engine enables the originator to determine the resolution strategy to apply, and manage the flow of the portfolio throughout the various stages of the debt lifecycle.

Compliant with ECB Guidance for Npl Management

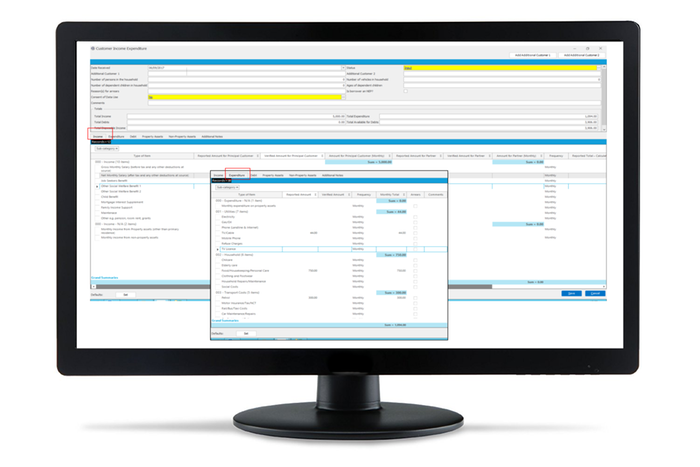

Set up workout units and allocate management. Reach a sustainable solution by considering disposable income and Net Present Value. Implement Going and Gone Concern approaches through user configurable workflows and configure restructuring products that offer a wide variety of options such as interest rate reduction, tenor extension, debt forgiveness, and split balance balloon payments.

Clarity on Performance

Clarity on performance, measurement and reporting. Monitor & improve productivity/financial performance through real-time reporting & analysis tools and built-in Data Warehouse.

Features

Advanced Segmentation, Customer Classification and Strategy Definition through the most sophisticated Decision Engine in the market incorporating scoring and decision that enables business decisions & automates treatment processes.

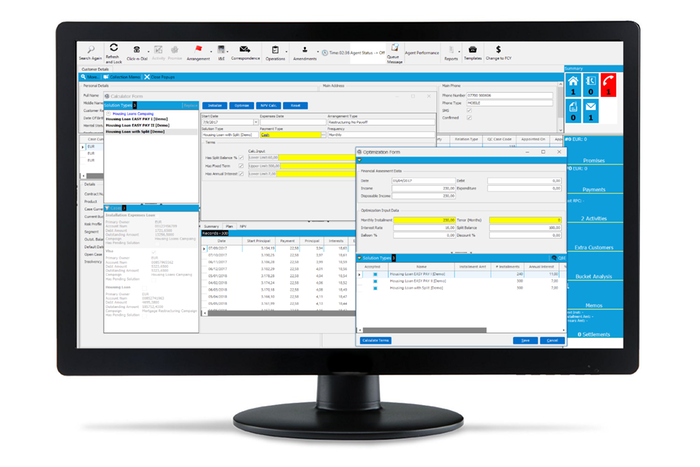

Customer Solutions functionality to configure, negotiate and offer affordable solutions to the customer with flexible repayment plans. Calculation of the NPV of affordable Solutions allows for ranked proposals to bank’s customers.

Financial Assessment functionality that identifies the disposable income of the client in order to choose the most appropriate solution and proper strategy re-shaping.

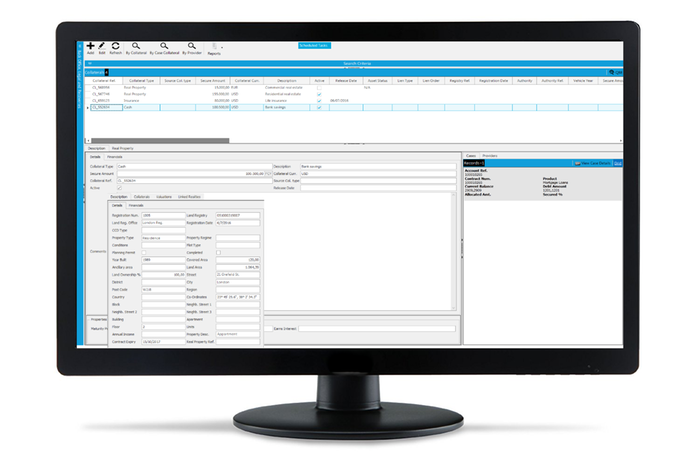

Collateral Management & Asset registry functionality for the management and maintenance of a detailed list of collaterals pledged by customers against their loan, with detailed information on their characteristics.

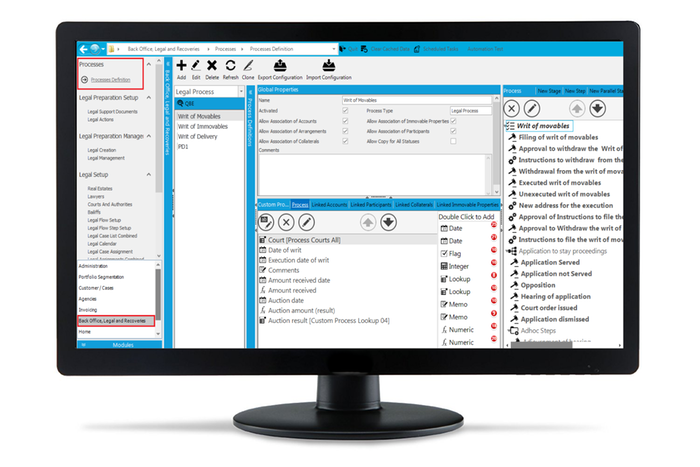

Legal Management and Process Set Up, through a fully configurable environment that supports end-to-end legal processes along with any related action taken to customers and accounts going under litigation.

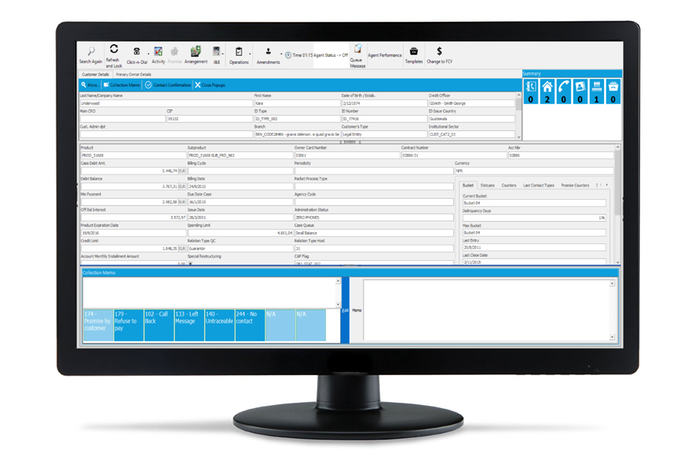

“One Call to Customer approach”. Due to the Customer centric approach of Qualco Collections & Recoveries and the presentation of all Customer information in one screen, the system allows the agent to conduct “one call” managing the complete Debt relation with the Customer.

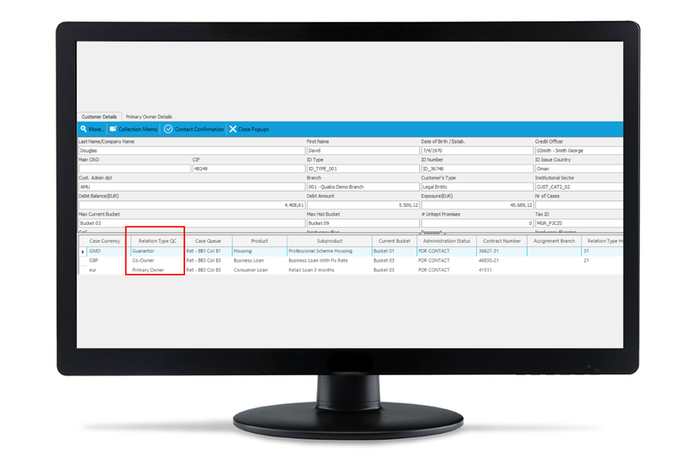

Customer relationships (e.g. main debtor, guarantors, joint cardholders, and other co-signers) between the account and customers of the Bank can be displayed and handled through the Collection Screen and various actions that allow different treatment for main owner and co –signers is supported.

Reporting at any management level through comprehensive and user-friendly out-of-the-box data warehouse, analytics environment & dashboard presentations.

Resources

United Bulgarian Bank case study

Vojvodjanska Banka case study

kbc case study

Stopanska Banka case study

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for QUALCO conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | February 2024 |

| Sustainability Accreditation | Builder | February 2024 |

Interested in the full QUALCO report? Click here to buy it now.