Temenos SaaS

Powering massive scalability, invigorating innovation, and delivering the broadest set of banking capabilities to accelerate your bank’s growth.

Explore what SaaS delivers for your bank

Get access to the broadest set of proven banking capabilities and grow your business through Temenos SaaS.

The trusted SaaS for financial services

Our clients demand the highest standards when it comes to risk, data, regulation, ESG and security management. Temenos SaaS delivers on these stringent needs to any financial institution in the world, while providing access to broad and deep market leading banking capabilities to compose exceptional banking experiences.

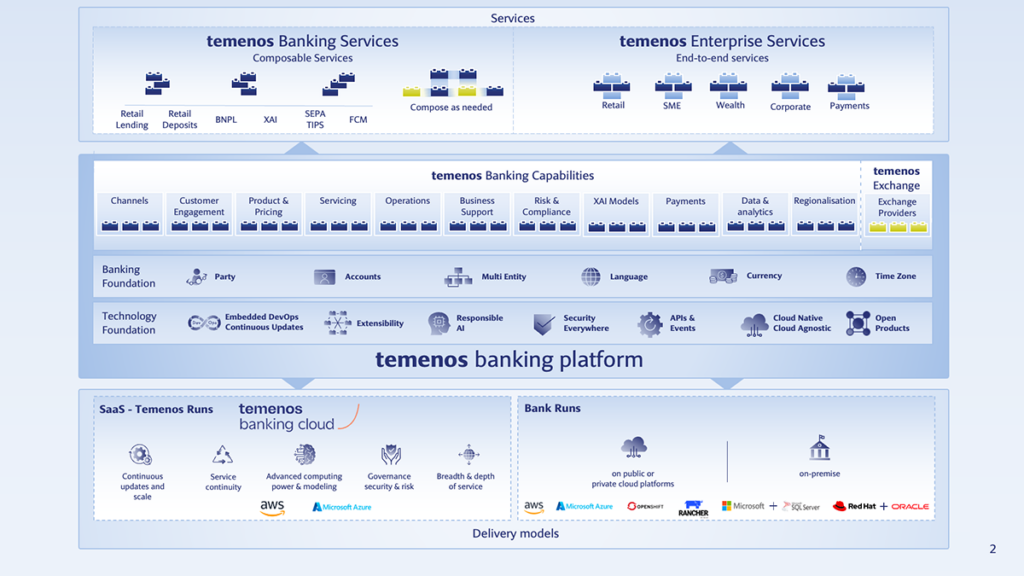

Temenos Enterprise Services

Get immediate access to pre-packaged, pre-configured, and end-to-end capabilities to support and continuously improve end-to-end banking experiences from a single service. On Temenos SaaS we currently provide Enterprise Services for Retail Banking, Business & Corporate Banking, and Wealth.

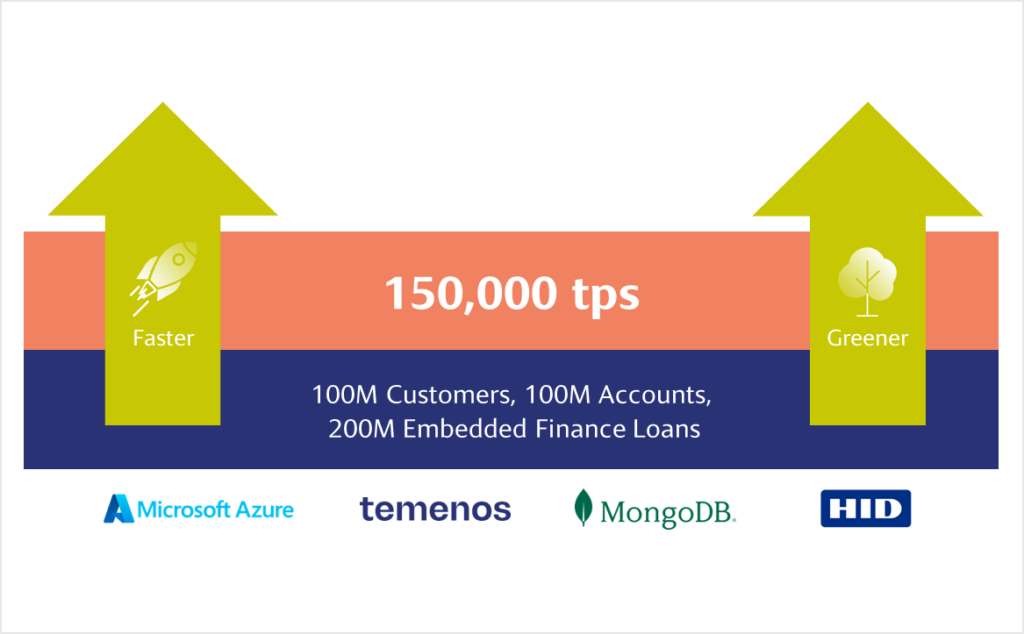

Up to 95% lower carbon footprint with SaaS banking

Temenos SaaS delivers on the growing sustainability needs of all financial institutions. Powered by hyperscalers, our clients create 92-98% annual savings in MTCO2e emissions, compared to on-premise alternatives.

Explore Temenos SaaS

Cloud partners

AWS

Temenos is an AWS Partner. Amazon Web Services (AWS) is the global cloud platform, offering over 200 fully featured services from data centers globally. Millions of customers are using AWS to lower costs, become more agile, and innovate faster.

Microsoft Azure

Microsoft commits to banking with bank-grade security, fast time to delivery, dynamic scale, and resiliency through the Azure datacenters. Get our eBook and learn about the dedicated support for the financial industry, as Azure helps banks to navigate through more than 60 regions worldwide.