Temenos Announces Strong Q2 2019 With Total Software Licensing Growth of 21%

Strong sales performance across geographies and client tiers in Q2

GENEVA, Switzerland, July 17, 2019 – Temenos AG (SIX: TEMN), the banking software company, today reports its second quarter 2019 results.

Q2 2019 highlights

- Strong sales performance across geographies and client tiers in Q2

- Digital, regulatory and cost pressures and move to open banking are driving demand

- Asia and Americas particularly strong in Q2 with significant US sales across products

- Key wins include European-based payments company for Temenos Transact and two global Tier 1 banks, one in US and one in Europe, for Temenos Infinity

- Ongoing investment in sales and product to support the six drivers of growth – Temenos Transact, Temenos Infinity, Wealth, Payments, Fund Management and SaaS

- Acquisition of AI platform Logical Glue significantly enhances the Temenos banking platform

- Sales momentum underpinning confidence in delivering 2019 guidance

- Recognition of leadership position across core banking and digital front office

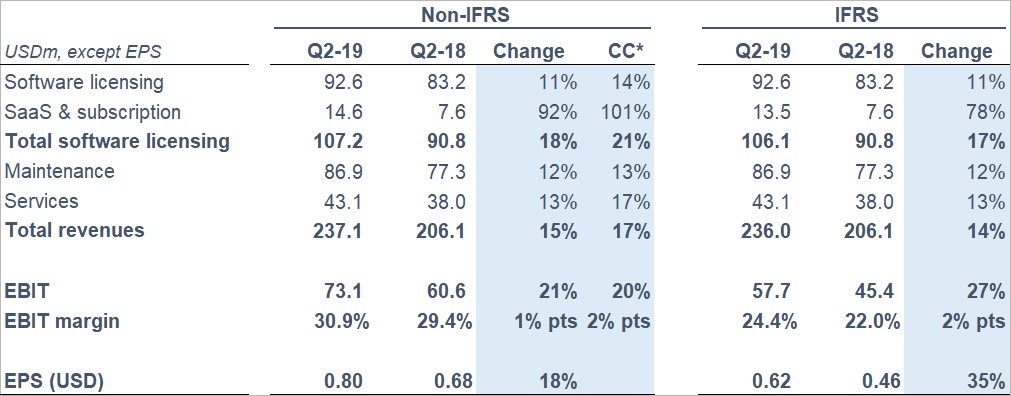

Q2 2019 Financial Summary (Non-IFRS)

- Non-IFRS total software licensing revenues up 21% c.c.

- Non-IFRS maintenance growth of 13% c.c.

- Non-IFRS total revenue growth of 17% c.c.

- Non-IFRS EBIT up 20%, EBIT margin of 30.9%

- Non-IFRS EPS increase of 18%

- Operating cash flow up 16%, LTM cash conversion of 111%

- DSOs down 4 days to 110 days (6 days proforma)

Commenting on the results, Temenos CEO Max Chuard said:

“I am very pleased with our performance in Q2, which built on the strong start we had in the first quarter. The growth continues to be broad-based across geographies and client tiers, with Asia and the Americas seeing particularly strong sales in the second quarter. The US was a substantial contributor with signings across a range of products and we continue to leverage our growing footprint and the integration of Avoka to expand our presence in that market.

We are benefiting from six drivers of growth today, across digital front office, core banking, wealth, payments, fund administration and SaaS, and Temenos has an established and credible solution to drive market share in each of these segments. I was delighted that Temenos was once again named by Forrester as the leading vendor of core banking platforms and it was equally important that they recognized Temenos Infinity as a global leader in the digital front office segment.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We continued our strong performance in Q2 to deliver total software licensing growth of 21%, total revenue growth of 17% and EBIT growth of 20%. We are seeing traction across our product offerings from front office through to the core, and also see continued increase in demand for SaaS and cloud.

We remain disciplined around our cash and balance sheet, with inflows of USD 77m in operating cash in Q2, our DSOs reducing 4 days year-on-year and our leverage coming down to 1.5x net debt to EBTIDA by the end of the quarter. The outlook for 2019 is positive with our sales momentum underpinning our confidence in delivering our 2019 guidance.

We also introduced new sustainable annual growth targets at our Capital Markets Day in May of at least 15% CAGR for total software licensing and 10-15% CAGR on total revenue, reflecting our belief that we can grow the business sustainably at these rates for the long term, given our leadership position and the sustainable structural growth in our end market.”

Revenue

IFRS revenue were USD 236.0m for the quarter, an increase of 14% vs. Q2 2018.

Non-IFRS revenue was USD 237.1m for the quarter, an increase of 15% vs. Q2 2018.

IFRS total software licensing revenue for the quarter was USD 106.1m, an increase of 17% vs. Q2 2018.

Non-IFRS total software licensing revenue was USD 107.2m for the quarter, an increase of 18% vs. Q2 2018.

EBIT

IFRS EBIT was USD 57.7m for the quarter, an increase of 27% vs. Q2 2018.

Non-IFRS EBIT was USD 73.1m for the quarter, an increase of 21% vs. Q2 2018.

Non-IFRS EBIT margin was 30.9%, up 1% point vs. Q2 2018.

Earnings per Share (EPS)

IFRS EPS was USD 0.62 for the quarter, an increase of 35% vs. Q2 2018.

Non-IFRS EPS was USD 0.80 for the quarter, an increase of 18% vs. Q2 2018.

Operating Cash Flow

IFRS operating cash was an inflow of USD 77m in Q2 2019 compared to USD 67m in Q2 2018, representing an LTM conversion of 111% of IFRS EBITDA into operating cash.

2019 Guidance

Our guidance for 2019 is in constant currencies. The guidance is as follows:

- Non-IFRS total software licensing growth at constant currencies of 17.5% to 22.5% (implying non-IFRS total software licensing revenue of USD 431m to USD 450m)

- Non-IFRS revenue growth at constant currencies of 16% to 19% (implying non-IFRS revenue of USD 966m to USD 991m)

- Non-IFRS EBIT at constant currencies of USD 310m to 315m, (implying non-IFRS EBIT margin of c. 31.9%, or 150bps expansion organically excluding the impact of Avoka)

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2019 tax rate of 15% to 16%

Currency Assumptions for 2019 Guidance

In preparing the 2019 guidance, the Company has assumed the following:

USD to Euro exchange rate of 0.881;

USD to GBP exchange rate of 0.757; and

USD to CHF exchange rate of 1.00.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 17 July 2019, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a conference call to present the results and offer an update on the business outlook, which can be followed either through the dial-in numbers or webcast. Listeners who have not pre-registered can access the conference call using the following dial-in numbers:

+41 (0) 58 310 50 00 (Europe & RoW)

+44 (0) 207 107 0613 (UK)

+1 (1) 631 570 56 13 (USA)

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed on the Temenos Investor Relations page.

IFRS 16

Temenos has implemented IFRS 16 for reporting period 1st January 2019 onwards using the modified retrospective method. Under the modified retrospective method the 2018 and prior results will not be restated under IFRS 16. From 2019, the reporting results will only be provided under IFRS 16.

For more information on the impact of IFRS 16, please visit the Temenos Investor Relations page.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2019 non-IFRS guidance:

- FY 2019 estimated deferred revenue write down of USD 4m

- FY 2019 estimated amortisation of acquired intangibles of USD 48m

- FY 2019 estimated restructuring costs of USD 5m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after 17 July 2019. The above figures are estimates only and may deviate from expected amounts.