Smart Business Banking

Temenos Smart Banking Advisor empowers financial institutions to become trusted partners by breaking the boundaries of traditional banking, and proactively supporting small business growth.

Example Use Case: How Temenos helps banks to become a trusted partner for small and medium-sized enterprises

Charlene is the CEO and co-founder of an Ecommerce Startup, spending most of her time focusing on business growth and expansion. However, operations like invoicing, payroll, inventory, marketing, and recruitment are time consuming and erode her passion over time.

With Temenos Smart Banking Advisor, small businesses—like the one Charlene operates—can get a real-time view of their businesses and get actionable insights and contextual recommendations that help their businesses grow, thus enabling banks to give their customers additional reasons to bank with them. This demo provides a complete overview of the product.

Watch the Demo: Integrated Banking Experience for Small and Medium-Sized Enterprises

Temenos Smart Banking Advisor powered by Data, Analytics, and AI is a solution that helps small business owners grow their businesses instead of running them. It is an innovation that makes intelligent decisions, problem solves and saves time. It works by aggregating data through APIs connected to multiple financial and business solutions like ERP, HR, Payroll, and expense management.

Demo: Sustainable Financing for Small and Medium-Sized Enterprises

The ‘GoEco App’ from Temenos empowers Banks to provide small businesses with the financial impetus for expansion, modernization, and refurbishment of their businesses.

About Temenos Smart Banking Advisor and Temenos Digital Business Banking

Temenos Smart Banking Advisor is an innovative solution that makes intelligent decisions, solves problems and saves time. It works by aggregating data through APIs connected to multiple financial and business solutions like ERP, HR, Payroll, and expense management.

Temenos Digital for Business removes the complexity of business banking and enables SME owners to focus on running their business and fulfilling their entrepreneurial dreams. The solution provides frictionless experiences throughout the entire customer journey and supports the SME business operation with highly automated digital processes. Thanks to embedded AI and data capabilities Temenos Digital for Business supports SMEs with relevant insights and suggestions and puts the business owners in control of their company’s financial lives.

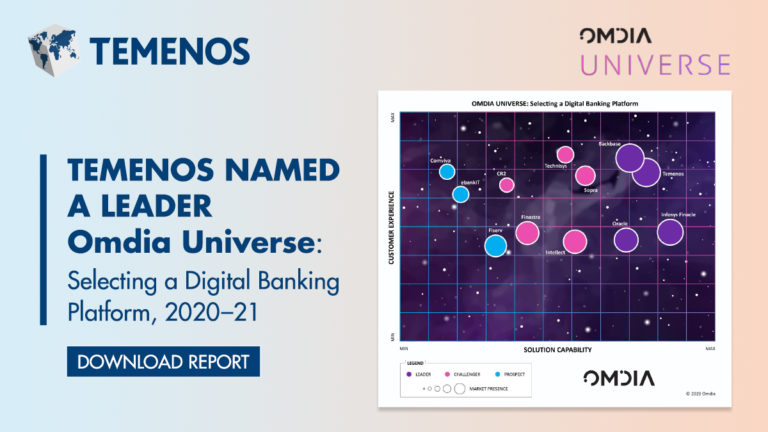

Recognized as a Leader by Global Analysts

Customer Success Stories

Find out how Temenos helps drive seamless and frictionless digital experiences for SME Banking in Asia-Pacific and globally

“To succeed in the fast-evolving digital landscape, we need flexible, scalable solutions that are both responsive and efficient. Temenos Banking Cloud opens up new opportunities for Baiduri Bank by providing instant access to world-class banking capabilities and the flexibility to consume what we need as we need it.”

Ti Eng Hui, Chief Executive Officer, Baiduri Bank

“We chose Temenos as we needed the agility and speed of a SaaS solution, and only the Temenos Banking Cloud offered the breadth of financial services functionality to meet our current and future needs.”

Thariq Usman Ahman, Deputy CEO, KAF Investment Bank

Featured content

Listen to the conversation with Rafiza Ghazali, Director of Digital Banking at KAF Investment Bank, and host Swapnil Deshmukh, Regional Director for Digital Banking at Temenos talking about the changing bank landscape and customer expectations.

Thought Leadership

Ebook: Six touchpoints to create emotional SME connections

Explore ways that banks can start to better support SMEs across multiple touchpoints, all through the lens of a business owner’s journey from idea to enterprise.

Next phase of digitising corporate banking in a hyper-connected world

This webinar recording shares how developing open banking frameworks and secured APIs can scale up financial services offerings.

Whitepaper: The Corporate Banking Revolution

Top corporate banking trends likely to be adopted by financial institutions globally in 2023. Read more.

The Temenos Value Benchmark – Maximizing Business Value From Your Investment in Information Technology

A long term partnership to help you focus on business value.

The Rise of Embedded Finance in SME Banking

For banks, embedded finance gives them a route to expanding their revenue base and building partnerships with retailers, manufacturers and many other types of business that want to offer these products.

Empowering Business with Embedded Finance

Robert Wint, Senior Product Director, Business Banking, discusses the key trends in SME banking, the benefits small businesses can gain through embedded finance and how technology enables banks to provide better services to SMEs.

Industry Insights

Customer Experience, AI, and Cloud Banking insights from global executive surveys and regulatory review – brought to you by the Economist Intelligence Unit (The EIU) and Temenos