Missing Measures of Digital Success

White Paper

Banks are pursuing a digital-first approach to redefine customer experience, with the banking-as-a-platform operating model paving the way. This calls for defining new digital milestones as important indicators of the progress banks make in their transformation journeys.

While most banks report good progress in their digital initiatives, many do not quantifiably measure these initiatives against revenue, profitability, digital experience, and operational efficiency.

Given the scale and complexity of digital initiatives, evaluating these parameters are critical to improving efficiency and performance, especially as more banks seek to position themselves as leading digital platforms and lifestyle ecosystem.

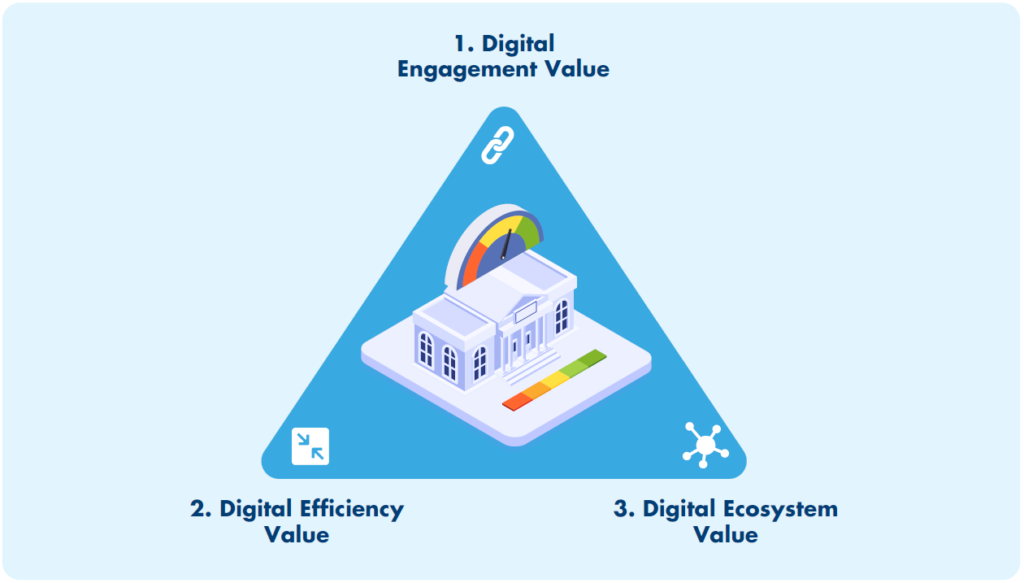

As such, banks should monitor their digital success in three distinct areas:

Hence, how can banks in Asia Pacific incorporate a comprehensive digital success evaluation framework into their transformation strategy?

In continuation of our “Digital Bank of Tomorrow” thought leadership series, we are excited to launch its part two.

This latest ” Missing Measures of Digital Success” White Paper provides you insights on:

- The Missing Measures: What are the Matrix that banks should consider for quantifiably measuring their digital success? What are the currently established, trendy ones and what are the missing ones?

- Indicative Benchmarks: Check your digital success progress versus “the Best-in-class”

- From Framework to Actions: How can banks incorporate this Digital Success Framework into your 2022 strategy

In Conversation with…

Discover in-depth insights

LevelUP with Temenos Infinity

Missing Measures of Digital Success

In continuation of our Digital Bank of Tomorrow thought leadership series, we are bringing you Episode 2 of our “In Conversation with experts” session.

Focusing on : why must banks in APAC adopt a digital success evaluation framework? And to translate that into actions, what should banks start to consider now?

” Banks in Asia Pacific have been investing in digital for years. And we all know that banks are KPI driven organizations, it’s not new that banks always benchmark their financial returns on traditional investment. However, we still see that many of these metrics are not built around the context of digital.”

“Banks need to incorporate into their measures of success is : what are customer expectations. And in digital, that means measuring convenience. And it means measuring engagement.”

“Banks can learn from Netflix and apply a similar recommendation engine for Banking products/services to create more value for their customers.”

Download White Paper

Missing Measures of Digital Success