The challenge facing the challengers

The climate has changed for fintechs and challenger banks. They are entering unchartered territory amidst rising interest rates, echoes of a recession, tightening funding and pushback from incumbent banks.

The challengers are all customer-centric, leveraging disruptive technologies such as AI to develop compelling customer experiences. But how do they navigate through…

- Profitability barriers?

- The uncertain path for growth?

- Rising interest rate and recessionary environment?

450

challenger banks globally

$300B

worth in 2022 compared to $161B in 2017

up to 75%

lower operational cost from fully operating digitally

Byte-sized banking: Can banks create a true ecosystem with embedded finance?

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe.

Can disruptive technologies bolster the competitiveness of North American Banks?

North American banks are turning to new technologies, to modernize and secure their core infrastructure and processes, while competing with non-traditional players. Download the new report from the Economist, commissioned by Temenos.

Temenos Highwater Benchmark

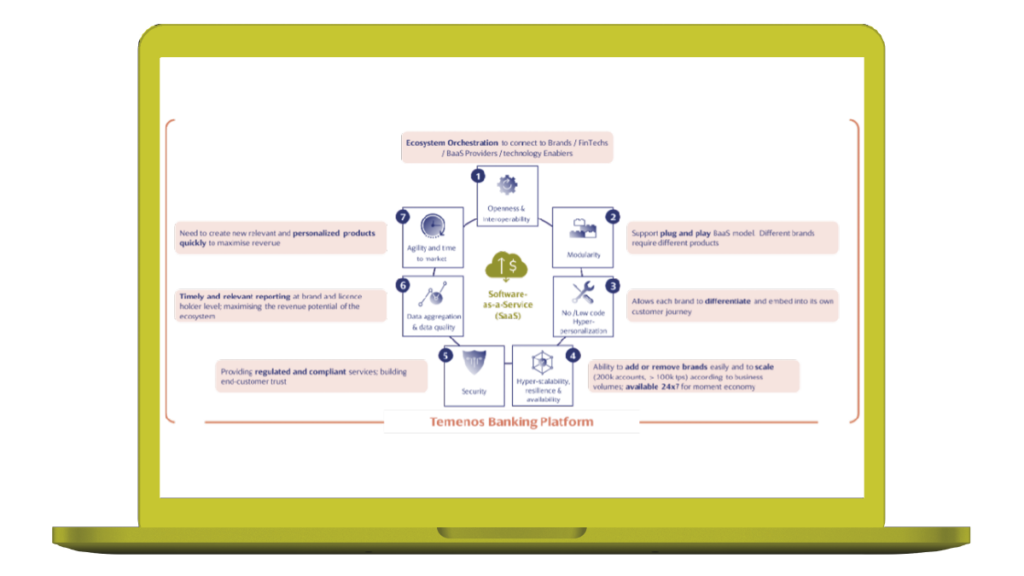

As banks are expected to seamlessly perform huge transaction volumes around the clock, the Temenos Banking Platform it’s massive scalability once again.