The core banking market is turning

Temenos reported very strong Q2 results: total software licences were 56% higher than a year ago (15% excluding acquisitions and FX).

Temenos reported very strong Q2 results: total software licences were 56% higher than a year ago (15% excluding acquisitions and FX).

The results reflect a lot of Temenos-specific factors, such as the successful development of the market in the US, where Temenos had two very strategic deals in the quarter, and continual market share growth in Europe and the Middle East.

But, Temenos is also benefiting from improving market dynamics

The market grew in 2014 – faster than first thought

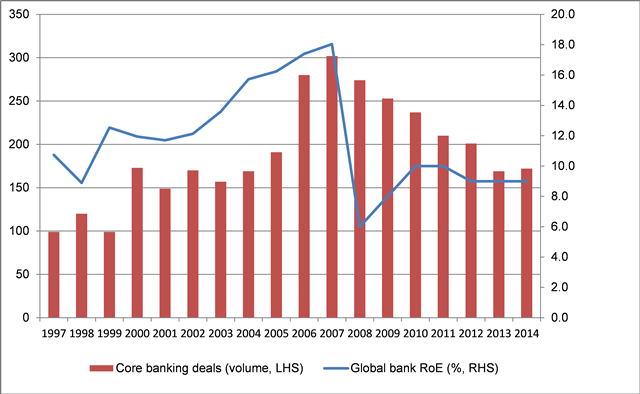

The IBS League Table showed volume growth for the first time in 2014. Every year, International Banking Systems (IBS) publishes a league table of core banking system sales. This captures all system sales to new-name customers. In 2014, it showed the first volume growth in the market since 2007 (i.e. pre-crisis). However, the volume growth was very slight (3 more systems were sold in 2014 than in 2013), so it was difficult really to define 2014 as a turning point.

But, the growth by value in 2014 was much more significant. Each year, we carry out an exercise to reconstruct the IBS League Table, using a variety of sources to fill in the gaps in the IBS dataset and build a complete picture of our market. Essentially, we arrive at an almost full view of which vendor won which deals in which countries and for what value. The result of that exercise showed around a 5% growth in value of sales made to new name customers compared to a 2% growth in volume.

We may also be witnessing the start of a break down in the historically very strong correlation between bank RoE and core banking sales. That is to say, core banking replacement is potentially moving from a pro-cyclical activity (one which banks undertake when times are good) to one that is more strategic/structural (and, thus, less correlated with the economic cycle).

Core banking sales vs Bank RoE

Why is the market growing again?

We would point to various factors, such as:

- Unsustainability of existing systems and the opportunity cost. Maintaining existing legacy systems, which most developed market banks still run, consumes three-quarters of IT budgets, crowding-out investment in IT enhancements. Further, these legacy systems are not fit for purpose: complex and not able to cope with the demands of digital banking and increasingly at risk of failure.

- A growing appreciation of the importance of technology in creating competitive advantage. As banking digitizes (moves online) and as payments dematerialize (move away from cash), banks will continue to reduce their physical presence and their staff numbers and IT will become a bigger proportion of expenditure and bigger source of differentiation (in areas such as efficiency and risk management for sure, but also most importantly in terms of customer experience). It is interesting to note that, after a first big round of CEO changes following the credit crisis (where banks appointed CEOs to cut costs, shrink risk-weighted assets and generally restore investor confidence) we now seem to be seeing a second wave of CEO changes. A new breed of CEO (digitally savvy, alive to changing customer behaviour and the changing competitive threat, and not necessarily drawn from the banking industry) seems to be coming to the fore to shift focus towards digitization – executives like Ernest Leung at BNP Paribas Wealth Management, Tidjane Thiam at Credit Suisse and David McKay at RBC.

- A realization that, without core replacement, banks can’t become true digital banks. To be a digital bank requires the right foundations. It requires an IT infrastructure that is built around customers, not products with (inter alia) a unified data architecture, real-time processing and straight-through processing. As Michal Panowicz put it very well during his very interesting debate with Brett King, “You can only expose in the channel what has actually been process-enabled in the product factory…you will only see the [level of digital] experience that the product factory and the rails have enabled.”

Is the growth sustainable?

For the sake of the core banking industry, which has weathered several difficult years, I hope that the current trend is sustained. But, more importantly, I hope so for the sake of the banking industry.

As we argued in a recent paper, the banking industry is at a turning point. While banks will always be necessary, their roles in our lives could become seriously diminished if they do not embrace what we term “experience-driven banking” (essentially, acting as an infomediary to give value-added advice and recommendations). If this happens, the nature, importance and profitability of the industry will shrink unrecognisably from where it is today.