The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

*Constant currency (c.c.) adjusts prior year for movements in currencies.

Q4 and FY 2019 Highlights

- Digital, regulatory and cost pressures and move to open banking continue to drive market growth

- Strong sales momentum in Europe, Asia and the Americas

- MEA performed well in Q4 with multiple new client wins

- Double digit growth in Temenos Transact, Temenos Infinity grew multiple times faster

- Exceptional growth in SaaS across geographies and client tiers, with Annual Contract Value (ACV) up 159% in Q4 and 68% in FY 19 c.c.

- 33 new client wins in Q4, total of 93 new customer wins in FY 19

- 330 go-lives across all clients in FY 19

- Completed the integration of the Kony organisation, driving pipeline growth in the US

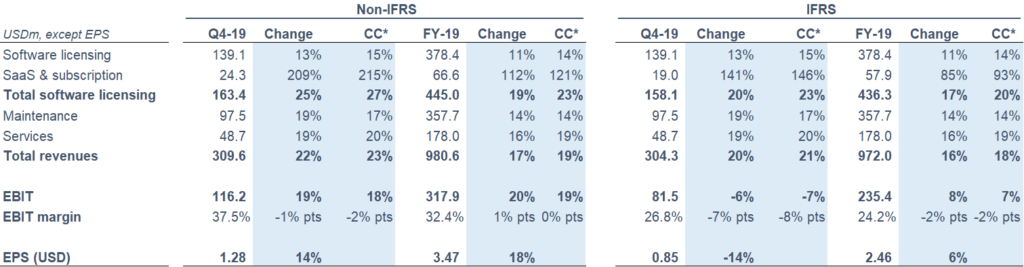

Q4 and FY 2019 Financial Summary (non-IFRS)

- Non-IFRS total software licensing revenues up 27% in Q4 19 and up 23% in FY 19 c.c.

- Non-IFRS maintenance growth of 17% in Q4 19 and 14% in FY 19 c.c.

- Non-IFRS total revenue growth of 23% in Q4 and 19% in FY 19 c.c.

- Non-IFRS EBIT up 18% in Q4 19, FY 19 non-IFRS EBIT margin of 32.4%

- FY 19 non-IFRS EPS increase of 18% to USD 3.47

- FY 19 cash conversion of 100%

- DSOs at 120 days reported including Kony, 114 days organic

- Profit and cash flow strength support proposed dividend of CHF0.85, a 13% annual increase

- 2020 guidance of non-IFRS total software licensing growth of 18.5% to 23.5% (c.c.), non-IFRS total revenue growth of 16% to 20% (c.c.) and non-IFRS EBIT of USD 380m to 385m.

Commenting on the results, Temenos CEO Max Chuard said:

“We delivered an excellent set of results in the fourth quarter and for the full year 2019. We saw strong sales momentum across geographies, with double-digit growth in Temenos Transact and very strong demand for Temenos Infinity. We have seen significant growth in demand for SaaS with signings in the fourth quarter across Asia and Europe for both Temenos Transact and Temenos Infinity.

It took Temenos 19 years to achieve approximately USD 100m of license bookings while we are forecasting to achieve the same milestone in less than four years with ACV bookings. This is a tectonic shift in growth acceleration never witnessed before in the history of Temenos. At the end of 2019, ACV bookings growth is already outpacing license bookings growth by a factor of more than 4x. While we are expecting sustained strong growth in license bookings in 2020, ACV bookings growth is set to further expand its relative growth multiple to 5x.

2019 has been a transformational year for us in terms of product and technology, with the separation of manufacturing and distribution by making Temenos Transact and Temenos Infinity stand-alone products that can be integrated through APIs. We have invested heavily in our technology, launching a microservices architecture to enable tier 1 and 2 clients to continuously renovate and to let them take advantage of cloud-based banking distribution services in the front office, and a more granular, progressive renovation in the back office. We have also demonstrated our leadership in cloud, with our strategic partnership with Google and our benchmarking of 50,000 transactions per second on AWS on distributed database NuoDB in which we are a strategic investor. We have embedded Explainable AI across our products to enable our clients to make faster, accurate and explainable decisions using AI across their front and back office.

We have completed the integration of the Kony organisation and are driving pipeline growth globally including in the US and especially across Temenos Transact and Temenos Infinity. Our investment in product, people and strategic acquisitions in 2019 has laid the foundation for a strong 2020.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We delivered strong growth in Q4 with total software licensing growth of 27%, total revenue growth of 23% and EBIT growth of 18%, ahead of our sustainable annual growth targets. We also delivered a full year 2019 EBIT margin of 32.4%, ahead of our revised guidance. We continued our strong momentum in SaaS, with our ACV up 159% in the quarter and 68% in full year 2019.

We remain very focused on our cash and balance sheet, and had operating cash inflow of USD 364m in the 2019, with an additional substantial cash inflow in the first few days of January. We ended the quarter with DSOs at 120 days reported of which 6 were due to the acquisition of Kony. We expect DSOs to continue declining in Q1 and to be below 110 days by the end of 2020 and our cash conversion to be well above 100%. Our leverage decreased to 2.6x net debt to EBITDA at the end of the quarter, and we expect this to approach 1.5x by the end of 2020.

We are recommending a 2019 dividend of CHF 0.85, an increase of 13% on 2018. We have a strong outlook for 2020 with our pipeline at record high levels. We are guiding for non-IFRS total software licensing growth of 18.5% to 23.5% and non-IFRS total revenue growth of between 16% and 20%. We are guiding for 2020 non-IFRS EBIT of USD 380m to 385m, which implies a margin of c.33%.”

Revenue

IFRS revenue were USD 304.3m for the quarter, an increase of 20% vs. Q4 2018.

Non-IFRS revenue was USD 309.6m for the quarter, an increase of 22% vs. Q4 2018.

IFRS total software licensing revenue for the quarter was USD 158.1m, an increase of 20% vs. Q4 2018.

Non-IFRS total software licensing revenue was USD 163.4m for the quarter, an increase of 25% vs. Q4 2018.

EBIT

IFRS EBIT was USD 81.5m for the quarter, a decrease of 6% vs. Q4 2018.

Non-IFRS EBIT was USD 116.2m for the quarter, an increase of 19% vs. Q4 2018.

Non-IFRS EBIT margin was 37.5%, down 1% points vs. Q4 2018.

Earnings Per Share (EPS)

IFRS EPS was USD 0.85 for the quarter, a decrease of 14% vs. Q4 2018.

Non-IFRS EPS was USD 1.28 for the quarter, an increase of 14% vs. Q4 2018.

Operating Cash Flow

IFRS operating cash was an inflow of USD 364m in FY 2019 compared to USD 365m in FY 2018, representing an LTM conversion of 100% of IFRS EBITDA into operating cash.

2020 Guidance

The guidance for 2020 is in constant currencies.

- Non-IFRS total software licensing growth at constant currencies of 18.5% to 23.5% (implying non-IFRS total software licensing revenue of USD 527m to USD 550m)

- Non-IFRS revenue growth at constant currencies of 16% to 20% (implying non-IFRS revenue of USD 1,137m to USD 1,177m)

- Non-IFRS EBIT at constant currencies of USD 380m to 385m, (implying non-IFRS EBIT margin of c. 33%)

- SaaS ACV to grow by more than 100%, implying at least USD42m for FY 2020

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2020 tax rate of 15% to 16%

Currency assumptions for 2020 guidance

In preparing the 2020 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.12;

- GBP to USD exchange rate of 1.28; and

- USD to CHF exchange rate of 0.99

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 12 February 2020, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a conference call to present the results and offer an update on the business outlook, which can be followed either through the dial-in numbers or webcast. Listeners who have not pre-registered can access the conference call using the following dial in numbers:

+41 (0) 58 310 50 00 (Europe & RoW)

+44 (0) 207 107 0613 (UK)

+1 (1) 631 570 56 13 (USA)

The webcast can be accessed by clinking on this webcast link.

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2020 non-IFRS guidance:

- FY 2020 estimated deferred revenue write down of USD 15m

- FY 2020 estimated amortisation of acquired intangibles of USD 65-70m

- FY 2020 estimated restructuring costs of USD 10m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after 12 February 2020. The above figures are estimates only and may deviate from expected amounts.

Other Definitions

Constant currency (c.c.) adjusts prior year for movements in currencies. SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

Press and media enquiries

Conor McClafferty | Martin Meier-Pfister