Banking Customer Acquisition: Top 7 Ways to Improve It

Knowing and understanding these Top 7 Best Practices will enable your financial institution to design successful digital applications, and increase digital sales.

Many banks give customers the opportunity to apply for their products online, however, the digital experience is not always effective. Have you ever tried to apply for a bank account online only to be left gasping at how complicated and lengthy the experience is?

Temenos’s research on digital banking shows:

- 89% abandonment of current account applications

- 93% abandonment of credit card applications

- 85% abandonment of loan applications

At Temenos, we believe it shouldn’t be that difficult. We would like to share our best practices, based on working with over 3,000 financial institutions of all sizes from around the world. Knowing and understanding these Top 7 Best Practices will enable you to design successful digital applications, which will deliver a frictionless customer experience and increase digital sales.

1. Design from your customer in. Give and take just the minimum information you need, remembering that the customer will be on a small screen, with touchscreen input, and a lot of distractions. Personalize the experience and make offers that not only resonate with them but also demonstrate how well you understand them.

2. Leverage pre-fill and validation services. Optimize the new experience for customers, thinking about how to save them time and hassle. For a mobile customer, pre-fill as much as possible from internal systems, using an API-based service layer to adapt the data. Use APIs to connect to outside address lookup and aggregation services, in order to eliminate error-prone data input. And never ask for the same information twice, especially if the customer is not “new to bank”.

3. Generate and nurture leads. When someone abandons an application for a banking product, it doesn’t always mean they’re not interested. Life can get in the way. So, generate and nurture leads from incomplete applications.

4. Minimize fields and ask why? Eliminate unnecessary fields. Ask yourself if a field is really needed. For example, asking for someone to enter and then confirm their email address takes time and can be difficult from a mobile device. Determine what info you really want to know and get rid of the rest

5. Use data to continuously improve. Use behavioral analytics to identify key customer friction points. Identify where their activities stall, incur errors, or drop off/ abandon. Then rapidly iterate, making small, incremental changes and measure the improvements over time.

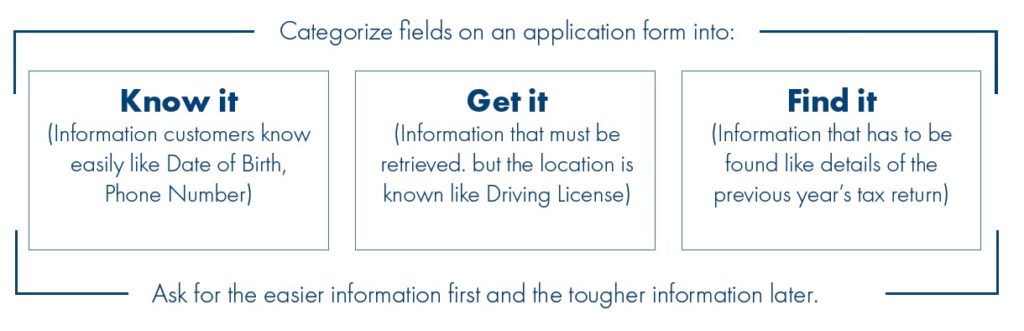

6. Ask tough questions last.

7. Make it a conversation, not an interrogation. Use a more conversational tone rather than confusing “bank talk” or other tones that may be confusing or not in line with building a relationship. It helps customers to relate to you and trust as a partner in their financial life.

These tips will bring you real results in increasing your customer acquisition rates. You can access the 7 Ways to Improve Customer Acquisition infographic here. Remember, this is their first impression of you, make it a good one!