Temenos Q1 2020 New License Performance Significantly Impacted by COVID-19; Double-Digit Recurring Revenue Growth and Resilient Business Model Give Visibility on Full Year Profit and Cash Flow

New guidance for at least 13% recurring revenue growth, at least 7% EBIT growth and conversion of 100% of IFRS EBITDA into operating cash

GENEVA, Switzerland, April 14, 2020 – Temenos AG (SIX: TEMN), the banking software company, today reports its first quarter 2020 results.

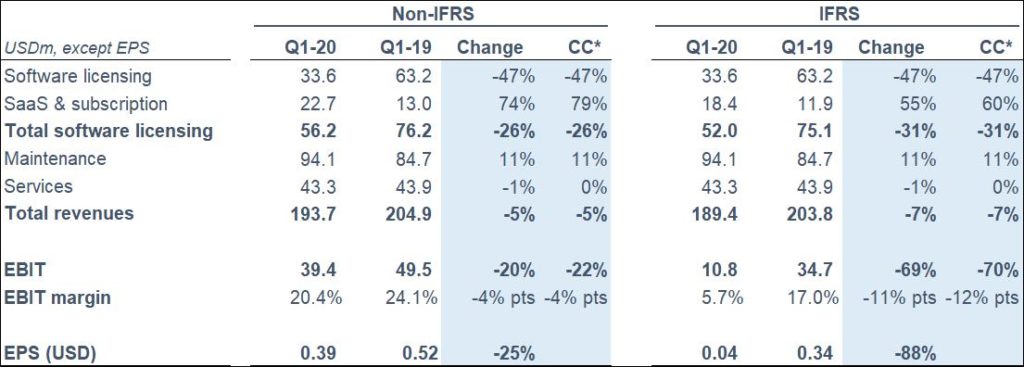

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

*Constant currency (c.c.) adjusts prior year for movements in currencies.

Q1 2020 highlights

- Sales in the first two months of the quarter were in line with expectations. There was a significant negative impact on licenses in the last month of the quarter due COVID-19

- Deals that did not sign in Q1 are being delayed, not cancelled

- Decline in signings particularly acute in Asia and Europe, with relatively less impact in the US and MEA

- Signings with new logos and competitive deals impacted significantly more than sales into the installed base

- SaaS growth was strong, SaaS ACV growth of 104% c.c., key deal signed with tier 1 bank

- 9 new client wins in Q1 across products

- Recurring revenue growth driving cash and profit visibility for 2020

- Flexible cost base enables profit protection, new guidance for EBIT growth of at least 7% for 2020

- CEO and Executive Chairman taking voluntary 50% salary cut, Executive Committee taking voluntary 25% salary cut for remainder of 2020

- Continued investment, in particular in R&D, to extend product advantage

- Structural drivers of digital, regulation, cost pressures and move to open banking are intact and likely to accelerate post-crisis

- Reconfirmed 2019 dividend payment of CHF 0.85 per share, subject to shareholder approval at the AGM taking place on May 20, 2020

Q1 2020 financial summary (non-IFRS)

- Non-IFRS total software licensing revenues down 26% c.c.

- Non-IFRS maintenance growth of 11% c.c.

- Non-IFRS total revenue down 5% c.c.

- Non-IFRS EBIT down 22% c.c., Q1 EBIT margin of 20.4%

- Non-IFRS EPS down 25% in Q1

- Operating cash flow of USD 60m, up 9%, LTM cash conversion of 106% of IFRS EBITDA

- DSOs at 109 days reported, 4 days due to Kony acquisition, down 11 days vs. Q4 2019

Commenting on the results, Temenos CEO Max Chuard said:

“I am very proud of how quickly Temenos has responded to the global challenge of COVID-19. Our clients, employees and the communities we operate in come first. We have continued to seamlessly support our clients across sales, implementations and SaaS. We have made the Temenos Learning Platform, our on-line learning resource, available to banks for free. We are ensuring our employees are safe and are able to work remotely and we are doing our utmost to protect jobs. And we are working with banks and governments to support the rapid roll-out of new products to support customers at this time, including SME crisis loans in the US and Apprentices and Trainees’ Wage Subsidies in Australia.

The crisis had a significant impact on new license signings in the first quarter, however our business model is resilient with nearly 50% recurring revenue and a flexible cost base. This gives us strong visibility on our cash flow and profitability, even in the face of such a crisis. We provide mission-critical software to banks and this crisis has highlighted the need for sophisticated digital banking platforms and modern core banking software which can be run remotely.

The structural drivers of digital, regulation, cost pressures and move to open banking are intact and likely to accelerate post-crisis, which gives me confidence in our sustainable long term annual growth targets.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We saw a significant impact on license signings in Q1 due to the evolving crisis, however, we had double digit growth in recurring revenues, which were up 20% year-on-year. SaaS revenue grew 79% and SaaS ACV grew 104%, with the majority of ACV growth coming from Temenos Transact. Maintenance was also up 11%. We had strong operating cash flow of USD 60m, up 9% in the quarter, equal to a cash conversion of 106%. We ended the quarter with DSOs at 109 days reported and 105 days organic, down 11 days versus Q4 2019. Our leverage remained at 2.6x net debt to EBITDA at the end of the quarter and we now expect this to come down to around 2x by year end.

Our resilient business model with nearly 50% recurring revenue and a flexible cost base gives us strong visibility on our cash flow and profitability. Even in an extreme environment, we are confident in delivering double-digit recurring revenue growth and to grow our operating profit.

We have revised our FY 2020 guidance for impact of COVID-19. We are guiding for recurring revenue growth of at least 13%, and EBIT growth of at least 7%. We retain our operating cash conversion target of at least 100% and expect DSOs to be around 110 days at year end and leverage to be around 2x.”

Revenue

IFRS revenues were USD 189.4m for the quarter, a decrease of 7% vs. Q1 2019.

Non-IFRS revenue was USD 193.7m for the quarter, a decrease of 5% vs. Q1 2019.

IFRS total software licensing revenue for the quarter was USD 52.0m, a decrease of 31% vs. Q1 2019.

Non-IFRS total software licensing revenue was USD 56.2m for the quarter, a decrease of 26% vs. Q1 2019.

EBIT

IFRS EBIT was USD 10.8m for the quarter, a decrease of 69% vs. Q1 2019.

Non-IFRS EBIT was USD 39.4m for the quarter, a decrease of 20% vs. Q1 2019.

Non-IFRS EBIT margin was 20.4%, down 4% points vs. Q1 2019.

Earnings per share (EPS)

IFRS EPS was USD 0.04 for the quarter, a decrease of 88% vs. Q1 2019.

Non-IFRS EPS was USD 0.39 for the quarter, a decrease of 25% vs. Q1 2019.

Operating cash flow

IFRS operating cash flow was USD 60m in Q1 2020 compared to USD 55m in Q1 2019, representing an LTM conversion of 106% of IFRS EBITDA into operating cash.

Revised 2020 guidance

The 2020 guidance has been revised for the impact of COVID-19. Our revised outlook is based on the assumption that the recessionary crisis due to COVID-19 will have the largest impact in Q2 2020 with gradual improvement in our end market environment in H2 2020 as banks adapt to the crisis and lockdowns are gradually relaxed.

Our guidance for 2020 is in constant currencies. The changes are as follows:

- Total software licensing guidance is withdrawn

- Total revenue guidance is withdrawn

- SaaS ACV guidance is withdrawn

- New guidance on recurring revenue (SaaS + Maintenance) growth is included

- Guidance for EBIT, tax and leverage are updated

- Cash conversion and DSOs guidance are maintained

The revised FY 2020 guidance is as follows:

- Non-IFRS recurring revenue growth (SaaS and Maintenance combined) of at least 13%

- Non-IFRS EBIT growth of at least 7%

- 100%+ conversion of IFRS EBITDA into operating cash flow

- DSOs to be around 110 days at year end

- Expected FY 2020 tax rate of 14% to 15%, revised from 15% to 16%

- Net leverage of c.2x by year end

Currency assumptions for 2020 guidance

In preparing the revised 2020 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.08;

- GBP to USD exchange rate of 1.20; and

- USD to CHF exchange rate of 0.98.

Webcast

At 08.00 CET / 07.00 GMT / 02.00 EST, today, April 14, 2020, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

A recording of the call will be made available on the Company website shortly after the call. A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2020 non-IFRS guidance:

- FY 2020 estimated deferred revenue write down of USD 13m

- FY 2020 estimated amortisation of acquired intangibles of USD 65-70m

- FY 2020 estimated restructuring costs of USD 10m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after April 14, 2020. The above figures are estimates only and may deviate from expected amounts.

Other definitions

Constant currency (c.c.) adjusts prior year for movements in currencies. SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch