Temenos Announces Strong Recurring Revenue Growth up 17% in Q2, Gradual Improvement Expected in Q3 and Q4 2020

Reconfirming guidance for at least 13% recurring revenue growth, at least 7% EBIT growth and conversion of 100% of IFRS EBITDA into operating cash

GENEVA, Switzerland, July 15, 2020 – Temenos AG (SIX: TEMN), the banking software company, today reports its second quarter 2020 results.

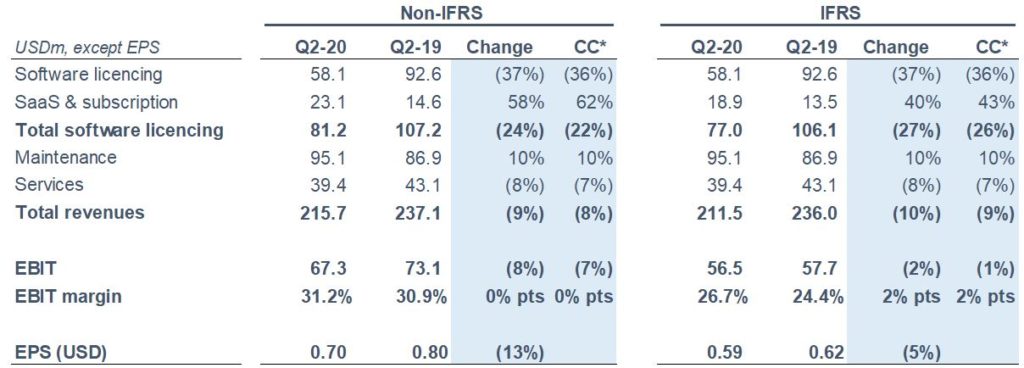

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

*Constant currency (c.c.) adjusts prior year for movements in currencies.

Q2 2020 highlights

- Strong growth in recurring revenue

- Q2 sales continued to be impacted by Covid-19

- Many banks remain focused on business continuity; limited visibility on when implementations could start also a continued cause of delay

- One third of deals delayed from Q1 signed in Q2

- Deals that did not sign in Q1 and Q2 continue to be delayed, not cancelled

- Double-digit growth in new pipeline opportunities year-on-year

- Exclusive partnership signed with HCL in Q2 which positively impacted total software licensing and EBIT

- Positive momentum in MEA and North America, which benefited from HCL partnership

- Travel restrictions impacted the sales force’s ability to close deals in particular in Europe

- SaaS growth remained strong, SaaS ACV growth of 21% c.c.

- Key tier 1 wins across Japan and Australia, and first SaaS signing in MEA

- 12 new client wins in Q2 across products

- Recurring revenue growth, cost base flexibility and strong cost control driving EBIT and cash performance

- Continued investment, in particular in R&D, to extend product advantage

- Structural drivers of digital, regulation, cost pressures and move to open banking are intact and likely to accelerate post-crisis, adoption of SaaS and cloud also likely to accelerate

Q2 2020 financial summary (non-IFRS)

- Non-IFRS total software licensing revenues down 22% c.c.

- Non-IFRS maintenance growth of 10% c.c.

- Non-IFRS recurring revenue growth of 17% c.c.

- Non-IFRS total revenue down 8% c.c.

- Non-IFRS EBIT down 7% c.c., Q2 EBIT margin of 31.2%

- Non-IFRS EPS down 13% in Q2

- Operating cash flow of USD 94m, up 21%, LTM cash conversion of 115% of IFRS EBITDA

- DSOs at 107 days reported, 105 days organic, down 2 days vs. Q1 2020

Commenting on the results, Temenos CEO Max Chuard said:

“I am very proud that Temenos has rapidly adapted to the global crisis, and we have focused on supporting our clients, employees and the communities in which we operate in these challenging times. Our sales and services teams have done an outstanding job of working with our clients remotely and we have maintained our very high R&D productivity as we continue to innovate and drive our product roadmaps forward. Clients have been quick to move to remote sales and implementation processes, which is reflected in the increase in implementation go-lives this quarter compared to Q2 2019.

The crisis continued to impact new license signings in the second quarter, however we expect a gradual improvement in Q3 and Q4. Sales activity increased in the quarter, driven both by the dedication of our sales force as well increased engagement from clients around their digital transformations. We closed around one third of the delayed Q1 deals in the second quarter. I was also pleased with the partnership we signed with HCL in the quarter which positively impacted license and EBIT. Importantly, the deals that did not sign were delayed rather than cancelled, and we fully expect these deals to close over the coming quarters.

We have a very resilient business model with around 50% recurring revenue and a flexible cost base which we have actively managed through the quarter. This gives us strong visibility on our cash flow and profitability for the full year. This crisis is accelerating the structural drivers of our end market – the need for modern, open and resilient front and back office platforms to enable banks to adapt and thrive in this new environment. As such, I am confident in our sustainable long term annual growth targets.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We continued to see an impact on license signings in the second quarter due to Covid-19, however we expect a gradual improvement in Q3 and Q4. We delivered excellent growth in recurring revenues, which were up 17% in the quarter, well ahead of our full year guidance of at least 13%. SaaS revenue grew 62%, SaaS ACV grew 21%, and Maintenance was up 10%. I am particularly pleased by our sustained focus on cash, delivering strong operating cash flow of USD 94m, up 21% in the quarter and equal to a cash conversion of 115%. We ended the quarter with DSOs at 107 days reported, down 2 days versus Q1 2020. Our leverage remained at 2.6x net debt to EBITDA at the end of the quarter and we still expect this to come down to around 2x by year end.

We are reconfirming our guidance for the year. We are guiding for recurring revenue growth of at least 13%, and EBIT growth of at least 7%. We retain our operating cash conversion target of at least 100% and expect DSOs to be around 110 days at year end and leverage to be around 2x.”

Revenue

IFRS revenues were USD 211.5m for the quarter, a decrease of 10% vs. Q2 2019.

Non-IFRS revenue was USD 215.7m for the quarter, a decrease of 9% vs. Q2 2019.

IFRS total software licensing revenue for the quarter was USD 77.0m, a decrease of 27% vs. Q2 2019.

Non-IFRS total software licensing revenue was USD 81.2m for the quarter, a decrease of 24% vs. Q2 2019.

EBIT

IFRS EBIT was USD 56.5m for the quarter, a decrease of 2% vs. Q2 2019.

Non-IFRS EBIT was USD 67.3m for the quarter, a decrease of 8% vs. Q2 2019.

Non-IFRS EBIT margin was 31.2%, up 0.4% points vs. Q2 2019.

Earnings per share (EPS)

IFRS EPS was USD 0.59 for the quarter, a decrease of 5% vs. Q2 2019.

Non-IFRS EPS was USD 0.70 for the quarter, a decrease of 13% vs. Q2 2019.

Operating cash flow

IFRS operating cash flow was USD 94m in Q2 2020 compared to USD 77m in Q2 2019, representing an LTM conversion of 115% of IFRS EBITDA into operating cash.

2020 guidance

The 2020 guidance is based on the assumption that the recessionary crisis due to COVID-19 had the largest impact in H1 2020, with continued gradual improvement in our end market environment in Q3 and Q4 2020 as banks adapt to the crisis and lockdowns are gradually relaxed. Our guidance for 2020 is in constant currencies.

The FY 2020 guidance remains unchanged and is as follows:

- Non-IFRS recurring revenue growth (SaaS and Maintenance combined) of at least 13%

- Non-IFRS EBIT growth of at least 7%

- 100%+ conversion of IFRS EBITDA into operating cash flow

- DSOs to be around 110 days at year end

- Expected FY 2020 tax rate of 14% to 15%

- Net leverage of c.2x by year end

Currency assumptions for 2020 guidance

In preparing the revised 2020 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.10;

- GBP to USD exchange rate of 1.23; and

- USD to CHF exchange rate of 0.96.

Webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, July 15, 2020, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

A recording of the call will be made available on the Company website shortly after the call. A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2020 non-IFRS guidance:

- FY 2020 estimated deferred revenue write down of USD 13m

- FY 2020 estimated amortisation of acquired intangibles of USD 65-70m

- FY 2020 estimated restructuring costs of USD 25m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after July 15, 2020. The above figures are estimates only and may deviate from expected amounts.

Other definitions

Constant currency (c.c.) adjusts prior year for movements in currencies. SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]