The Way Forward for Wealth: Changing Misconceptions with a Connected Technology

Challengers have disrupted customer expectations about wealth management – with a connected tech ecosystem, banks can stay at the top of the game.

The rise of challenger banks and fintechs is not only disrupting the standards of digital banking, but also related financial services, including wealth management. As these challengers begin to redefine standards set by traditional banks, consumers are rethinking how they seek financial advice, build wealth and improve their overall financial fitness. These shifts have an obvious impact on how customers view the expertise and value that both challengers and traditional banks bring.

Traditional Wealth Management Lags Behind in Customer Perception of Digital Transformation

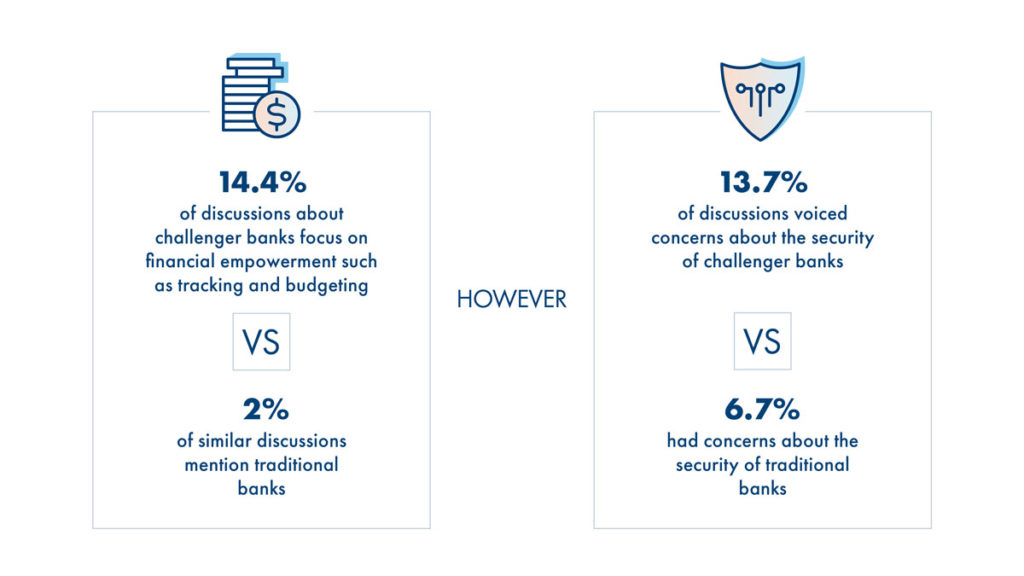

Since 2015, customer perception about the respective strengths of different kinds of financial institutions has been in flux, made apparent by the disparities in topics of inquiry and language used when discussing or researching challenger vs. traditional banks.

At face value, these statistics suggest that challenger banks are doing a better job of servicing customer needs around investment advice, planning and overall wellbeing. This is likely an oversimplification, however, grounded in the misconception that traditional wealth management is less progressive and customer-centric. In reality, nothing could be further from the truth: traditional banks are placing a huge emphasis on creating better customer experiences, with over 30% of surveyed banks saying this is their top priority for 2021 and beyond. In this new landscape, both challenger banks and traditional banks are equally committed to creating transformational digital experiences for their customers.

Where the difference lies—and where the misconception is likely rooted—is in the technology. Start-up banks and fintechs have been able to build wholly new tech stacks grounded in digital transformation, while many traditional wealth management banks still rely mainly on digitizing in-person processes for online customers due to the limits of their technology infrastructure. On the other hand, traditional banks benefit from being seen as secure, stable institutions that are well-regulated and trustworthy. Money is highly emotional, and the safety that traditional banks can offer to their customers well positions them to be a trusted advisory partner: it’s hard to trust the person giving you investment advice if you worry about their ability to safeguard your money. While challengers undoubtedly excel in providing future-oriented, digitally-native financial empowerment and investment tools, traditional banks remain strong leaders with the reputation, capital and market share to be even better advisory partners to their customers.

How can banks leverage their long-held, well-earned history of being trustworthy repositories for their customer’s wealth while also combatting their reputation as being slow to embrace change? To move forward in building value as a digitally-savvy, secure advisory partner, wealth management must invest in a core technology platform that is:

- Human-centric and hyper-personalized, defined by a proactive service model that leverages automated tools and advisors that are highly skilled in emotional intelligence and holistic financial planning.

- Centered on an open platform that adds value by connecting to adjacent legal, will & estate, tax, philanthropy, real estate and other services.

Integrating these two characteristics requires a creative , expansive approach that reimagines the role wealth managers take in the lives of customers and prioritizes nimble, flexible processes and streamlined experiences. This strategy involves choosing a technology partner that can offer a solution that goes beyond a table-stakes wealth management platform and provides a comprehensive connected ecosystem that allows advisors to work with customers more holistically across the spectrum of their financial goals and needs.

Wealth Management Must Plug Into a Connected Tech Ecosystem

In order to become a progressive, trusted partner that wealth management clients across demographics and investment types believe in, wealth managers must expand their scope to include insight and expertise into the full spectrum of customer financial wellness. This includes being adaptable to different kinds of advising in different settings, including robo-advising as a primary or supplemental advising tool for customers who desire it, as well as explainable AI that gives insight into its decision-making and draws customers deeper into the process. These tools must be part of a larger wealth management platform that enables strong communication between customers and advisors and offers excellent experiences across everyday interactions and activities as well as adding new products or services to their investment portfolio.

This kind of wealth management experience, while extremely important, is the default expectation from customers at this point. Next gen wealth management clients want to move beyond investment advice and see how investment fits into their overall life goals and financial wellness, from generating new income to identifying the best savings products and planning the financial future of their family. To successfully implement these diverse customer experiences, wealth managers must invest in a platform that can easily adapt to changing market demands and customer expectations. The pandemic has proven that it is vitally important to have a solution that can facilitate a variety of use cases and provide proactive, personalized customer support with rich, omnichannel UX. As financial services increasingly move to the cloud, platforms that prime firms for success will offer cloud-agnostic, open API structures that are flexible, modular and can be scaled up or down while reducing costs.

Choosing a Next Generation Technology Partner

The modern client-advisor relationship is powered by digital tools, processes and platforms but remains human at its core. Temenos understands this this and provides solutions that increase client satisfaction with thoughtfully designed efficient and transparent experiences that add value to their financial wellbeing beyond wealth management. From low-code development environments that allow banks to quickly create integrated, omnichannel experiences across wealth management, retail and beyond to bespoke marketing products that allow a bank to present a streamlined, unified brand front across its lines of business, Temenos has built a technology ecosystem that enables people to work, connect and invest in a distinctly human way, unfettered by invisible backend silos that only frustrate customers.

Transforming wealth management can be the first step to transforming the relationship that customer have with the entire brand, deepening and diversifying the relationships that drive revenue. Temenos is dedicated to this combination of human + digital, from Temenos Infinity Wealth for a seamless front-to-back wealth solution to Transact for an unparalleled core processing that together create a unified experience for customers across the spectrum of wealth management and financial empowerment.