The Retail Banking Capability Model of the Future

Digital and Open Banking drive retail banks to transform.

Digital and Open Banking Drive Retail Banks to Transform

The widespread uptake of disruptive new technologies is exacerbating the pressures facing retail banking today, thereby driving a fundamental change in the structure of the industry: the digital-driven disintermediation of the banking value chain and the divergence of manufacturing and distribution. The COVID-19 pandemic has rapidly changed consumer mindsets and circumstances driving banks to both accelerate and scale digital transformation and customer experience across complex product and customer journeys.

Incumbent banks possess scale, connectivity, assets and a special role as trusted custodians of consumers’ financial information put them in a prime position to seize the market opportunity and differentiate against nimble new entrants. However, this necessitates moving from legacy-based IT and operating models to acquiring critical new capabilities.

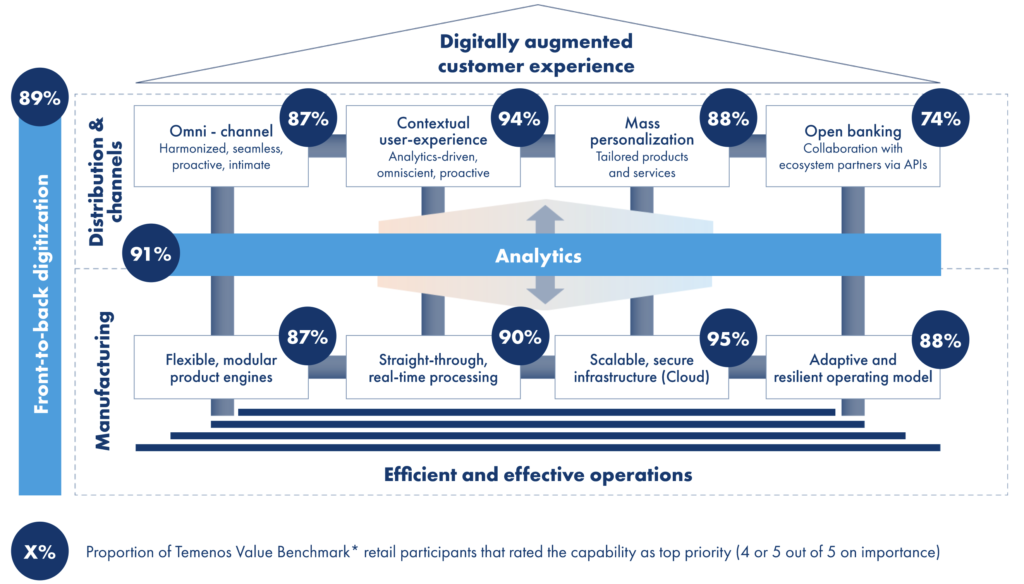

The Retail Banking Capability Model

The Temenos Value Benchmark (TVB) is Temenos’ proprietary survey-based strategic programme to discuss business performance and value creation by a bank’s investment in IT. Benchmark participants confirm the key capabilities required by banks to compete in the industry today, which are a balance between customer-driven differentiation in distribution and efficiency-driven standardisation in manufacturing, both of which are underpinned by front-to-back digitization and analytics.

Front-to-back digitization includes seamless on-boarding and origination, automated processing of transactions, payments and settlements as well as automatic accounts reconciliation and billing processes. Analytics is about ensuring that decision-making across the bank is supported by user-friendly facts and data using descriptive/ diagnostic as well as predictive/prescriptive capability embedded into banking processes.

8 Key Banking Capabilities

Omni-channel: Today’s full-service banks need to support a consistent experience across multiple channels, assisted and unassisted, internal and external. The focus has moved from driving customers towards lower-cost digital channels to re-injecting intimacy into these e.g. chatbots, hybrid video chats with human and digital touchpoints delivered at scale.

Contextual User Experience: A bank must understand customer behaviour at every touchpoint as well as preferences and spending habits, and then use real-time and predictive analytics to dynamically change this behaviour by providing the next best interaction or propensity to buy or to leave.

Mass personalization: Customers want their own personalized set of products and services, designed and priced based on a 360-degree lifetime view, preferably via a self-service menu of mix-and-match options.

Open banking: Banks need to flexibly and seamlessly collaborating with 3rd party service providers or technology developers via open APIs in a bid to deliver beyond banking lifestyle services to the end-customer.

Flexible, modular product engines: Modern product architectures with re-usable product features, hierarchies and relationship pricing allow banks to offer customer-centric, innovative feature-rich products that are quick to create and easy to maintain.

Straight-through, real-time processing: In order for banks to support digital customer journeys end-to-end from prospecting and from order fulfillment to servicing, they need straight-through processing all the way. Today’s always-on customers can only be catered to by highly available 24×7 real-time core processing engines which can receive and process transactions and queries at any time.

Scalable, secure infrastructure (Cloud): Banks must be able to handle the proliferation of increasingly complex customer interactions at acceptable levels of performance. New business models mean unpredictability and rapid response to change which cloud-based infrastructures with auto-elasticity, hyper-scaling and accelerated release cycles provide. Resilience and the highest levels of security are prerequisites.

Adaptive and resilient operating model: The operating model of the future must have in-built mechanisms for self-monitoring and logging of interactions and transactions in real-time to continually optimize performance. Technologies like robotic process automation embedded into banking processes help achieve this.

The Future of Retail Banking

At Temenos, we believe the tipping point has been reached. The banking industry is changing so dramatically, it is no longer possible for banks to stay competitive and fulfill the needs of customers without building these key capabilities. Banks have no choice but to digitally transform and renovate their end-to-end business model to the core.

To learn more about our predictions for the future of retail banking, download our new White Paper The Future of Retail Banking and the Case for Digital Transformation.