Temenos Announces Sustained Strong Q2-21 Momentum With Bookings Growth of 104%, Raises Guidance for FY-21 SaaS ACV Growth to 50-60%

SaaS ACV growth of 409%

Total Bookings growth of 104%

Total Software Licensing growth of 16%

ARR growth of 8%

EBIT growth of 16%

FCF growth of 24%

FY-21 guidance for SaaS ACV growth increased to 50-60%

Rest of FY-21 guidance reconfirmed

Ad hoc announcement pursuit to Article 53 of the SIX Listing Rules

GENEVA, Switzerland, July 21, 2021 –Temenos AG (SIX: TEMN), the banking software company, today reports its second quarter 2021 results.

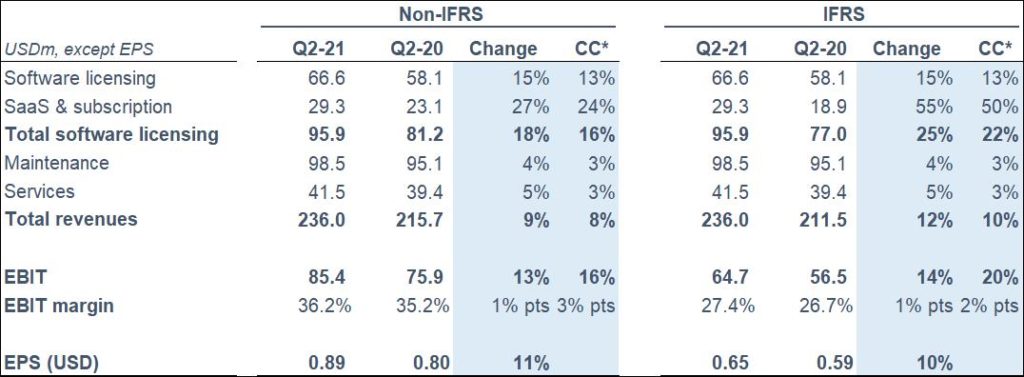

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

*Constant currency (c.c.) adjusts prior year for movements in currencies

Q2 2021 highlights

- Strong momentum in the second quarter

- Significant growth in SaaS ACV in particular, up 409%

- Excellent growth in Total Bookings, up 104%, up on Q2-19 levels

- All regions delivered double digit growth in the quarter

- US continued to be the largest contributor to total software licensing

- US SaaS and cloud was particularly strong across new clients and growth in existing clients

- Europe recovery is following the US with a short time lag, deal pipeline is building with strong sales growth expected in H2

- 16 new client wins in the quarter across license and SaaS

- 15 implementation go-lives in the quarter

- EBIT growth and margin expansion continued to drive operating and free cash flow generation

- Raised FY-21 guidance for increased SaaS momentum – SaaS ACV now expected to grow 50-60%, up from 40-50% previously, rest of FY-21 guidance reconfirmed

Q2 2021 financial summary (non-IFRS)

- Total Bookings growth of 104% c.c. in Q2-21

- SaaS Annual Contract Value (ACV) up 409% c.c. in Q2-21

- Annual Recurring Revenue growth of 8% c.c. in Q2-21

- Non-IFRS SaaS & subscription revenue growth of 24% c.c. in Q2-21

- Non-IFRS total software licensing revenues up 16% c.c. in Q2-21

- Non-IFRS total revenue up 8% c.c. in Q2-21

- Non-IFRS EBIT growth of 16% c.c. in Q2-21

- Q2-21 non-IFRS EBIT margin of 36.2%, up 3% points c.c.

- Operating Cash Flow growth of 19% and Free Cash Flow growth of 24% in Q2-21

- Leverage at 2.3x, expected to be at 2.1x by year end

- DSOs down 1 days year-on-year and 1 day sequentially to 106 days

Commenting on the results, Temenos CEO Max Chuard said:

“I am very pleased with our second quarter performance, with sustained strong momentum across the business. The sales environment continued to improve with all regions delivering double digit growth in the quarter, with very strong performance in the US in particular. We are seeing increased activity with Tier 1 and 2 accounts and are proactively responding to this by strengthening our global sales leadership. Our SaaS business had another quarter of significant growth as we continue to take market share in new SaaS deals as well as benefiting from excellent momentum in some of our existing SaaS customers. We also had strong growth in software licensing, with more banks embarking on digital transformation journeys in response to the pandemic and the ongoing structural pressures on traditional banking models.

The sales environment continued to steadily improve this quarter, which was reflected in our excellent Total Bookings growth of 104%, driven by broad based demand across products and regions. Our Total Bookings growth is driving our backlog and our long-term visibility, giving confidence in our FY-21 guidance and 2025 targets.

The US continued its very strong performance, and was again the largest contributor to total software licensing and SaaS ACV. Activity in Europe is also increasing and we expect strong sales growth in this region over the coming quarters.

We once again topped the industry league tables and were ranked No. 1 for core banking, digital front office, retail payments, risk management and sales to Neo and Challenger banks. This in particular reflects the years of investment we have made in our SaaS and cloud capabilities and the strength of our offering for new entrants.With a further improvement in the sales environment and increasing market share, I expect to be at 2019 levels of combined license and equivalent ACV bookings for the full year.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“This quarter we continued to build on the significant momentum from Q1-21, with strong growth across the business, in particular for our recurring revenue. SaaS ACV grew 409%, and our ARR growth accelerated to 8% in the quarter. Maintenance grew by 3% in the quarter, and we expect maintenance to grow at similar levels in Q3-21 and then to accelerate considerably in Q4-21 reflecting the stronger license growth in the first half of the year. Similarly, we expect a strong sequential improvement in SaaS revenue of USD2-3m in Q3-21 and even more in Q4-21, driven by the ACV growth of the prior quarters.

Total Bookings also grew an excellent 104%, continuing to drive growth in backlog and underpinning our one year and medium term growth targets. Total revenue grew 8% in the quarter and non-IFRS EBIT grew 16%, delivering a non-IFRS EBIT margin of 36.3%, up 1% point reported.

We continue to generate significant amounts of cash, with an operating cash inflow of USD 112m in Q2-21, up 19%, and USD87m of Free Cash Flow, up 24%. DSOs ended the quarter at 106 days, down 1 day sequentially and year-on-year, and debt leverage was at 2.3x. We expect our leverage to be at around 2.1x by year end, at the same level as in FY20.

Given the strength of our SaaS business, we have raised our FY-21 guidance for SaaS ACV growth to 50-60%, up from 40-50%. In license equivalent terms this would represent an increase of c.2-3% of total software licensing revenue growth. We have reconfirmed the rest of our FY-21 guidance for ARR growth of 10-15%, non-IFRS total software licensing growth of 14% to 18%, and non-IFRS total revenue growth of between 8% and 10%. We are guiding for a 2021 non-IFRS EBIT growth of 12-14%, implying an EBIT margin of 37.2%.”

Revenue

IFRS revenue was USD 236.0m for the quarter, an increase of 12% vs. Q2 2020.

Non-IFRS revenue was USD 236.0m for the quarter, an increase of 9% vs. Q2 2020.

IFRS total software licensing revenue for the quarter was USD 95.9m, an increase of 25% vs. Q2 2020.

Non-IFRS total software licensing revenue was USD 95.9m for the quarter, an increase of 18% vs. Q2 2020.

EBIT

IFRS EBIT was USD 64.7m for the quarter, an increase of 14% vs. Q2 2020.

Non-IFRS EBIT was USD 85.4m for the quarter, an increase of 13% vs. Q2 2020.

Non-IFRS EBIT margin was 36.2%, up 1% point vs. Q2 2020.

Earnings per share (EPS)

IFRS EPS was USD 0.65 for the quarter, an increase of 10% vs. Q2 2020.

Non-IFRS EPS was USD 0.89 for the quarter, an increase of 11% vs. Q2 2020.

Cash flow

IFRS operating cash was an inflow of USD 112m in Q2 2021 compared to USD 94m in Q2 2020, an increase of 19% and representing an LTM conversion of 107% of IFRS EBITDA into operating cash.

USD 87m of Free Cash Flow was generated in the quarter, an increase of 24% vs. Q2 2020.

Revised 2021 non-IFRS guidance

ARR was included as a new guidance metric for 2021. ARR is Annual Recurring Revenue committed at the end of the period for both SaaS and Maintenance. It includes New Customers, up-sell/cross-sell, and attrition. It only includes the recurring element of the contract and exclude variable elements.

The guidance for 2021 is non-IFRS and in constant currencies. SaaS ACV growth has been increased and the other guidance items have been reconfirmed.

- SaaS ACV growth of 50-60%, increased from 40-50%

- ARR growth of 10-15%

- Total software licensing growth of 14-18%*

- Total revenue growth of 8-10%*

- EBIT growth of +12-14% (USD 362-369m)*, implying 37.2% margin

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2021 tax rate of 16% to 18%

- DSOs to be below 105 days by year end

Non-IFRS EBIT is adjusted for share-based payments and related social charges costs going forward. For comparison purposes, the FY-20 EBIT adjustments exclude USD 11m of costs. Estimated FY-21 share-based payments and related social charges costs are c.USD 20m. The share-based payment cost in Q2-21 was USD6.0m.

*Q2-21 HCL impact of 4% headwind on SaaS growth, 9% headwind on total software licensing growth, 4% headwind on total revenue growth and 10% headwind on EBIT growth. Expected FY-21 HCL impact of c.5% headwind on SaaS growth, c.5% headwind on total software licensing growth, 3% headwind on total revenue growth, and 5% headwind on EBIT growth, linked to the migration of the acquired non-banking business of Kony to HCL.

Currency assumptions for 2021 guidance

In preparing the 2021 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.19;

- GBP to USD exchange rate of 1.38; and

- USD to CHF exchange rate of 0.92

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, July 21, 2021, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as financing costs, advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Note: share-based payments and related social charges costs are considered as non-IFRS adjustments from FY21.

Below are the accounting elements not included in the 2021 non-IFRS guidance.

- FY 2021 estimated share-based payments and related social charges charges of USD 20m

- FY 2021 estimated amortisation of acquired intangibles of USD 50m

- FY 2021 estimated restructuring costs of USD 10-12m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after July 21, 2021. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch