Digital Banking Made Human: Bridging the Emotional Divide

While digital banking has steadily increased over the past 15 years, COVID-19 accelerated this shift at an unprecedented rate. In 2020, branch teller transactions dropped an average of 30-40% (some banks like Santander saw a drop of over 50%) as mobile banking app usage jumped 35%. And 65% of bankers now believe that the branch-based model will be “dead” within five years, up from 35% just four years ago, according to new research from The Economist Intelligence Unit. The golden age of digital banking is truly here.

However, bankers are noticing a worrying trend— as digital banking becomes more prevalent, customer satisfaction is decreasing. According to Gallup, banks that can’t create and maintain lasting emotional connections with their customers are losing out on an additional 23% of revenue. Is it possible that the promise of digital banking will be derailed by a lack of human-to-human interaction? In this blog, we explore how banks can meet the evolving needs of their customers, whether individuals or businesses, through digital transformation, while also maintaining human connections.

Money is Fundamentally Human

Money and wealth management are fundamentally human experiences that elicit a range of emotions. From anxiety, when money is tight and bills are coming due, to the elation of hitting a long-term financial goal, banks must understand that it’s impossible to separate money from emotions. In our recent survey, we asked customers what they look for in a bank and their responses included a range of sentiments: hopefulness in accomplishing their financial goals, trust that their bank cared about their future, and empathy in understanding their day-to-day schedules and obligations. But the one common thread in every response? Customers are looking for banks that care.

Customer Interaction Preferences are Evolving

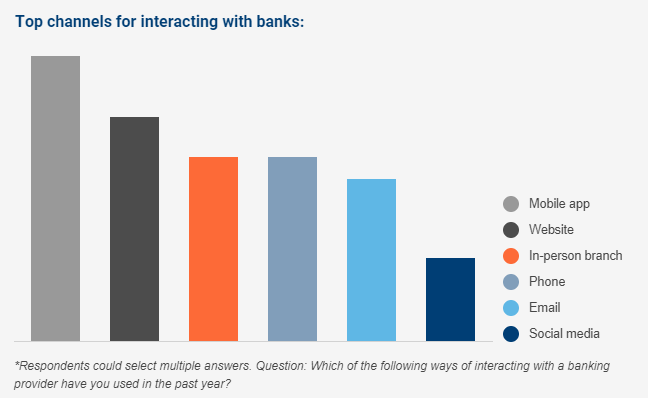

Our recent research of 5,000 retail banking customers found that in-person banking is now only the third most utilized banking channel for customers, behind mobile apps and websites. And of those visiting branches, 3 in 5 customers said that they visited a branch because they needed to rather than because they wanted to. This indicates that customers are first trying to accomplish their goals via digital channels, and when that fails, they are forced to walk into a bank.

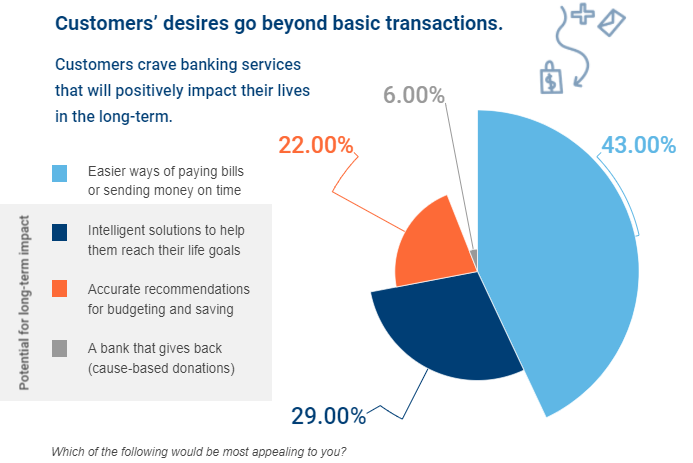

Looking at which services are the top priority for bank customers we found that 43% are looking for basic transactional services from their bank: easier ways of paying bills and sending money. However, over half wanted their bank to provide services that had the potential for long term impact in their lives. 29% of retail customers wanted intelligent solutions to help them reach their life goals and 22% required accurate recommendations for budgeting and saving. These are services which require a personal connection to every customer to understand their individual needs and ambitions. Finally, 6% of consumers also want to bank with an organization that gives back to the community through cause-base donations, which reflects a 2020 study that found 70% of Gen-Z and Millennials globally believe a brand should have a purpose they believe in.

Previously, these emotional connections were often cultivated by local bank branch managers but with fewer physical interactions and an increase in digital channels and access, technologies like data analytics and artificial intelligence can help to build 360-degrees view of each customer, and the activities that make up their lives. From here, banks can adapt to better serve the needs of their customers and drive personalization in their services.

Transforming CX Yields Happier, More Loyal Customers

57% of consumers want banks to go beyond just transferring their money and bill paying—they want their bank to care about them as a person, instead of simply as a customer. These “connected consumers” are 22% more likely to buy services from their bank without a price comparison. Thankfully, bankers are getting the message — 81% believe that the main differentiator for their business is customer experience rather than products, and this requires a human-centric approach to both in-branch and online.

4 Pillars To Bring the Human Touch To Digital Banking

At Temenos, we believe there are four key pillars that banks must prioritize in order to build lasting relationships with each of their customers, whether they choose to interact in branch or digitally. At all points, banks must look to bring personalization, empathy and relevant products and services to their customers..

- Be Authentic—Only 27% of bank customers say they trust their bank, while 16% feel apathetic. This represents a disturbing lack of connection that banks have with their customers which means loyalty is largely based on inertia rather than a relationship. Bring your brand and values to life in every touchpoint, across every channel.

- Be Personal—Branch traffic declines mean that banks will seldom interact face-to-face with their customers in the future. But that doesn’t mean you can’t still develop personalized ways to interact. Customize journeys at a deep level for every customer using data and AI.

- Be Connected—Driven by experiences outside of banking, consumers increasingly want to interact with their bank anytime, anywhere, on their own terms. Being a connected bank means having a traditional call center and branch but also online chat, responsive social media profiles, and giving your customers and employees easy access to the information and tools they need to add value to their lives.

- Be Aspirational—Banking scandals have steadily eroded public trust in traditional financial institutions. Today, only 38% of consumers have confidence that their money will be protected by their bank. Being aspirational means imagining a more human future in which banks have a positive impact in their communities and environment.

The challenge for banks is undoubtedly to ensure their digital transformation strategy maintains and fosters emotional relationships with every customer. Making digital banking human means understanding what is important to people—not just features and functions they need to execute tasks—but the drivers behind them.

To learn more about centering digital banking on the human experience, read our guide Digital Banking Made Human or for SME digital banking discover 6 touchpoints to create emotional SME connections.

Making Digital Banking Human

Discover how to turn Digital Banking experiences with customers and SMEs into emotional connections.