Temenos Announces Q4 and FY 2021 Results

ARR growth of 12% in FY-21

SaaS ACV up 65% in FY-21

Total Bookings growth of 37% in FY-21

Total Software Licensing growth of 17% in FY-21

FCF growth of 21% in FY-21

Move to subscription model to accelerate growth and drive recurring revenue

Proposed dividend of CHF 1.00 for FY-21 to be voted on at AGM

FY-22 guidance (non-IFRS) announced with ARR growth of 18-20%, Total Software Licensing growth of 16-18%, Total Revenue growth of at least 10%, and EBIT growth of 9-11%

Ad hoc announcement pursuit to Article 53 of the SIX Listing Rules

GENEVA, Switzerland, February 14, 2022 –Temenos AG (SIX: TEMN), the banking software company, today reports its fourth quarter and full year 2021 results.

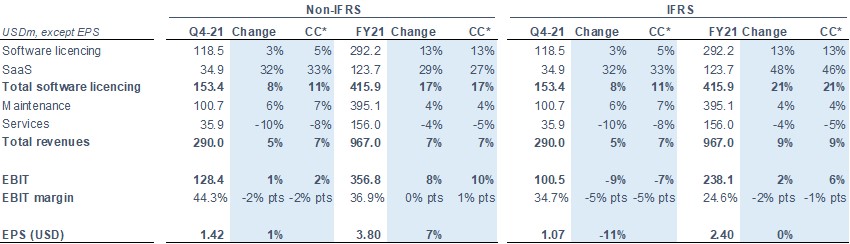

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II. * Constant currency (c.c.) adjusts prior year for movements in currencies.

Q4-21 highlights

- Strong momentum in the fourth quarter

- SaaS performed particularly well with ACV up 52% and revenue up 33% in Q4-21

- Total Bookings up 10% in Q4-21, and 37% in FY-21, also up on FY-19, driving backlog and visibility

- EBIT growth continued to drive operating and free cash flow generation

- Significant investments to ensure we are well positioned for future growth

- Move to subscription model for on-premise licenses will accelerate revenue growth and further increase visibility

- US performed particularly well, as did APAC and MEA

- Europe saw strong sequential improvement with deal signings across both license and SaaS, and further recovery is expected in H1-22

- Tier 1 and 2 banks contributed 41% of total software licensing in Q4-21 as strategic transformation projects continue to gain momentum

- 19 new client wins in Q4-21, total of 63 new customer wins in FY-21

- 98 implementation go-lives in the quarter, total of 345 go-lives across all clients

- Well positioned for strong growth in 2022

Q4 and FY 2021 financial summary (non-IFRS)

- Total Bookings growth of 10% in Q4-21 and 37% in FY-21 c.c.

- SaaS Annual Contract Value (ACV) of USD17m, 52% growth in Q4-21 and 65% growth in FY-21

- Annual Recurring Revenue growth of 12% in Q4-21 and 12% in FY-21 c.c.

- Non-IFRS SaaS revenue growth of 33% in Q4-21 and 27% in FY-21 c.c.

- Non-IFRS total software licensing revenues up 11% in Q4-21 and 17% in FY-21 c.c.

- Non-IFRS total revenue up 7% c.c. in Q4-21 and 7% in FY-21 c.c.

- Non-IFRS EBIT growth of 2% in Q4-21 and 10% in FY-21 c.c.

- FY-21 non-IFRS EBIT margin of 36.9%, up 1% points c.c.

- Operating Cash Flow growth of 16% and Free Cash Flow growth of 21% in FY-21

- Leverage at 1.8x at year end

- DSOs at 117 days

- Profit and cash flow strength support proposed dividend of CHF1.00, an 11% annual increase

Commenting on the results, Temenos CEO Max Chuard said:

“We had a great end to 2021, with strong growth as the sales environment continued to improve and we are now at pre-Covid levels in closure rates and predictability. Our US business performed particularly well and I was pleased with the good level of deal signings in Europe in the fourth quarter. Activity with Tier 1 and 2 banks continued to increase, making up 41% of our total software licensing in Q4-21. We clearly see acceleration in the market post the pandemic, and banks no longer have a choice but to invest in their core banking and customer experience platforms. The unbundling of manufacturing and distribution is fundamentally changing our market and creating opportunities for so many new business models. I am proud that we have been able to capitalize on this, winning significant market share in the non-incumbent space through the strength of our open platform and the Temenos Banking Cloud while our sales to the traditional banking market have regained their poise post the pandemic.

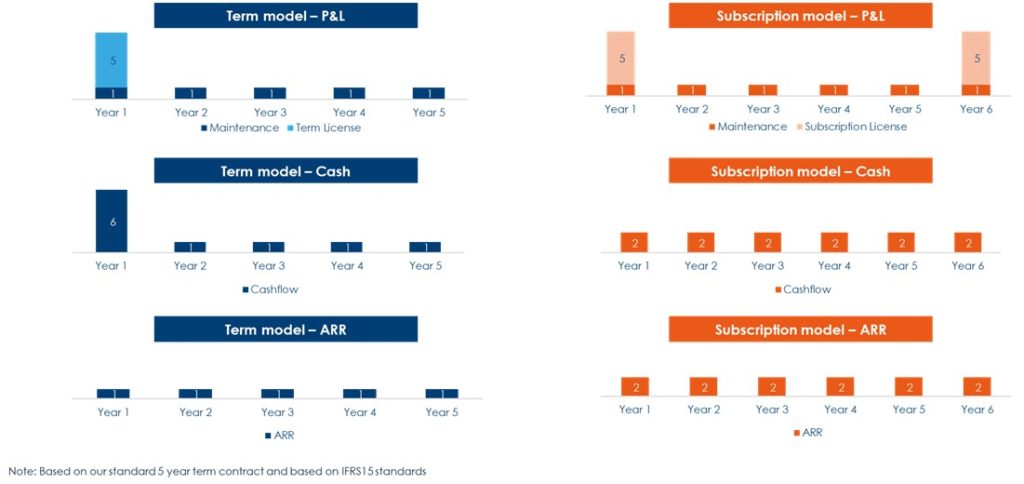

I am also very excited to announce our move to a subscription model for our traditional on-premise business from 2022, which enables us to capture greater value and accelerate our growth from 2022. We see an increasing number of clients across all tiers asking for subscription-based pricing. We will sell five-year subscription contracts for on-premise license and maintenance as standard, including for renewals. This move will also expand long-term value creation potential, increase total contract values and significantly accelerate our growth, in particular ARR as well as TSL and EBIT. We now expect ARR to grow 20-25% CAGR 2021-25 to reach USD 1.3bn by 2025, equal to 85% or more of our total revenue.

Looking forward to 2022, we are starting the year from a position of great strength. Our open platform is the leader in our market, and we have demonstrated our ability to win deals across both incumbents and non-incumbents, with our market share even higher in the non-incumbent segment. We have a robust R&D and innovation roadmap and the strongest deal pipeline across regions since before the pandemic. Activity with tier 1 and 2 banks is increasing as is deal activity in Europe. I am confident this will be a great year for Temenos.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“Q4 was another strong quarter of growth across the P&L. We had particularly strong SaaS bookings in Q4, with USD17m of SaaS ACV across new and existing clients. This represents 52% growth in the quarter and 65% for the full year. SaaS revenue also accelerated to 33% growth in Q4 and 27% for the full year, and going forward we expect SaaS revenue to grow much more closely in line with ACV. With maintenance growing 7% in the quarter as expected, we had strong ARR growth of 12% in Q4 and also for the full year. Licenses also grew a healthy 5% in the quarter, and 13% for the full year. We generated USD 293m of Total Bookings in Q4, an increase of 10% for the quarter and 37% for the full year, as we continue to add to our backlog. The move to a subscription model in 2022 will further accelerate ARR and Total Software Licensing growth and ultimately EBIT.

Our track record of strong cash generation continued, with an operating cash inflow of USD 473m in FY-21, up 16%, and we generated USD 358m of Free Cash Flow in FY-21, up 21%. Debt leverage was at 1.8x, approaching our target run-rate of 1.5-2.0x and fully deleveraging from our Kony acquisition within 2 years. With our strength of balance sheet, we have proposed a dividend of CHF 1.00 for FY-21.

We initiate our guidance for 2022, with ARR growth of 18-20%, Total Software Licensing growth of 16-18% and Total Revenue growth of at least 10%. Lastly, we expect EBIT to grow 9-11% for the year. We expect to continue converting 100%+ of EBITDA into operating cash, and we expect our FY-22 tax rate to be between 18-20%.”

Revenue

IFRS revenue was USD 290.0m for the quarter, an increase of 5% vs. Q4-20.

Non-IFRS revenue was USD 290.0m for the quarter, an increase of 5% vs. Q4-20.

IFRS total software licensing revenue for the quarter was USD 153.4m, an increase of 8% vs. Q4-20.

Non-IFRS total software licensing revenue was USD 153.4m for the quarter, an increase of 8% vs. Q4-20.

EBIT

IFRS EBIT was USD 100.5m for the quarter, a decrease of 9% vs. Q4-20.

Non-IFRS EBIT was USD 128.4m for the quarter, an increase of 1% vs. Q4-20.

Non-IFRS EBIT margin was 44.3%, down 2% point vs. Q4-20.

Earnings per share (EPS)

IFRS EPS was USD 1.07 for the quarter, a decrease of 11% vs. Q4-20.

Non-IFRS EPS was USD 1.42 for the quarter, an increase of 1% vs. Q4-20.

Cash flow

IFRS operating cash was an inflow of USD 473m in FY-21, an increase of 16% and representing an LTM conversion of 124% of IFRS EBITDA into operating cash. USD 358m of Free Cash Flow was generated in FY-21, an increase of 21% vs. FY-20.

Dividend

Taking into account the strength of profit growth and cash generation, as well as the expected strength of future cash flows, subject to shareholder approval at the AGM on 25 May 2022, Temenos intends to pay a dividend of CHF 1.00 per share in 2022. The timing for the dividend payment will be as follows:

- 25 May AGM approval

- 30 May Shares trade ex-dividend

- 31 May Record date

- 1 June Payment date

The dividend will be taken from the retained earnings (cash dividend) and therefore taxable (WHT 35%).

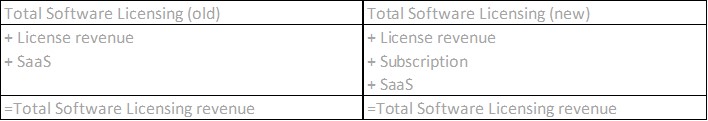

Move to subscription revenue and impact on future reporting

Temenos will sell five-year subscription contracts for on-premise license and maintenance as standard from 2022, including for renewals. This will accelerate growth by capturing greater contract value and accelerate the shift to more financial performance driven by a much higher proportion of recurring revenues. To reflect this change, an additional revenue line will be added to the P&L for recognition of Subscription licenses.

The impact of the move to a subscription model on P&L, cash and ARR is shown for illustrative purposes below:

2022 non-IFRS guidance

The guidance for 2022 is non-IFRS and in constant currencies.

- ARR growth of 18-20%

- Total Software Licensing growth of 16-18%

- Total revenue growth of at least 10%

- EBIT growth of +9-11%

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2022 tax rate of 18-20%

Medium term targets by/for 2025

The medium-term targets by/for are non-IFRS and in constant currencies.

- ARR growth of 20-25% CAGR 2021-25 to reach c.USD1.3bn of ARR by 2025

- Total Software Licensing growth of 15-20% CAGR 2021-25

- Total revenue growth of 10-15% CAGR 2021-25

- EBIT margin to reach c.41% by 2025

- Free Cash Flow growth of 10-15% CAGR 2021-26 to reach >USD600m by 2026

Currency assumptions for 2022 guidance

In preparing the 2022 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.14;

- GBP to USD exchange rate of 1.35; and

- USD to CHF exchange rate of 0.91

Conference call and webcast

At 19.00 CET / 18.00 GMT / 13.00 EST, today, February 14, 2022, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as financing costs, advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2022 non-IFRS guidance.

- FY 2022 estimated share-based payments and related social charges charges of c.5% of revenue

- FY 2022 estimated amortisation of acquired intangibles of USD 50m

- FY 2022 estimated restructuring costs of USD 10m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after February 14, 2022. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch