How request to pay will transform payments relationships

Mick Fennell, Business Line Director for Payments at Temenos and Mehmet Eryilmaz, Vice President Real-Time Payments & New Payment Platforms at Mastercard, presented at MoneyLIVE Summit 2022 focusing on how Request to Pay has the potential to transform billing processes and improve the customer experience. This is a short blog taken from their session.

Introducing the session, Mick Fennell highlighted key challenges the market is facing, but also the opportunities that are out there for banks, and the need to collaborate across the ecosystem to build successful end-to-end request to pay solutions.

Research conducted for Mastercard demonstrated that consumers are facing increased financial pressures, which is having an impact on their ability to manage bill payments, and resolving resulting issues is not always easy. 53% of irregular incomers said their financial situation had worsened and this has forced them to pass the due date for bills several times. 30% of consumers feel it’s complicated to resolve issues around payments when they experience an issue with their bill. And 41% of vulnerable consumers are interested in having a digital conversation similar to texting to help them manage their bills.

“I think, in this day and age, we’re only going to see that increasing in terms of the desire and need for people to be able to communicate and manage this digitally,” said Mick.

This was reiterated by Mehmet who said that “we are working with both billers and consumers, where we continually identify business opportunities for Request To Pay.”

“We also have our personal stories that highlight the challenge. Recently I changed houses and had problems with my Council tax. I ended up paying for my neighbor! So I started getting notices of arrears from my council. A simple payment gone wrong took six months of numerous calls to get right.”

As someone who deals with payments every day and works on this technology, Mehmet’s experience has illuminated the challenges and problems people experience. And things are only getting harder. Financial difficulties through COVID-19 and now the cost of living challenges means people are struggling more than ever to manage their finances.

The challenges that consumers are facing are also having an impact on billers, as Mastercard’s research suggests. A survey of around 400 consumers and 200 billers – including a number of larger billers in the UK representing a wide range of industries from utilities, insurance, telecom, retail through to government –has highlighted specific issues around disjointed internal processes leading to poor customer experiences.

- 68% of billers stated that in the last 12 months the number of disputed bills have increased.

- A third of the billers are planning on investing across secure payment request messaging and related communications.

“There has been an increase in late payments and arrears. It takes a long time to resolve the problems. Even if you mandate direct debits, some customers seek flexibility, and when there is a financial problem that leads to cancellation – they want to be able to flexibly manage their own finances,” Mehmet continues.

UK bill payment market and opportunity for innovation

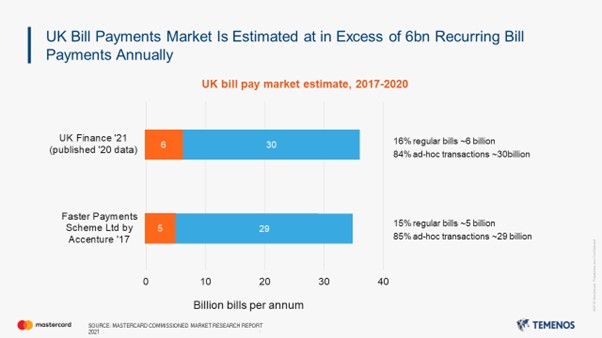

It’s clear that there are major challenges out there, but it’s also important for banks to recognize the opportunities that the bill payments market represents, given the large numbers of transactions involved.

- 5-6 billion per annum in recurring transactions

- Two thirds of recurring bills are paid as Direct Debit, amounting to over £100 billion

- 30 billion ad hoc transactions

“If you look at these numbers, there’s an opportunity there to help automate that better, particularly for exceptions and those ad hoc bill processes, so the opportunity out there is enormous. By leveraging its position as a trusted service provider, the bank can become a center for bill payments for their customers,” said Mick.

This is where Request to Pay can play a significant role, as it is designed to support the customer’s payment needs. It enables the production of enhanced mobile banking apps that leverage both instant payments rails and other investments that banks have made. But it is also an excellent opportunity to increase customer loyalty and get better insights into what the customer is doing. It is a significant value-add service that banks can provide to both billers and their consumers. And as Mick said: “It is a win-win situation.”

Fennell carried on: “And so even on the bank side, it is something that we see our customers looking to embrace. They see an opportunity. We also see several challenger organizations and FinTechs seeing this opportunity to get into this space. So there’s a competitive push driving a heightened interest in offering Request To Pay services for everyone”.

This was reflected in Mehmet’s comments: “Mastercard surveyed some of the larger corporates and billers. We’re hearing that billers want to present more alternatives to their customers. Customers’ demands have increased significantly. Now, coupled with the financial difficulties caused by the cost of living crisis, billers need to respond and find ways to improve service, arrears and late payments processes.”

Transforming the bill payment experience

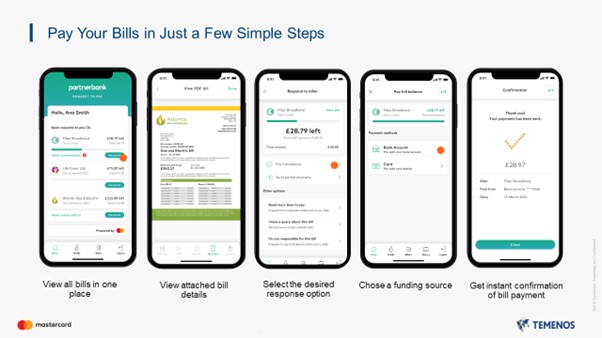

For banks, the opportunity lies in being central in the bill presentment and payment process to bring about critically needed solutions. Leveraging Request to Pay, the graphic below shows how banks can play a role in connect billers and their customers in a single, highly trusted channel – a mobile banking app.

However, no single stakeholder can provide the entire end-to-end value chain. The different players in the market need to work together to create the seamless process required for automation. This is why Temenos has joined forces with Mastercard to bring together our expert systems and processing components to ensure banks have a ready-made solution with faster time to market and lower risks.

The time to act is now. Society is increasingly demanding more streamlined solutions, and banks can be at the center, creating added value services for their customers, be they billers or payers. To deliver these solutions requires collaboration to provide that innovation, which means financial institutions, suppliers, vendors, and partners working together to power the entire innovative value chain.