Temenos Announces Q2 2022 Results

• Accelerating demand for subscription ahead of expectations driving ARR to 16% growth

• Supportive demand environment, Total Bookings growth of 12%

• Total software licensing growth of 8%, below FY guidance due to large tier 1 European deal slippage expected to close shortly

• SaaS ACV of USD11m, SaaS revenue growth of 36%

• EBIT decline of 9% with cost management reducing impact of slower total software licensing growth in the quarter

• Free Cash Flow (FCF) decline of 42% y-o-y with faster-than-expected shift to subscription; FCF down 5% LTM

• FY-22 guidance reconfirmed

Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, July 21, 2022 –Temenos AG (SIX: TEMN), the banking software company, today reports its second quarter 2022 results.

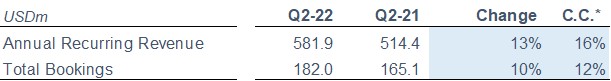

Annual Recurring Revenue and Total Bookings

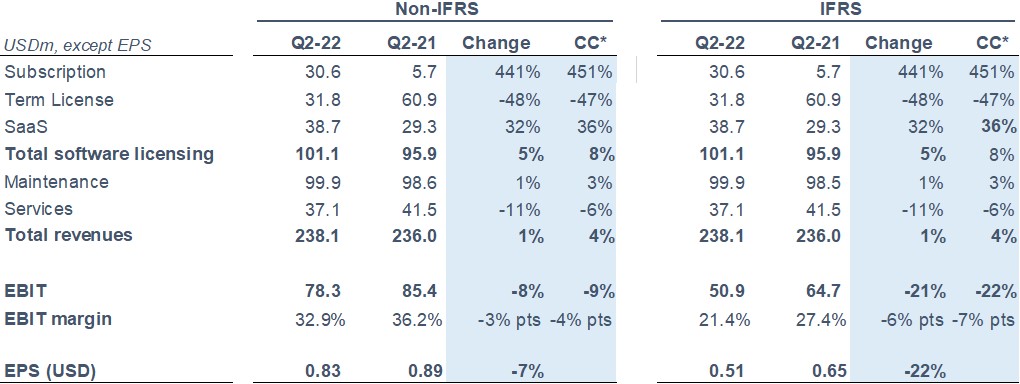

Income statement

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q2-22 highlights

- Demand for subscription model is accelerating ahead of expectations, driving ARR growth of 16%, up from 14% in Q1-22; EBIT growth to track 75% of prior year ARR growth from 2023

- Supportive demand environment reflected in 12% Total Bookings growth

- Total software licensing growth of 8%, below FY guidance due to large tier 1 European deal slippage expected to close shortly

- SaaS ACV of USD11m driven by largely new signings growth

- EBIT decline of 9% with cost management reducing impact of slower total software licensing growth in the quarter

- Free cash flow decline of 42% as expected despite faster than expected transition to subscription license model

- US activity remains high, won top 20 US bank for core banking renovation, deal expected to close in H2-22

- Europe recovery continues with double digit growth in Total Bookings and increased SaaS demand

- APAC performed particularly well with a number of new signings

- Tier 1 and 2 banks contributed 31% of total software licensing in the quarter, with increasing commitment among large banks to IT transformation

- Strong sales activity with partner deals in the quarter with focus on building partner channel

- 16 new client wins in the quarter, predominantly for core banking

- 83 go-lives including 23 implementation go-lives in the quarter

- FY-22 guidance reconfirmed

Q2-22 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) growth of 16% c.c. in Q2-22

- Total Bookings growth of 12% c.c. in Q2-22

- USD30.6m of subscription licenses signed in the quarter

- SaaS Annual Contract Value (ACV) of USD11m in Q2-22

- Non-IFRS SaaS revenue growth of 36% c.c. in Q2-22

- Non-IFRS total software licensing revenues up 8% c.c. in Q2-22

- Non-IFRS total revenue up 4% c.c. in Q2-22

- Non-IFRS EBIT decline of 9% c.c. in Q2-22

- Q2-22 non-IFRS EBIT margin of 32.9%, down 4% points c.c.

- Operating Cash Flow decline of 22% and Free Cash Flow decline of 42% in Q2-22; FCF down 5% LTM

- Leverage at 1.8x at end of Q2-22

- DSOs at 114 days

Commenting on the results, Temenos CEO Max Chuard said:

“I was pleased with the demand for subscription this quarter, having only introduced this new pricing model at the start of the year. Demand was ahead of our expectations and, along with our strong SaaS revenue, drove 16% growth in our Annual Recurring Revenue, up from 14% in Q1-22. I expect this trend to continue, and we are guiding for ARR growth of 18-20% for the full year.

We had a large European deal move from Q2-22 into Q3-22 which was a headwind on our total software licensing revenue this quarter. We are seeing increased activity with large tier 1 and 2 banks across all regions which, whilst it can be hard to time the closing of these deals, is clearly a positive and indicative of overall market activity which remains robust. This is particularly true in the Wealth space, where we are engaged in discussions with a number of global tier 1 private banks around transformational IT renovation.

We see strong levels of activity in the US and reached a significant milestone in the quarter as we won a top 20 US bank for core banking replacement. This builds on the Commerce Bank go-live which is opening up opportunities for us in the US market. We also had a good number of deals signed with partners, which is a channel we are increasingly focused on and expect to drive more sales through this channel going forward. With accelerating demand for subscription, we are well on our way to building a robust and more predictable recurring revenue business model.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We had strong demand for subscription this quarter, with USD31m of subscription licenses signed, significantly ahead of our expectations. Our total software licensing was impacted by one large deal that we expect to close shortly.

SaaS continues to perform well, with USD11m of SaaS ACV almost entirely won from new customers, and SaaS revenue accelerating to 36% growth year-on-year. This strong growth in subscription and SaaS is driving an acceleration in ARR, which grew 16% this quarter and which we expect to continue to accelerate. Overall, the demand environment remained robust with USD182m of total bookings in the quarter, up 12%.

In terms of cash, we generated USD87m of operating cash flow, a decline of 22%, and USD50m of Free Cash Flow, a decline of 42% due to the shift to subscription.

We reiterate our guidance for 2022, with ARR growth of 18-20%, Total Software Licensing growth of 16-18% and Total Revenue growth of at least 10%. Lastly, we expect EBIT to grow 9-11% for the year. We expect to continue converting 100%+ of EBITDA into operating cash, and we expect our FY-22 tax rate to be between 18-20%.”

Revenue

IFRS revenue was USD 238.1m for the quarter, an increase of 1% vs. Q2-21.

Non-IFRS revenue was USD 238.1m for the quarter, an increase of 1% vs. Q2-21.

IFRS total software licensing revenue for the quarter was USD 101.1m, an increase of 5% vs. Q2-21.

Non-IFRS total software licensing revenue was USD 101.1m for the quarter, an increase of 5% vs. Q2-21.

EBIT

IFRS EBIT was USD 50.9m for the quarter, a decrease of 21% vs. Q2-21.

Non-IFRS EBIT was USD 78.3m for the quarter, a decrease of 8% vs. Q2-21.

Non-IFRS EBIT margin was 32.9%, down 3% point vs. Q2-21.

Earnings per share (EPS)

IFRS EPS was USD 0.51 for the quarter, a decrease of 22% vs. Q2-21.

Non-IFRS EPS was USD 0.83 for the quarter, a decrease 7% vs. Q2-21.

Cash flow

IFRS operating cash was an inflow of USD 86.8m in Q2-22, a decrease of 22% vs. Q2-21 and representing an LTM conversion of 116% of IFRS EBITDA into operating cash. USD 49.9m of Free Cash Flow was generated in Q2-22, a decrease of 42% vs. Q2-21 due to the accelerating move to subscription and lower term licenses.

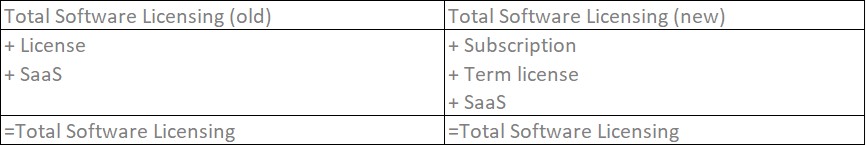

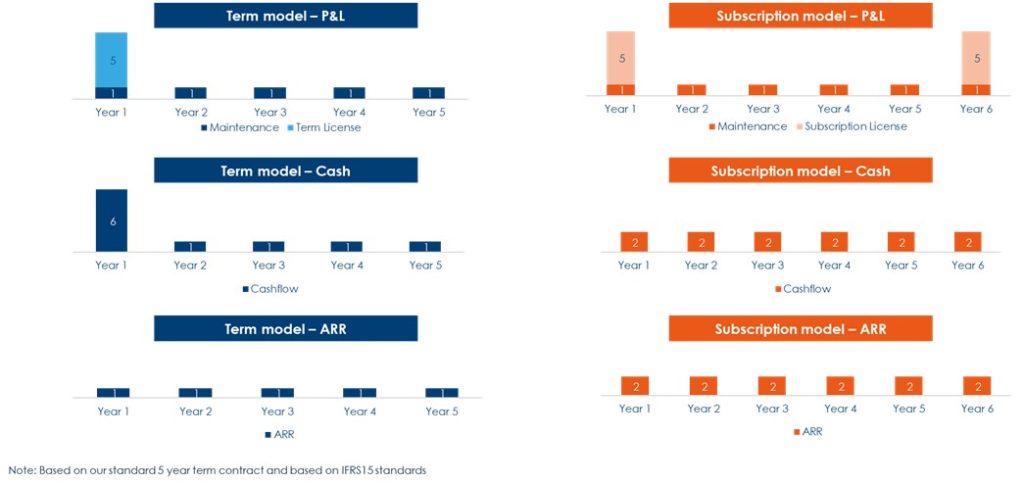

Move to subscription revenue and impact on future reporting

Temenos will sell five-year subscription contracts for on-premise license and maintenance as standard from 2022, including for renewals. This will accelerate growth by capturing greater contract value and accelerate the shift to more financial performance driven by a much higher proportion of recurring revenues. To reflect this change, on the P&L the License revenue is split into either Subscription license or Term license, depending on the nature of contract.

The impact of the move to a subscription model on P&L, cash and ARR is shown for illustrative purposes below:

2022 non-IFRS guidance

The guidance for 2022 is non-IFRS and in constant currencies.

- ARR growth of 18-20%

- Total Software Licensing growth of 16-18%

- Total revenue growth of at least 10%

- EBIT growth of +9-11%

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2022 tax rate of 18-20%

Medium term targets by/for 2025

The medium-term targets by/for are non-IFRS and in constant currencies.

- ARR growth of 20-25% CAGR 2021-25 to reach c.USD1.3bn of ARR by 2025

- Total Software Licensing growth of 15-20% CAGR 2021-25

- Total revenue growth of 10-15% CAGR 2021-25

- EBIT margin to reach c.41% by 2025

- Free Cash Flow growth of 10-15% CAGR 2021-26 to reach >USD600m by 2026

Currency assumptions for 2022 guidance

In preparing the 2022 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.05;

- GBP to USD exchange rate of 1.24; and

- USD to CHF exchange rate of 0.96

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as financing costs, advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2022 non-IFRS guidance.

- FY 2022 estimated share-based payments and related social charges charges of c.5% of revenue

- FY 2022 estimated amortisation of acquired intangibles of USD 50m

- FY 2022 estimated restructuring costs of USD 10m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after July 21, 2022. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

– Ends –

About Temenos

Temenos (SIX: TEMN) is the world’s leading open platform for composable banking, creating opportunities for over 1.2 billion people around the world every day. We serve two-thirds of the world’s top 1,000 banks and 70+ challenger banks in 150+ countries by helping them build new banking services and state-of-the-art customer experiences.

The Temenos open platform helps our top-performing clients achieve return on equity three times the industry average and cost-to-income ratios half the industry average.

For more information, please visit www.temenos.com.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch