Temenos pre-announces Q3 2022 results

Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, October 13, 2022 –Temenos AG (SIX: TEMN), the banking software company, today pre-announces its third quarter 2022 results.

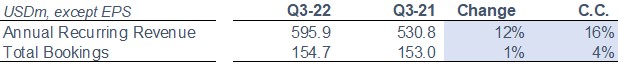

Annual Recurring Revenue and Total Bookings

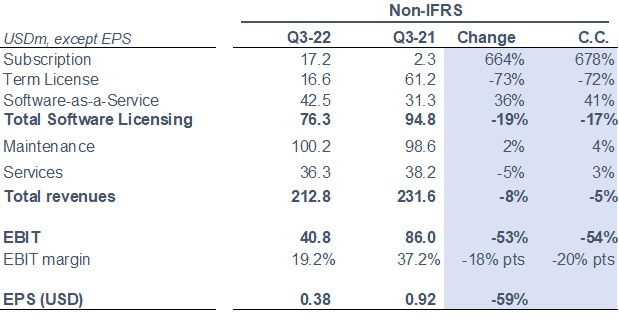

Income statement

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q3-22 business update

- Lengthening sales cycles linked to a number of large deals in the pipeline, subscription revenue of USD 17.2m significantly below expectation

- Banks more cautious in their decision making given future macro economic uncertainty

- Term license revenue of USD 16.6m in line with expectations, mainly driven by deals closed early in the quarter that had not moved to the subscription pricing model

- Sales execution also impacting deal closures; action on sales leadership taken, the Chief Revenue Officer has left the business effective immediately

- Accelerating growth in SaaS revenue from mix of new business and additional consumption from existing clients, with no visible impact on decision making by non-incumbents and smaller banks from macro economic uncertainty

- Good growth in ARR in the quarter, up 16% (c.c.)

- Services returned to growth this quarter, still impacted by accelerated shift to partner model

- Cost increases driven by combination of wage inflation and increased services costs driven by incremental partner costs around a number of implementations

- Underlying operational costs in the quarter were as expected

- EBIT decline of 53% impacted by lower subscription revenue and cost increases

- FY-22 guidance revised and de-risked to reflect macro impact, sales execution and services costs

- Revised FY-22 guidance (constant currency) of ARR growth of 17-18%, Total Software Licensing growth of 0% and EBIT decline of 25%

Q3-22 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) growth of 16% c.c. in Q3-22

- Total Bookings growth of 4% c.c. in Q3-22

- USD17.2m of subscription licenses signed in the quarter

- SaaS Annual Contract Value (ACV) of USD17.9m in Q3-22

- Non-IFRS SaaS revenue growth of 41% c.c. in Q3-22

- Non-IFRS total software licensing revenues down 17% c.c. in Q3-22

- Non-IFRS total revenue down 5% c.c. in Q3-22

- Non-IFRS EBIT decline of 54% c.c. in Q3-22

- Q3-22 non-IFRS EBIT margin of 19.2%

Commenting on the results, Temenos CEO Max Chuard said:

“I am disappointed by our results this quarter, which were severely impacted by banks delaying signing decisions in the last weeks of the quarter due to uncertainties linked to the worsening macro environment, as well as sales execution. We have a greater than average number of large deals in the pipeline at present, and we saw the sales cycles lengthening on several of these. We have conducted a thorough review of our pipeline and de-risked our full year guidance on this basis. We have also taken appropriate actions on leadership, with the Chief Revenue Officer leaving the business. SaaS was a bright spot this quarter, with SaaS ACV of USD17.9m and SaaS revenue growth accelerating to 41%. We had good levels of demand from non-incumbents and smaller banks, both new and existing customers.

We have a strong and resilient business model and the continued growth in SaaS in particular provides the foundation for strong growth in ARR in the following years. Our pipeline continued to grow in Q3 across territories and client tiers and, despite the impact we saw in Q3 from bank decision making, we do expect further acceleration in ARR in 2023 which will also drive profit growth. This validates our strategic shift to a more recurring revenue business model and provides better visibility on profit growth next year and the years beyond. I am confident we will weather this storm and come out stronger than before.”

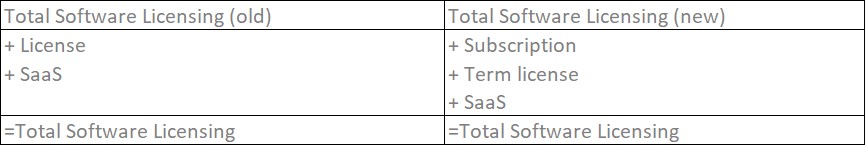

Move to subscription revenue and impact on future reporting

Temenos will sell five-year subscription contracts for on-premise license and maintenance as standard from 2022, including for renewals. This will accelerate growth by capturing greater contract value and accelerate the shift to more financial performance driven by a much higher proportion of recurring revenues. To reflect this change, on the P&L the License revenue is split into either Subscription license or Term license, depending on the nature of contract.

The impact of the move to a subscription model on P&L, cash and ARR is shown for illustrative purposes below:

Revised 2022 non-IFRS guidance

The revised guidance for 2022 is non-IFRS and in constant currencies.

- ARR growth of 17-18%

- Total Software Licensing growth of 0%

- EBIT decline of -25%

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2022 tax rate of 18-20%

For reference, the previous guidance was as follows:

- ARR growth of 18-20%

- Total Software Licensing growth of 16-18%

- Total revenue growth of at least 10%

- EBIT growth of +9-11%

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2022 tax rate of 18-20%

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as financing costs, advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2022 non-IFRS guidance.

- FY 2022 estimated share-based payments and related social charges charges of c.5% of revenue

- FY 2022 estimated amortisation of acquired intangibles of USD 50m

- FY 2022 estimated restructuring costs of USD 14m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after October 13, 2022. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements. Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch