Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, October 20, 2022 –Temenos AG (SIX: TEMN), the banking software company, today reports its third quarter 2022 results.

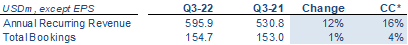

Annual Recurring Revenue and Total Bookings

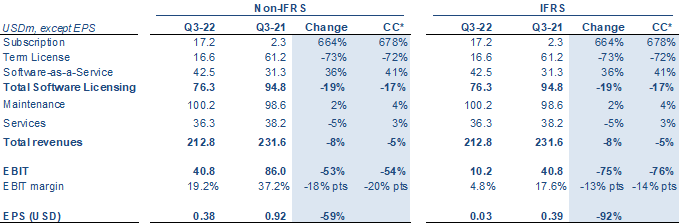

Income statement

Q3-22 business update

- Lengthening sales cycles and sales execution impacted deal closures; subscription revenue of USD 17.2m significantly below expectation; larger banks more cautious in their decision making given future macro economic uncertainty

- Accelerating growth in SaaS revenue from mix of new business and additional consumption from existing clients

- Good growth in ARR in the quarter, up 16% (c.c.)

- Action on sales leadership taken, the Chief Revenue Officer and President of the Americas have left the business effective immediately

- Responsibility for U.S. Operations and U.S. sales to Colin Jarrett and Philip Barnett, two long-tenured members of Temenos management

- Cost increases driven by combination of wage inflation and increased services costs; majority of operational costs in the quarter were as expected

- Revised FY-22 guidance provided with pre-announcement; ARR growth of 17-18%, Total Software Licensing growth of 0% and EBIT decline of 25%

- Success of partner strategy resulted in a decline in customised development licenses in the last 12 months

- Excluding customised development licenses, LTM-Q3 total software licensing grew 11% (c.c.), expected to grow c.4% (c.c.) for FY-22

- We target a continued acceleration in ARR in FY23 driven by SaaS and subscription transition, driving profitability growth

- We expect locked in SaaS revenue by year-end to contribute c.10% points of growth in FY-23 on total software licensing

- FY-23 guidance and medium term targets will be given in February 2023 with the Q4-22 results and Capital Markets Day

Q3-22 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) growth of 16% c.c. in Q3-22

- Total Bookings growth of 4% c.c. in Q3-22

- USD17.2m of subscription licenses signed in the quarter

- SaaS Annual Contract Value (ACV) of USD18m in Q3-22

- Non-IFRS SaaS revenue growth of 41% c.c. in Q3-22

- Non-IFRS total software licensing revenues decline of 17% c.c. in Q3-22

- Non-IFRS total revenue decline of 5% c.c. in Q3-22

- Non-IFRS EBIT decline of 54% c.c. in Q3-22

- Q3-22 non-IFRS EBIT margin of 19.2%, down 20% points c.c.

- Operating Cash Flow decline of 49% and Free Cash Flow decline of 88% in Q3-22; FCF down 17% LTM

- Leverage at 2.0x at end of Q3-22

- DSOs at 112 days

Commenting on the results, Temenos CEO Max Chuard said:

“We had a disappointing quarter, with significantly lower subscription revenue than expected. Sales cycles lengthened on a number of deals, with banks delaying decisions due to the worsening macro environment. We also had some sales execution issues. We have conducted a thorough review of our pipeline and de-risked our guidance. We have also made leadership changes, with the departure of both the Chief Revenue Officer and President of the Americas, and the appointment of two of our most senior Executives to run our US business. SaaS was a bright spot this quarter, with SaaS ACV of USD17.9m and SaaS revenue growth accelerating to 41%. We had good levels of demand from smaller banks and non-incumbents, which reflects the diversity in our client base.

We have a strong and resilient business model and the continued growth in SaaS provides the foundation for further growth in ARR. Our pipeline continued to grow in Q3 across territories and client tiers and we expect further acceleration in ARR in 2023 which will also drive profit growth. We expect locked in SaaS revenue by year-end to contribute c.10% points of growth in FY-23 on total software licensing.

With nearly USD600m of ARR at the end of Q3, our recurring revenue base gives greater visibility on future growth than ever before. We are selling into a massive market, we are market leading, and we have a significant global client base.

I am confident we will weather this storm and come out stronger than before.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“A key consideration for us this quarter has been our cost structure. While the majority of our operating costs were in line with expectations, there was a significant increase in services costs around a number of partner implementations and we were affected, to a lesser extent, by inflationary pressures on wages in a tight labour market. We expect these non-recurring services costs to remain high in Q4 and then to start coming down in Q1-23. We will continue investing in our business, in particular in sales and R&D, to drive our future growth.

Cash was impacted by the lower signings in the quarter and the subscription transition, with USD34.8m of operating cash generated and USD5m of Free Cash Flow.

We revised our guidance for 2022 last week at the pre-announcement and are now expecting ARR growth of 17-18%, Total Software Licensing revenue growth of 0% and an EBIT decline of -25%. We expect to continue converting 100%+ of EBITDA into operating cash, and we expect Free Cash Flow to decline by c.50%, largely due to the EBIT decline and subscription transition as well as higher cash costs mainly due to increased service costs as explained. We expect our FY-22 tax rate to be between 18-20%. We will issue our FY-23 guidance and revised medium term targets in February 2023 at the Q4 results and Capital Markets Day.”

Q3-22 financial summary (IFRS and non-IFRS)

Revenue

IFRS and non-IFRS revenue was USD 212.8m for the quarter, a decrease of 8% vs. Q3-21.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 76.3m, a decrease of 19% vs. Q3-21.

EBIT

IFRS EBIT was USD 10.2m for the quarter, a decrease of 75% vs. Q3-21.

Non-IFRS EBIT was USD 40.8m for the quarter, a decrease of 53% vs. Q3-21.

Non-IFRS EBIT margin was 19.2%, down 18% point vs. Q3-21.

Earnings per share (EPS)

IFRS EPS was USD 0.03 for the quarter, a decrease of 92% vs. Q3-21.

Non-IFRS EPS was USD 0.38 for the quarter, a decrease of 59% vs. Q3-21.

Cash flow

IFRS operating cash was an inflow of USD 34.8m in Q3-22, a decrease of 49% vs. Q3-21, representing an LTM conversion of 117% of IFRS EBITDA into operating cash. USD 4.8m of Free Cash Flow was generated in Q3-22, a decrease of 88% vs. Q3-21 due essentially to the change in revenue mix towards subscription, which impacts the upfront free cash flow profile of the company, as well as lower EBIT for the quarter.

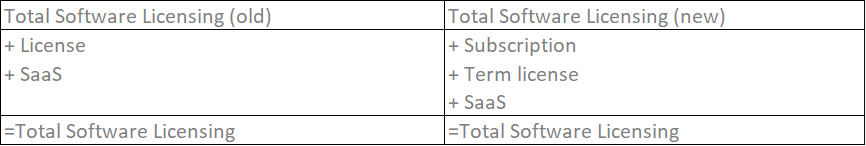

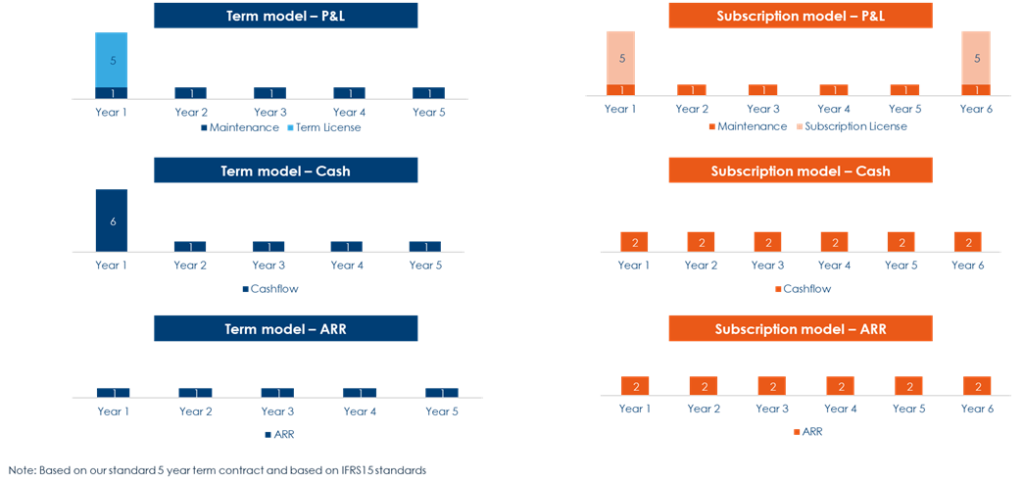

Transition to subscription revenue and impact on future reporting

Temenos aims to sell five-year subscription contracts for on-premise license and maintenance as standard from 2022 onwards, including for renewals. Temenos expects that this transition will accelerate growth by capturing greater contract value and will also contribute to the shift to more predictable financial performance driven by a much higher proportion of recurring revenues. To reflect this change, in Temenos’ income statement, the Total Software Licensing Revenue line is now reported in three sub-segments: Subscription license, Term license and SaaS.

The impact of the move to a subscription model on the income statement, cash and ARR is shown for illustrative purposes below:

Revised 2022 non-IFRS guidance

The revised guidance for 2022 is non-IFRS and in constant currencies.

For reference, the previous guidance was as follows:

- ARR growth of 18-20%

- Total Software Licensing growth of 16-18%

- Total Revenue growth of at least 10%

- EBIT growth +9-11%

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2022 tax rate of 18-20%

Currency assumptions for 2022 guidance

In preparing the 2022 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.02;

- GBP to USD exchange rate of 1.14; and

- USD to CHF exchange rate of 0.96

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of 20 October 2022. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, October 20, 2022, Max Chuard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

The supplemental non-IFRS information presented in this press release is subject to inherent limitations. Non-IFRS measures are not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS measures may not be comparable to similarly titled non-IFRS measures used by other reporting companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as financing costs, advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2022 non-IFRS guidance.

- FY 2022 estimated share-based payments and related social charges charges of c.5% of revenue

- FY 2022 estimated amortisation of acquired intangibles of USD 50m

- FY 2022 estimated restructuring costs of USD 14m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after October 20, 2022. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value, which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

Press and media enquiries

Conor McClafferty | Martin Meier-Pfister