Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, February 20, 2023 –Temenos AG (SIX: TEMN), the banking software company, today announces its fourth quarter and full year 2022 results.

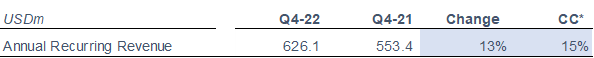

Annual Recurring Revenue

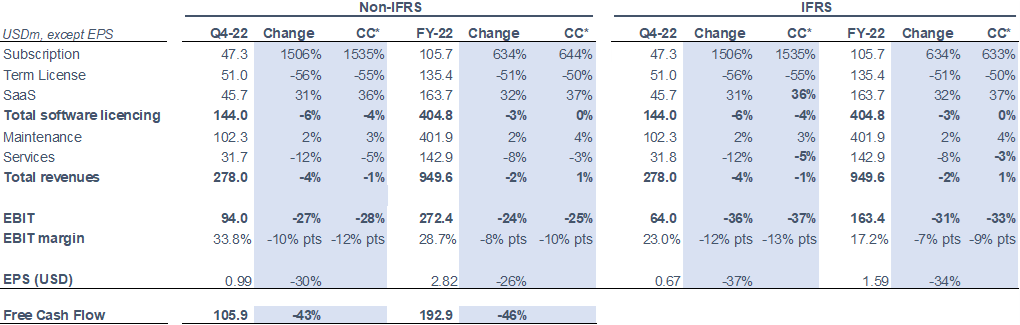

Income statement and Free Cash Flow

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q4 and FY-22 business update

- No further lengthening of sales cycles witnessed vs. Q3-22; banks remain cautious based on uncertain 2023

- A number of tier 1 deals signed across regions, including with leading US bank extending its relationship to include its international private banking operations; revenue mix from Tier 1 and 2 during FY 2022 recovers to 2019 levels

- Maintained strong win-rates vs. competition, both traditional and neo-vendors

- Rise of cloud starting to also benefit subscription business as banks, especially Tier 1 and 2, but also others, start to implement cloud native solutions that they run themselves on public cloud

- North America total software licensing at 37% for FY-22, highest ever as we continue to make consistent progress in the US

- Continued strong SaaS growth and ACV driven by sales to new customers as SaaS becoming more mainstream; not a transition

- Subscription transition continues at pace, realised value premium within expected range

- Strong ARR growth driven by SaaS ACV and subscription transition

- Cash flows benefit significantly from the positive working capital dynamics of the SaaS business to minimise impact of subscription shift

- Capital Markets Day to be held on 21st February in person in London and via webcast, register here to attend

Q4 and FY-22 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) growth of 15% in Q4-22 and FY-22 c.c.

- Total Bookings decline of 10% in Q4-22 and growth of 4% in FY-22 c.c.

- SaaS Annual Contract Value (ACV) of USD10.5m in Q4-22 and USD58.1m in FY-22

- USD 47.3m of non-IFRS subscription licenses signed in Q4-22 and USD105.7m signed in FY-22

- Non-IFRS SaaS revenue growth of 36% in Q4-22 and 37% in FY-22 c.c.

- Non-IFRS total software licensing revenues down 4% in Q4-22 and 0% in FY-22 c.c.

- Non-IFRS total revenue down 1% in Q4-22 and up 1% in FY-22 c.c.

- Non-IFRS EBIT decline of 28% in Q4-22 and 25% in FY-22 c.c.

- Q4-22 non-IFRS EBIT margin of 33.8% and FY-22 non-IFRS EBIT margin of 28.7%

- Q4-22 Operating Cash Flow of USD135m, down 38% y-o-y; FY-22 Operating Cash Flow of USD317m, down 33%

- Q4-22 Free Cash Flow of USD 106m, down 43% y-o-y; FY-22 Free Cash Flow of USD 193m, down 46%

- Leverage at 2.0x at end of Q4-22

- DSOs at 129 days

- Long term profit and cash flow strength support proposed dividend of CHF1.10, a 10% annual increase

Outlook

- Sales environment expected to remain stable this year, banks to continue remaining cautious in 2023

- Demand for SaaS and cloud increasing

- Both Subscription and SaaS revenue being driven by demand for cloud

- Good pipeline development, including a number of tier 1 deals

- Subscription transition to be substantially complete by year-end FY-23

- Subscription transition and growth in demand for SaaS and cloud driving ARR growth

- Both revenue streams contribute to ARR despite different revenue recognition and cash flow profiles

- 2022 investment in sales and R&D to provide growth platform for 2023

- Headwind from decline in customised development license revenue now fully absorbed – partners doing significant majority of client-specific work

- Minimum cash flow point on subscription behind us with positive working capital from SaaS business more than offsetting remaining negative working capital from subscription transition – Free Cash Flow growth expected to accelerate

- Simplification of communication, ARR primary revenue outlook KPI – appropriate given critical mass of recurring revenue expected to reach over 70% of total revenue and over 80% of product revenue in 2023

- Continued strong ARR growth driving increasing visibility on profit and FCF

Commenting on the results, Temenos Executive Chairman and Acting CEO, Andreas Andreades, said:

“Having taken on the role of Acting CEO in January, I am pleased with the dedication and focus of our people in delivering the fourth quarter and building a strong base for 2023. While I expect the sales environment to remain stable this year, with banks being cautious around their IT spend given the uncertain macro outlook I also expect 2023 to be a growth year for Temenos especially because of the strong growth of our SaaS business. Our pipeline has continued to develop positively, including a number of tier 1 deals. We made considerable investment in the business in 2022 and this provides us with a platform for growth in the coming year. Our subscription transition is continuing at pace and we expect it to be largely complete by the end of the year. Both SaaS and subscription revenue are benefiting from the growing demand for cloud, and this is helping to drive strong growth in our Annual Recurring Revenue which will be a key KPI for us going forward.”

Commenting on the results, Temenos CFO, Takis Spiliopoulos, said:

“Despite what was clearly a tough second half of the year, I am pleased that we were able to deliver on the revised guidance, and in fact exceed the expectations on Free Cash Flow. In constant currency, our ARR continued to grow at a decent pace, up 15% in Q4-22, and our transition to subscription is also proceeding as planned. SaaS revenue was up 36% in the quarter and 37% for the Full Year in constant currency, and our FY-22 SaaS ACV means we have around 10 percentage points of Total Software Licensing growth already locked in for 2023.

Free Cash Flow was down 46% for the year, impacted by the transition to subscription and rising costs. It is worth noting that our cash flows benefit significantly from the positive working capital dynamics of the SaaS business which minimises the impact of the shift to subscription. Looking at the balance sheet, we ended the year with leverage of 2x net debt to EBITDA and expect this to trend downwards in 2023. Given the strength of our balance sheet and visibility on FCF growth, we have proposed a 10% increase in dividend to CHF 1.10 for FY-22.

Looking forward, we have announced our guidance for 2023. Our guidance is non-IFRS and in constant currency. We expect ARR to grow at least 12%, Total Software Licensing to grow at least 6%, EBIT to grow at least 7% and EPS to grow at least 6%. We also expect Free Cash Flow to accelerate based on positive working capital dynamics and grow at least 12%, in-line with ARR, and we expect an FY-23 tax rate of between 19-21%.”

Revenue

IFRS and non-IFRS revenue was USD 278.0m for the quarter, a decrease of 4% vs. Q4-21.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 144.0m, a decrease of 6% vs. Q4-21.

EBIT

IFRS EBIT was USD 64.0m for the quarter, a decrease of 36% vs. Q4-21.

Non-IFRS EBIT was USD 94.0m for the quarter, a decrease of 27% vs. Q4-21.

Non-IFRS EBIT margin was 33.8%, down 10% point vs. Q4-21.

Earnings per share (EPS)

IFRS EPS was USD 0.67 for the quarter, a decrease of 37% vs. Q4-21.

Non-IFRS EPS was USD 0.99 for the quarter, a decrease of 30% vs. Q4-21.

Cash flow

IFRS operating cash was an inflow of USD 134.6m in Q4-22, a decrease of 38% vs. Q4-21, representing an LTM conversion of 105% of IFRS EBITDA into operating cash. USD 105.9m of Free Cash Flow was generated in Q4-22, a decrease of 43% vs. Q4-21 due essentially to the change in revenue mix towards subscription, which impacts the upfront free cash flow profile of the company, as well as higher costs for the quarter.

Dividend

Taking into account the profit and cash generation in 2022, as well as the expected strength of future cash flows, subject to shareholder approval at the AGM on 3 May 2023, Temenos intends to pay a dividend of CHF 1.10 per share in 2023. The timing for the dividend payment will be as follows:

- 3 May AGM approval

- 5 May Shares trade ex-dividend

- 8 May Record date

- 9 May Payment date

The dividend will be taken from the retained earnings (cash dividend) and therefore taxable (WHT 35%).

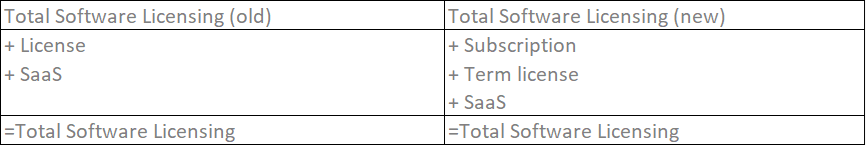

Move to subscription revenue and impact on future reporting

Temenos moved to selling five-year subscription contracts for on-premise license and maintenance as standard from 2022, including for renewals. This will accelerate growth by capturing greater contract value and accelerate the shift to more consistent financial performance driven by a much higher proportion of recurring revenues. To reflect this change, on the P&L the License revenue is split into either Subscription license or Term license, depending on the nature of contract.

The impact of the move to a subscription model on P&L, cash and ARR is shown below for illustrative purposes:

2023 non-IFRS guidance

The guidance for 2023 is non-IFRS and in constant currencies.

- ARR growth of at least 12%

- Total Software Licensing Revenue growth of at least 6%

- EBIT growth of at least 7%

- EPS growth of at least 6%

- FCF growth of at least 12%, in-line with ARR

- Expected FY 2023 tax rate of 19-21%

- Cash conversion expected to remain at 100%+ of EBITDA into operating cash flow

Currency assumptions for 2023 guidance

In preparing the 2023 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.09;

- GBP to USD exchange rate of 1.24; and

- USD to CHF exchange rate of 0.92

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of 20 February 2023. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, February 20, 2023, Andreas Andreades, Executive Chairman and Acting CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Capital Markets Day

Temenos will host an in-person Capital Markets Day on Tuesday 21st February in London. The event will also be webcast. Registration and the agenda for the Capital Markets Day is available here.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2023 non-IFRS guidance.

- FY 2023 estimated share-based payments and related social charges charges of c.5% of revenue

- FY 2023 estimated amortisation of acquired intangibles of USD 50m

- FY 2023 estimated restructuring costs of USD 14m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after February 20, 2023. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements. Total Bookings includes fair value of license contract value, committed maintenance contract value on license, and SaaS committed contract value. All must be committed and evidenced by duly signed agreements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

Press and media enquiries

Conor McClafferty | Martin Meier-Pfister