Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, July 20, 2023 –Temenos AG (SIX: TEMN), the banking software company, today reports its second quarter 2023 results.

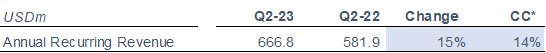

Annual Recurring Revenue

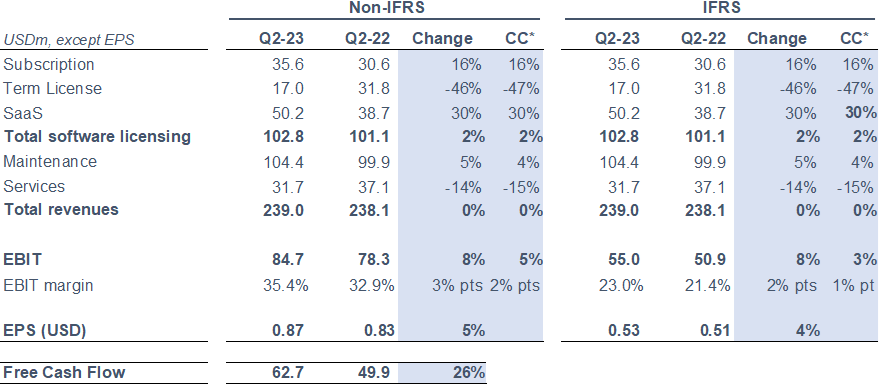

Income statement and Free Cash Flow

The definition of non-IFRS adjustments is set out below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II. * Constant currency (c.c.) adjusts prior year for movements in currencies

Q2-23 operational highlights

- Sales environment remained stable in the quarter

- Pipeline developed positively in the quarter; large deals progressing well

- Subscription transition continuing to progress and delivering value uplift for both new clients and renewals; expected to be substantially complete by end of FY-23

- SaaS ACV driven by both incremental consumption and new logos

- Strong US performance; signed Convera, the largest non-bank global B2B payments provider, to modernize its payments in the cloud, beating domestic US competition

- Signed top 20 US regional bank for core banking in its UK commercial banking operations

- Solid quarter in Europe with good pipeline development; European recovery expected to continue in H2-23

- 9 new client wins in the quarter, across SaaS and subscription

- Services continued trend of profitability; good cost control across the business

Q2-23 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) growth of 14% c.c.

- SaaS Annual Contract Value (ACV) of USD 20.2m, highest ever quarterly SaaS ACV

- Non-IFRS SaaS revenue growth of 30% c.c.

- Non-IFRS total software licensing revenues growth of 2% c.c.

- Non-IFRS total revenue growth of 0% c.c.

- Non-IFRS EBIT growth of 5% c.c.

- Q2-23 non-IFRS EBIT margin of 35.4%, up 2% points c.c.

- Q2-23 operating cash flow of USD 90.2m, up 4% y-o-y

- Q2-23 Free Cash Flow of USD 62.7m, up 26% y-o-y

- Leverage at 2.0x at end of Q2-23

- DSOs at 124 days

Commenting on the results, Temenos CEO, Andreas Andreades, said:

“I’m pleased with our performance this quarter, which continued the trend from Q1 and has set us up well for the second half of the year. The sales environment was stable through the quarter with ARR growth of 14% c.c. a particular highlight. Our transition to a recurring revenue model is progressing well, with strong subscription license signings and our highest ever quarterly SaaS ACV. I expect our subscription transition to be substantially complete by year-end.

From a regional perspective, our US business continued to deliver, in particular with the signing of Convera, the largest non-bank global B2B payments provider, which we won against all the top US incumbent vendors. Convera has selected us to modernize its cloud-based payments software, a testimony to the strength of our SaaS and cloud capabilities. We also signed a top 20 regional US bank for core banking in its UK commercial banking operations. We saw a sequential improvement in Europe with good pipeline development and with further recovery expected in H2, and our APAC business performed in line with our expectations against a strong comparative.

We have raised our guidance for ARR and FCF, reflecting the strength of our first half performance. I expect the sales environment to remain stable going forward and I am confident we will continue our strong performance in H2.”

Commenting on the results, Temenos CFO, Takis Spiliopoulos, said:

“We had a good performance across most key metrics in the second quarter, and I was particularly pleased with our recurring revenue growth. We have now grown our ARR by 14% both in the quarter and in H1-23 which, combined with the positive pipeline development we have seen, supports the increase in full year guidance for ARR and Free Cash Flow. We now expect ARR to grow 12%-14%, and also expect Free Cash Flow to grow 12%-14%, in line with ARR. We have reconfirmed our other FY-23 guidance.

Our Services business continued to be profitable this quarter on a non-IFRS basis, although Services revenue declined as we continue our strategy of working more with partners. Overall we had good cost control in Q2, as we continue to benefit from both the investments we made last year and the decline in our Services cost base as projects go live, enabling us to deliver EBIT growth of 5% c.c..

We had a strong cash quarter, with our Free Cash Flow growing 26% year-on-year, with our SaaS revenue and deferred revenue more than offsetting the impact from subscription. I still expect Free Cash Flow to grow in-line with ARR for the full year. Looking at the balance sheet, we ended the quarter with leverage of 2.0x net debt to EBITDA and expect this to trend down from this level by year end.”

Q2-23 financial summary (IFRS and non-IFRS)

Revenue

IFRS and non-IFRS revenue was USD 239.0m for the quarter, an increase of 0% vs. Q2-22.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 102.8m, an increase of 2% vs. Q2-22.

EBIT

IFRS EBIT was USD 55.0m for the quarter, an increase of 8% vs. Q2-22.

Non-IFRS EBIT was USD 84.7m for the quarter, an increase of 8% vs. Q2-22.

Non-IFRS EBIT margin was 35.4%, up 3% points vs. Q2-22.

Earnings per share (EPS)

IFRS EPS was USD 0.53 for the quarter, an increase of 4% vs. Q2-22.

Non-IFRS EPS was USD 0.87 for the quarter, an increase of 5% vs. Q2-22.

Cash flow

IFRS operating cash was an inflow of USD 90.2m in Q2-23, an increase of 4% vs. Q2-22, representing an LTM conversion of 108% of IFRS EBITDA into operating cash. USD 62.7m of Free Cash Flow was generated in Q2-23, an increase of 26% vs. Q2-22. Free Cash Flow is still expected to grow in line with ARR for the full year.

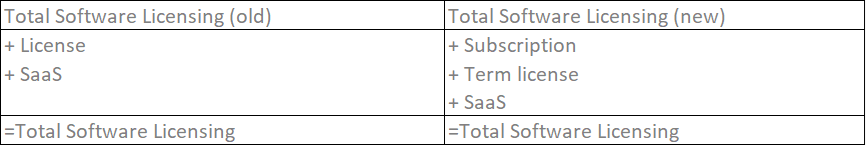

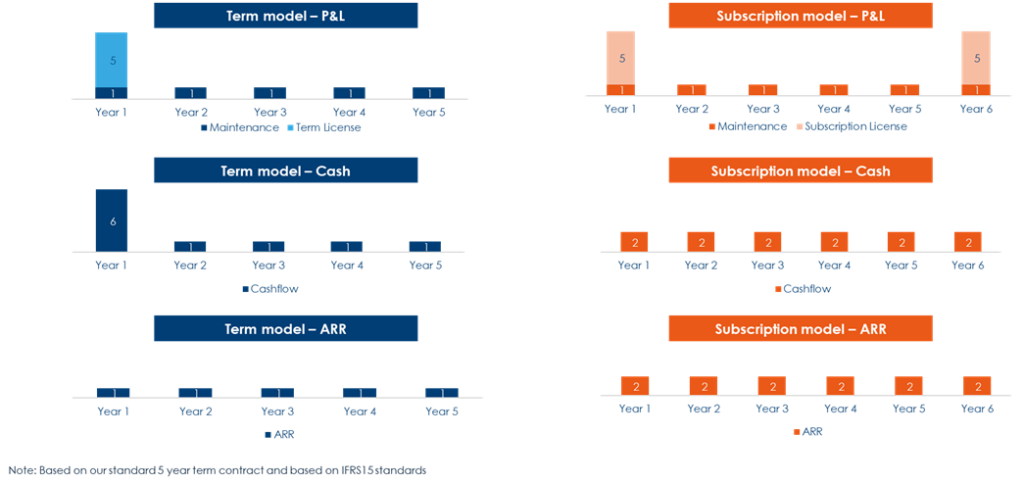

Transition to subscription revenue and impact on future reporting

Temenos moved to selling five-year subscription contracts for on-premise license and maintenance as standard from 2022, including for renewals. This will accelerate growth by capturing greater contract value and accelerate the shift to more consistent financial performance driven by a much higher proportion of recurring revenues. To reflect this change, on the P&L the license revenue is split into either subscription license or term license, depending on the nature of contract.

The impact of the move to a subscription model on the income statement, cash and ARR is shown for illustrative purposes below:

FY-23 non-IFRS guidance

The guidance for FY-23 is non-IFRS and in constant currencies. Guidance for FY-23 ARR and FCF has been raised, other guidance items have been reconfirmed:

• ARR growth of 12%-14% (up from at least 12%)

• Total software licensing revenue growth of at least 6%

• EBIT growth of at least 7%

• EPS growth of at least 6%

• FCF growth of 12%-14%, in-line with ARR (up from at least 12%)

Currency and other assumptions for FY-23 guidance

In preparing the FY-23 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.09;

- GBP to USD exchange rate of 1.24; and

- USD to CHF exchange rate of 0.90

The Company has also assumed the following:

- Expected FY-23 tax rate of 19-21%

- Cash conversion expected to remain at 100%+ of EBITDA into operating cash flow

Mid-term targets

The mid-term targets and are non-IFRS and in constant currencies, except Free Cash Flow which is reported:

- ARR of at least USD 1.3bn

- EBIT of at least USD 570m

- FCF of at least USD 700m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of 20 July 2023. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.15 CET / 17.15 GMT / 12.15 EST, today, July 20, 2023, Andreas Andreades, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-23 non-IFRS guidance.

- FY-23 estimated share-based payments and related social charges charges of c.5% of revenue

- FY-23 estimated amortisation of acquired intangibles of USD 50m

- FY-23 estimated restructuring costs of USD 14m

Restructuring costs include realizing R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programs commenced after 20 July, 2023. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

Press and media enquiries

Conor McClafferty | Martin Meier-Pfister