Temenos Announces Q4 and FY-23 Results; Strong Cash Flow and Continued Positive Momentum

• Q4 and FY-23 results in line with pre-announcement

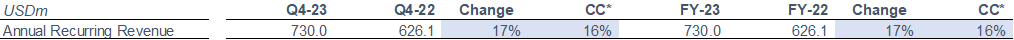

• FY-23 ARR grew 16% c.c. to USD730m, exceeding raised guidance of 13-15%

• FY-23 total software licensing growth of 10% c.c. vs. guidance of at least 6% growth

• FY-23 EBIT growth of 12% c.c. vs. raised guidance of at least 8% growth

• FY-23 Free Cash Flow grew 26% to USD243m, significantly exceeding raised guidance of 12-14%

• FY-23 EPS grew 13%, vs. raised guidance of at least 7% growth

• FY-24 guidance (non-IFRS, constant currency) announced with ARR growth of about 15%, total software licensing growth of 7-10%, EBIT growth of 7-9%, EPS growth of 6-8% and Free Cash Flow growth of at least 16%

• Mid-term targets reconfirmed; ARR to reach more than USD1.3bn, EBIT to reach more than USD570m and Free Cash Flow to reach more than USD700m in the mid-term

• Proposed dividend of CHF 1.20 for FY-23 to be voted on at AGM on 7 May 2024

Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, February 19, 2024 – Temenos AG (SIX: TEMN), the banking software company, today announces its fourth quarter and full year 2023 results.

Annual Recurring Revenue

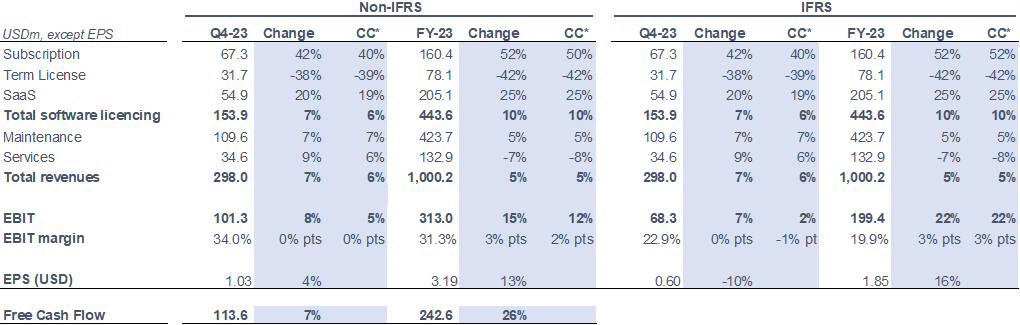

Income Statement and Free Cash Flow

The definition of non-IFRS adjustments is set out below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q4 and FY-23 business update

- Strong Q4 and FY-23 performance; sales environment remained stable through Q4-23, with continued positive pipeline development

- ARR of USD730m at quarter-end, driven by strong subscription, maintenance and SaaS growth; ARR represents 84% of FY-23 product revenue

- Subscription transition substantially complete, minimal term license remaining in the pipeline for FY-24

- Non-IFRS SAAS revenue was up 19% c.c. in the quarter and 25% c.c. in FY-23

- SaaS ACV of USD 8.6m from incremental signings with new clients, in particular in Europe, and some additional volume consumption from existing clients; expect to see sequential growth in subsequent quarters

- Continued strong performance in Europe, multiple deals with large banks signed in the quarter

- Sustained momentum with tier 1 and 2 banks, contributing 46% of total software licensing in Q4-23 and 43% in FY-23

- Delivering for our clients with 391 implementations on our software in 2023

- Significant progress on customer engagement, NPS score of +54 based on survey of over 900 customers

- Industry-leading client retention with churn of only c.3% p.a. on a dollar basis

- Capital Markets Day to be held on 20th February 2024 virtually and in-person in London. Registration details are available here

Q4 and FY-23 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) of USD730.0m, up 16% c.c.

- USD67.3m of non-IFRS subscription licenses signed in Q4-23 and USD160.4m signed in FY-23

- SaaS Annual Contract Value (ACV) of USD8.6m in Q4-23 and USD60.5m in FY-23

- Non-IFRS SaaS revenue of USD54.9m in Q4-23 and USD205.1m in FY-23

- Non-IFRS total software licensing revenues up 6% in Q4-23 and 10% in FY-23 c.c.

- Non IFRS maintenance revenue growth of 7% in Q4-23 and 5% in FY-23 c.c.

- Non-IFRS total revenue up 6% in Q4-23 and up 5% in FY-23 c.c.

- Non-IFRS EBIT up 5% in Q4-23 and 12% in FY-23 c.c.

- Q4-23 non-IFRS EBIT margin of 34.0% and FY-23 non-IFRS EBIT margin of 31.3% up 2% pts c.c. on FY-22

- Non-IFRS EPS up 4% in Q4-23 and 13% in FY-23 reported

- Q4-23 Free Cash Flow of USD113.6m, up 7% y-o-y, FY-23 Free Cash Flow of USD242.6m, up 26% y-o-y

- Leverage at 1.6x at end of Q4-23

- DSOs at 141 days

- Long term profit and cash flow strength support proposed dividend of CHF1.20, a 9% annual increase

Commenting on the results, Temenos CEO Andreas Andreades said:

“I am very pleased with our strong performance in 2023, where we delivered results that significantly exceeded all our raised guidance KPIs, which was made possible by the focus and determination of everyone at Temenos. This demonstrates our ability to execute and deliver growth despite macro uncertainty. The sales environment remained stable through Q4, with our European and American businesses performing particularly well. We signed a number of deals with tier 1 global banks that put their trust in Temenos as a strategic partner to support their transformation programs to enable future growth. Our pipeline continued developing positively in the quarter including a number of large deals, giving revenue visibility for 2024, and our increasing percentage of recurring revenues as a percent of total revenues gives us increasing profit visibility.

We have made a number of exciting announcements recently, in particular the launch of Temenos Enterprise Services, with over 120 pre-configured products, processes and 700 APIs which help our clients to reduce modernization cost, complexity and risk and accelerate time to value, and Temenos LEAP, our program to support our clients to move to the latest cloud- native Temenos platform and get them ready to benefit from cloud and SaaS.

With our ongoing investments in Sales & Marketing and R&D I am confident we will continue to execute on our strategies to drive innovation for our clients, enhance our market-leading position and deliver value for all our stakeholders.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“We have seen strong growth in recurring revenue in 2023, with ARR of USD730m, up 16%, as we executed on our subscription transition, saw continued growth in SaaS, and our maintenance revenue continued to accelerate. Maintenance was up 7% in Q4-23, benefiting from similar trends to those we saw in Q3, in particular the growth in our subscription revenue which contributes to maintenance in the P&L, value uplift on contract renewals, and the positive impact of CPI clauses. Our ARR now represents 84% of our FY-23 product revenue and we expect this to continue growing in the coming years.

Cash Flow in the quarter and the year was also strong reflecting the underlying growth in profits. Looking at the balance sheet, we ended the quarter with leverage of 1.6x net debt to EBITDA.

DSOs were up at 141 days which was expected given the transition to subscription which is now substantially complete.

We have announced our FY-24 guidance which is non-IFRS and in constant currencies. We are expecting ARR growthof about 15%, total software licensing growth of 7-10%, EBIT growth of 7-9%, EPS growth of 6-8% and Free Cash Flow growth of at least 16%.”

Thibault de Tersant, Non-Executive Chairman of the Board, said:

“The business has performed very well in 2023. Focused execution of the strategic roadmap has delivered strong growth in the face of ongoing macroeconomic uncertainty. We have a talented Executive team currently led by Andreas, who are performing well as evidenced by results released today and strengthened by the recent appointments announced at the start of 2024.

We are seeking an exceptional individual to lead the next phase of Temenos’ development and I am leading the Board Committee overseeing this, with the support of external advisors. We were close to an appointment for this role in the second half of 2023, which unfortunately did not proceed. We are making good progress toward hiring an alternative and managing the transition.

With regards to the recent short seller report and further to the statement made by the Board in the press release on 15 February 2024, we reiterate our position. As Chairman and former Audit Committee Chair, I want to assure you of my confidence that Temenos is running a sound business with good financial controls in place. The Board places the upmost importance on its responsibilities to all stakeholders and will oversee a thorough examination of the allegations raised, with independent third parties. We will give an initial response to the allegations of irregularities in the results call later today and at our Capital Markets Day and will revert with a considered response once we have undertaken such thorough examination.”

Revenue

IFRS and non-IFRS revenue was USD298.0m for the quarter, an increase of 7% vs. Q4-22.

IFRS and non-IFRS total software licensing revenue for the quarter was USD153.9m, an increase of 7% vs. Q4-22.

EBIT

IFRS EBIT was USD68.3m for the quarter, an increase of 7% vs. Q4-22.

Non-IFRS EBIT was USD101.3m for the quarter, an increase of 8% vs. Q4-22.

Non-IFRS EBIT margin was 34.0%, up 0.2% point vs. Q4-22.

Earnings per share (EPS)

IFRS EPS was USD0.60 for the quarter, a decrease of 10% vs. Q4-22.

Non-IFRS EPS was USD1.03 for the quarter, an increase of 4% vs. Q4-22.

Cash flow

IFRS operating cash was an inflow of USD175.7m in Q4-23, an increase of 31% vs. Q4-22, and representing an LTM conversion of 118% of IFRS EBITDA into operating cash. USD113.6m of Free Cash Flow was generated in Q4-23, an increase of 7% vs. Q4-22.

Dividend

Taking into account the profit and cash generation in 2023, as well as the expected strength of future cash flows, subject to shareholder approval at the AGM on 7 May 2024, Temenos intends to pay a dividend of CHF1.20 per share in 2024. The timing for the dividend payment will be as follows:

- 7 May AGM approval

- 10 May Shares trade ex-dividend

- 13 May Record date

- 14 May Payment date

The dividend will be taken from the retained earnings (cash dividend) and therefore taxable (WHT 35%).

FY-24 non-IFRS guidance

The guidance for FY-24 is non-IFRS and in constant currencies.

- ARR growth of about 15%

- Total software licensing growth of 7-10%

- EBIT growth of 7-9%

- EPS growth of 6-8%

- FCF growth of at least 16%

The Company has also assumed the following for FY-24 guidance:

- Cash conversion of 100%+ of IFRS EBITDA into Operating Cash

- FY-24 tax rate expected to be between 20-22%

Currency assumptions for FY-24 guidance

In preparing the FY-24 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.08;

- GBP to USD exchange rate of 1.27; and

- USD to CHF exchange rate of 0.87

Mid-term targets

Temenos reconfirms its mid-term targets. The targets non-IFRS and in constant currencies.

- ARR to reach at least USD1.3bn

- EBIT to reach at least USD570m

- FCF to reach at least USD700m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of 19 February 2024. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Such events may include adverse publicity from information put into market place by a short seller, which the company believes to be inaccurate and misleading, as well as the time and efforts relating to the company’s response thereto. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST today, February 19th, 2024, Andreas Andreades, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Capital Markets Day

Temenos will host a Capital Markets Day on Tuesday 20th February virtually and in person in London. Registration details for the Capital Markets Day are available here.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 asnyder@temenos.comPress and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 conor.mcclafferty@fgsglobal.com | meier-pfister@irf-reputation.ch