Temenos Announces Q1-24 Results; Strong Profitability and Free Cash Flow Growth

GENEVA, Switzerland, April 23, 2024 – Temenos AG (SIX: TEMN), the banking software company, today announces its first quarter 2024 results.

Ad hoc announcement pursuant to Art. 53 LR

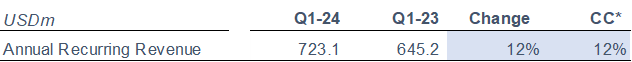

Annual Recurring Revenue

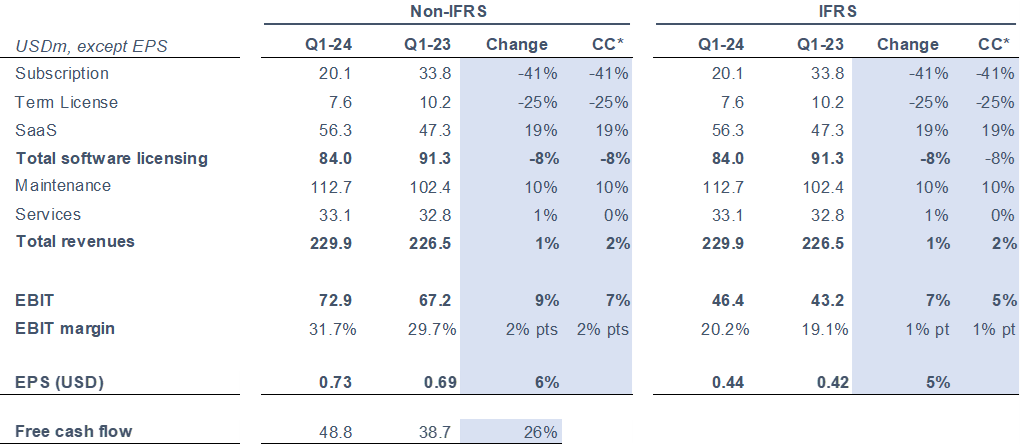

Income Statement and Free Cash Flow

The definition of non-IFRS adjustments is set out below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q1-24 business update

- Temporary lengthening of sales cycles due to short seller allegations impacted signings in Q1-24

- Pipeline continued to grow despite challenging sales environment

- Sales environment otherwise remained stable with no impact from macro

- APAC and Europe still grew year-on-year, with Americas flat and MEA seeing a decline due to a tough comparative

- Subscriptions continued to grow as a percentage of the license mix, at 73% in Q1-24, continuing to achieve value uplift on new clients and renewals

- Sales focus on ARR drove strong growth in recurring revenue streams

- Shift to recurring revenue model with ARR as key metric is reducing quarterly volatility, with total revenue still growing despite lower license sales

- No change to full year guidance with publication of independent report on allegations expected to restore normal deal closure rates

Q1-24 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) of USD 723.1m, up 12% c.c.

- Non-IFRS subscription licenses of USD 20.1m signed in Q1-24

- SaaS Annual Contract Value (ACV) of USD 4.7m in Q1-24

- Non-IFRS SaaS revenue of USD 56.3m, up 19% c.c.

- Non-IFRS total software licensing revenues down 8% in Q1-24 c.c.

- Non IFRS maintenance revenue growth of 10% in Q1-24 c.c.

- Non-IFRS total revenue of 2% in Q1-24 c.c.

- Non-IFRS EBIT up 7% in Q1-24 c.c.

- Q1-24 non-IFRS EBIT margin of 31.7%, up 2% pts c.c.

- Non-IFRS EPS up 6% in Q1-24 reported

- Q1-24 free cash flow of USD 48.8m, up 26% y-o-y

- Leverage at 1.4x at end of Q1-24, down from 1.6x at end of FY-23

- DSOs at 136 days vs. 141 days at end of FY-23

Commenting on the results, Temenos CEO Andreas Andreades said:

“I am very proud of every one of my colleagues in Temenos, who worked collaboratively and with determination to continue serving our clients, partners and broader ecosystem during Q1. We faced a challenging sales environment, with some clients delaying decisions whilst the independent investigation was ongoing. With the results of the investigation now published, we are receiving positive feedback from our clients, both existing and prospective. Importantly, our pipeline continued to grow in the quarter.

We have built a resilient business with our move to a recurring revenue model and so, despite the challenges, we had strong growth in ARR, our most important revenue KPI, and our total revenue also grew as did our profitability and cash flow. We had good levels of contribution from tier 1 and 2 clients and continued to win new logos in the quarter as well. Our Q1 results clearly demonstrate the benefits of the move to a recurring revenue model.

As you are aware, this is my last quarterly results with Temenos. I am incredibly grateful for the opportunity I have had to work in and run this company over the last 25 years. It has been core to everything I have done. I would like to extend my thanks to all my colleagues, clients, partners, shareholders and all other stakeholders who have supported and worked with me on this journey in building an undisputed global leader in banking software, and I wish our new CEO every success as he joins Temenos.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“Given the temporary delays we saw in client deal signings, I was pleased with the 12% growth in ARR delivered in Q1-24. We are clearly seeing the benefit of aligning our sales force targets to ARR, with particularly strong growth in maintenance this quarter which was up 10%, and I expect our ARR momentum to continue throughout this year.

Free cash flow growth was also strong in Q1-24, maintaining our good cash performance. We continued our deleveraging trend, ending the quarter with leverage at 1.4x net debt to EBITDA, down from 1.6x at the end of FY-23. Our leverage is now slightly below our target range of 1.5 to 2.0x which gives us tactical and strategic flexibility.

DSOs also trended down to 136 days as expected, having peaked at 141 days at the end of FY-23 and with the transition to subscription which is now substantially complete.

We have confirmed our FY-24 guidance which is non-IFRS and in constant currencies. We are expecting ARR growthof about 15%, total software licensing growth of 7-10%, EBIT growth of 7-9%, EPS growth of 6-8% and free cash flow growth of at least 16%.”

Revenue

IFRS and non-IFRS revenue was USD 229.9m for the quarter, an increase of 1% vs. Q1-23.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 84.0m, a decrease of 8% vs. Q1-23.

EBIT

IFRS EBIT was USD 46.4m for the quarter, an increase of 7% vs. Q1-23.

Non-IFRS EBIT was USD 72.9m for the quarter, an increase of 9% vs. Q1-23.

Non-IFRS EBIT margin was 31.7%, up 2% points vs. Q1-23.

Earnings per share (EPS)

IFRS EPS was USD 0.44 for the quarter, an increase of 5% vs. Q1-23.

Non-IFRS EPS was USD 0.73 for the quarter, an increase of 6% vs. Q1-23.

Cash flow

IFRS operating cash was an inflow of USD 71.6m in Q1-24, an increase of 1% vs. Q1-23, and representing an LTM conversion of 118% of IFRS EBITDA into operating cash. USD 48.8m of free cash flow was generated in Q1-24, an increase of 26% vs. Q1-23.

FY-24 non-IFRS guidance

The guidance for FY-24 is confirmed. It is non-IFRS and in constant currencies.

- ARR growth of about 15%

- Total software licensing growth of 7-10%

- EBIT growth of 7-9%

- EPS growth of 6-8%

- FCF growth of at least 16%

The Company has also assumed the following for FY-24 guidance:

- Cash conversion of 100%+ of IFRS EBITDA into Operating Cash

- FY-24 tax rate expected to be between 20-22%

Currency assumptions for FY-24 guidance

In preparing the FY-24 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.08;

- GBP to USD exchange rate of 1.26; and

- USD to CHF exchange rate of 0.87

Mid-term targets

Temenos reconfirms its mid-term targets. The targets are non-IFRS and in constant currencies.

- ARR to reach at least USD1.3bn

- EBIT to reach at least USD570m

- FCF to reach at least USD700m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of April 23, 2024. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Such events may include adverse publicity from information put into the marketplace by a short seller, which the company believes to be inaccurate and misleading, as well as the time and efforts relating to the company’s response thereto. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST today, April 23, 2024, Andreas Andreades, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-24 non-IFRS guidance.

- FY-23 estimated share-based payments and related social charges charges of c.5% of revenue

- FY-23 estimated amortisation of acquired intangibles of USD 50m

- FY-23 estimated restructuring/M&A related costs of USD 22m

Investor & Media Contacts

Investors

Adam Snyder

Head of Investor Relations, Temenos

Email: asnyder@temenos.com

+44 207 423 3945

International media

Conor McClafferty

FGS Global on belhalf of Temenos

conor.mcclafferty@fgsglobal.com

+44 7920 087 914

Swiss media

Martin Meier-Pfister

IRF on belhalf of Temenos

meier-pfister@irf-reputation.ch

+41 43 244 81 40