TAFF Day 2

🌴 That’s a wrap for Temenos Americas Fall Forum!

Day two was filled with valuable insights, engaging discussions, and breakout sessions tailored to North American #banks, Latin American banks, and #creditunions and cooperatives across the region. We enjoyed the deep dives on business models, #modernization, and actionable strategies. Thank you to all of our clients and partners for joining us! Let’s continue to challenge, innovate, and succeed.

👌 Excellent offering

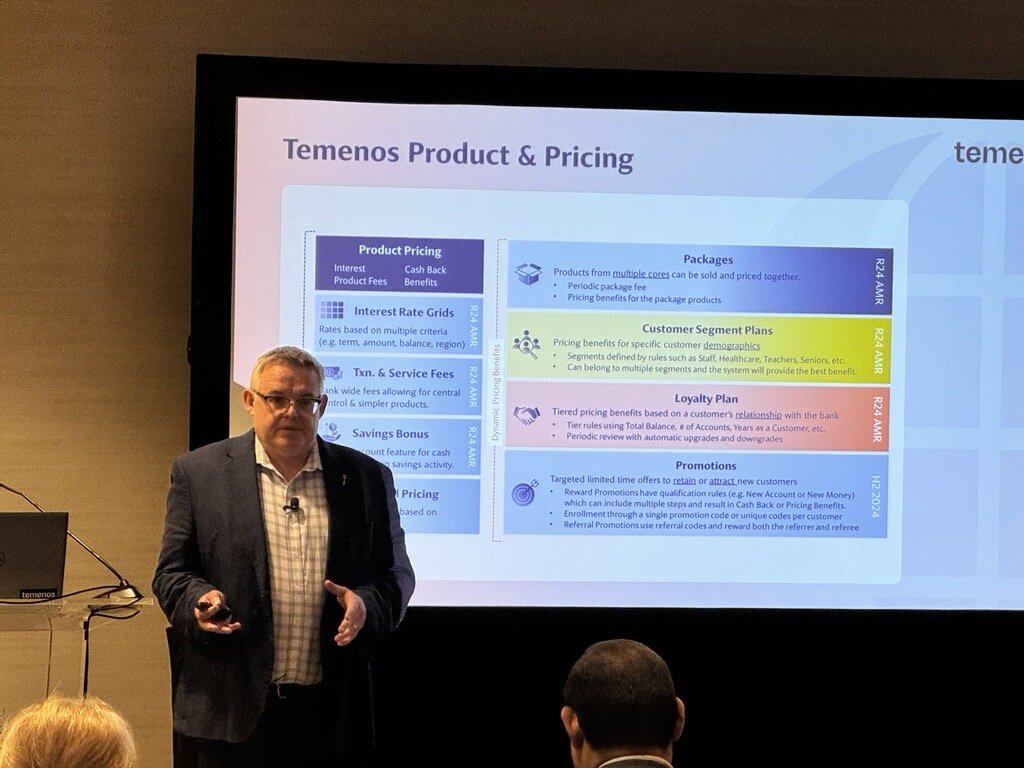

Dallan McManus, Temenos EVP for Product Management, discusses the latest product offerings for different North American markets and what our customers can expect. TAFF participants took in the latest in capabilities and functionalities for core and journey management offerings, among others, and what key markets can look forward to in the near future.

At the Temenos Americas Fall Forum, Charith Mendis, Head of Market Development for Banking at AWS, discussed how the hyperscaler is supporting a shift to core banking through modernization and innovation. Emphasizing critical success factors like security, scalability, and resilience, he highlighted how AWS supports banks in adapting to trends and leveraging data with Generative AI (GenAI) to drive future growth and transformation.

What’s New with Temenos: Wealth Management

Many factors are shaping the relationship-critical wealth management sector today, including digitization, tokenization, ESG influences, new demographic and market trends, economic shifts, client mobility, and AI. Attendees gained insights into these factors and learned how Temenos is addressing both today’s and tomorrow’s challenges. Vincent Munari, Business Solutions Manager at Temenos, provided an overview of the evolving landscape and Temenos’ solutions in wealth management.

TAFF attendees discovered how ITSS, in partnership with Temenos, has transformed challenges into opportunities across Latin America with innovative digital solutions, strategic alignment, and proven success in banking transformations. ITSS Project Manager Evelyn Galvan and ITSS Regional Sales Manager Luis Aramayo discussed the power of partnerships in a key growth region—Latin America.

☝️ Financial institutions know what their customers want, but are they delivering?

The Temenos Value Benchmark provides professional consulting engagement and deliverables to help financial institutions deliver and more. Customer Value Director Vincent Chamasrour addressed the program’s work with customers to correlate performance drivers and operational metrics to really drive value. You know what your customer experience should look like. What will you do with your Temenos tools and with what configurations will you use to deliver? Let the Temenos Value Benchmark guide you.

🛡️ Take Care of Threats, Embrace Opportunities: Cybersecurity and Blockchain Insights

This session featured experts in cybersecurity, who shared key trends and insights on how successful business transformation projects began with proactive cybersecurity planning and robust safety measures. Always assume a threat. And always assume opportunities. Speakers included Maria Elena Aitken, Americas Sales Director at FINLABS, and Marcel Gerardino, Cybersecurity and Blockchain Director at FINLABS

🤝Sow Seeds of Trust, Reap Massive Rewards: Capturing the Loyalty of Millennials and Gen Z in Banking

Millennials and Gen Z customers want what everyone does from a financial institution—good products and delightful user experiences. But for these digital-first generations, raised on Netflix and on-demand everything, winning their trust means not only securing their loyalty but also gaining vocal, visible support. This conclusion was one of several key takeaways from a #TAFF2024 panel on youth banking, featuring Temenos VP for Canada Strategy Genevieve Oliver, EQ Bank CTO Geoff Vona, and TS Banking Group CTO Julian Caldwell. Attendees left with actionable insights on the hard and soft skills needed to capture the loyalty of today’s younger customers.

Latin America Banking Track

🚀 Better Technology, Better Results

What technology tools can support your top and bottom lines? Temenos Sr. Business Solutions Consultant Sergio Villegas delves into asset finance and supply chain finance, guiding participants at the Temenos Americas Fall Forum through the company’s latest product modules. His presentation highlighted the significant business benefits that technology offers, especially for Latin American financial institutions.

Latin America Banking Track

☀️ Progressive Modernization: Shaping Latin America’s bright future one step at a time

The evolution of the banking industry and the demand for core modernization served as key themes in an insightful panel on progressive modernization, specifically catering to Latin American financial institutions. Experts shared innovative strategies to achieve agility and cost savings while modernizing at a pace that suits individual needs. Attendees gained valuable insights from Samuel Gomez (VP Technology, BHD), Patricia Rodriguez (Sub Gerente General, Grupo Monge), and Haydee Urquiaga (Technology Services Manager, BCP Miami), in a session led by Euliana Gonzalez (Head of Services–Americas, Temenos). The group offered actionable guidance for those defining their own modernization paths.

Credit Unions Show How They Can Compete

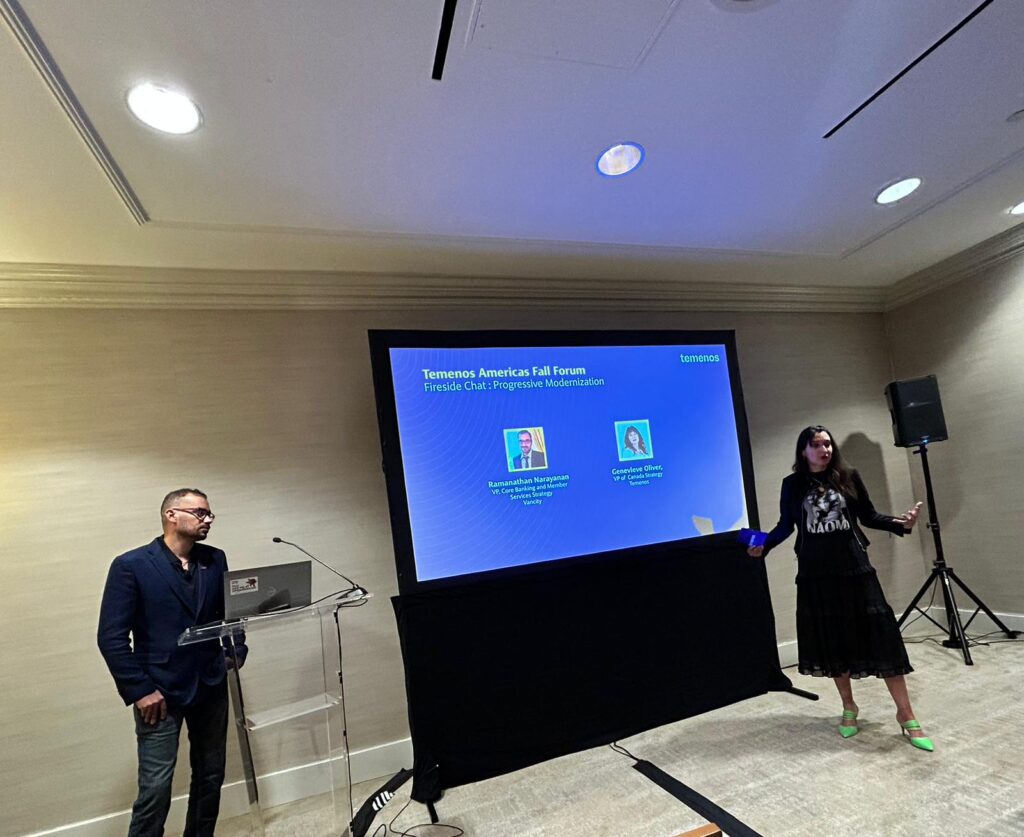

As business models and economic cycles evolve, the need for continuous adaptation remains a central focus for credit unions. In a very informative fireside chat, Ramanathan Narayanan (VP, Core Banking and Member Services Strategy, Vancity) and Genevieve Oliver (VP of Canada Strategy, Temenos) explored how financial institutions can address legacy constraints and progressively modernize their operations. The discussion highlighted the role of how the latest technologies can drive agility and unlock new opportunities especially when used to support achieving business goals first. Attendees left with actionable insights to guide their modernization strategies.

North America Banking Track

In today’s fast-paced banking landscape, staying ahead demands continuous innovation and a commitment to the latest technologies. On Day Two of the Temenos Americas Fall Forum, Sweekruth S., VP of Business Solutions, and Saravanan M., VP and Principal Architect, led an insightful session on the latest advancements in Temenos’ offerings. Participants explored key product enhancements designed to meet the evolving needs of financial institutions. The session covered vital topics including extensibility, automation and other critical areas that drive operational efficiency and help banks remain competitive in the digital age.

Temenos Senior Vice President Mari Herrera kicked off Day Two with opening remarks for U.S. banking participants and others, setting the tone for an exciting day ahead. The sessions that followed dove into the latest updates on Temenos products and services, highlighting the business and technological benefits they bring to financial institutions. Attendees gained valuable insights into how these innovations are driving growth and efficiency in the banking sector.

🌴 Day Two of the Temenos Americas Fall Forum is underway!

Participants gained valuable insights and key takeaways from the Day One sessions and numerous informal discussions on the sidelines. Day Two kicked off with a networking breakfast followed by breakout sessions tailored to North American banks, Latin American banks, and credit unions. TAFF attendees are diving deep into highly relevant topics, gathering actionable strategies and fresh perspectives to shape the future of their industries and markets.

TAFF Day 1

You’re smart, capable, and more skilled than you give yourself credit for. So why doesn’t it feel that way?

Here’s a hint: you might be focusing on the problems instead of the solutions.

At #TAFF2024, Keynote Speaker Dr. Jason Selk reveals how shifting just one inch towards Relentless Solution Focus—and away from problem-centric thinking—can unlock extraordinary growth in your career, health, and life.

Hundreds of TAFF attendees on Day One discovered how focusing on what you can do right now to make things better can lead to achieving what once seemed impossible.

🏄♀️It’s an art

Temenos Americas Fall Forum MCs Holly Webster and Diego Pinto keep a very scheduled schedule on schedule. Thanks for ensuring the flow of scores of participants and speakers to the stage. The right messaging targeted the right audiences. Day One was super smooth and super informative.

Is core modernization truly business modernization?

As financial institutions navigate the complexities of upgrading legacy systems while serving millions of customers, the challenge can feel like performing open-heart surgery on a patient going about their daily life. Coexistence offers a solution, allowing banks to innovate swiftly without disrupting existing services. At #TAFF2024, our expert panel delved into how a composable-led approach can enable seamless innovation and controlled technology migration, unlocking new opportunities for your bank. The chat featured insights from Daksa Mody (COO, PC Financial), Ezequiel Mina (CTO, Ualá MX), Luis Carrasco (IBM Consulting), and moderated by Grace Chen (VP for U.S. Strategy, Temenos).

🧠Is technology the end goal, or the means to achieve it?

In today’s competitive landscape, banks and credit unions must strategically leverage technology to meet their business objectives. Euliana Gonzalez, Head of Services – Americas at Temenos, and Roberto Gomes, Partner, Technology Solutions Delivery at Ernst & Young, explore how the right technology partnerships can drive success and give financial institutions a competitive edge.

🌱 Stronger together

Partnerships among tech companies and financial services institutions aim to improve the design and delivery of products for the end users and making banking a better experience. They also make the world a better place. Temenos Chief ESG Officer Kalliopi Chioti and EQ Bank Chief Technology Officer Dan Broten illustrate how Temenos and banks can facilitate efforts to curb emissions and operate more efficiently in the process.

Sanjay Bhanot, Head, BFS Industry Solutions at Cognizant, shares his expertise in how composable, easy-to-configure core banking architectures efficiently drives digital transformation and enhances customer experience. Key to this transformation is risk-mitigated, predictable modernization programs that enable banks to achieve their digital operating models. With 15 years’ experience managing successful Temenos implementations across various banking segments, Cognizant builds pre-packaged solutions tailored for North America helps tackle legacy modernization challenges, and AI will facilitated this process even more.

🤖 Banking in the era of AI

José Nuñez, Microsoft Industry Advisor Director, Financial Services Americas – Canada, USA, Latin America, discusses the role of AI in the financial services sectors and how banks and credit unions can unlock the most value from it. While the cost savings it brings are important, the benefits it brings when used to hyper-personalize offerings to customers are even greater. Excellent presentation from Jose at the Temenos Americas Fall Forum 2024 in Miami!

💪 The financial landscape today is filled with challenges, but for those who act, the opportunities are even greater

At the Temenos Americas Fall Forum, industry leaders Heather DeStefano, SVP & Director of Innovation at MidWest One Bank, Chris Ferguson, Vice President of Lending at Forum Credit Union, and Michael Terburg, Managing Director at APC Bank, engage in a dynamic discussion with Temenos Business Solutions Group VP Chris Howell. In a packed ballroom, our panelists are exploring how digital transformation is redefining customer expectations. Fraud prevention improves, efficiency skyrockets, and customer experiences, onboarding, and innovation are grow stronger and more continuous through partnerships with Temenos.

🏄♂️ The curtain rises

Rodrigo Silva, President of Temenos Americas, opens the Temenos Americas Fall Forum in Miami, discusses the value our partnerships bring to banks, credit unions and other financial institutions of all sizes in North America, Latin America and the Caribbean.

🌴 Welcome to TAFF’24 !

The doors are open and our community is already arriving for our first day of activities. We’ve got more than 350 financial industry professionals joining us. Stay tuned to this blog for regular updates from all around the event.