Temenos Announces Q3-24 Results and Slightly Revised FY-24 Guidance; EBIT and EPS Guidance Remain Unchanged

• Continued customer engagement in Q3-24 after sales cycles already normalized in Q2-24

• New product and technology leadership with hiring of Barb Morgan as new CPTO

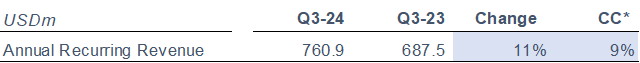

• Q3-24 ARR of USD 761m, up 9% y-o-y c.c.

• Sales execution issues in MEA led to Q3-24 total software licensing of USD 96.4m, slightly lower than consensus

• Q3-24 non-IFRS EBIT up 19% y-o-y c.c., with 4% points margin expansion

• Q3-24 non-IFRS EPS of USD 0.76 up 25%

• Free cash flow down 21%; Q3-24 free cash flow grew 26% excluding payments related to independent investigation and is expected to grow at least 12% for the full year

• Issued Q4-24 and slightly revised FY-24 guidance, taking conservative view on Q4-24 pipeline

• Q4-24 guidance (non-IFRS, constant currency); total software licensing growth of about 5%

• Slightly revised FY-24 guidance (non-IFRS, constant currency); ARR growth of 11-12% (previously about 13%), total software licensing flattish to FY-23 (previously 3-6%), EBIT growth of 7-9% (no change), EPS growth of 6-8% (no change) and free cash flow growth of at least 12% (previously at least 16%)

Ad hoc announcement pursuant to Art. 53 LR

GRAND-LANCY, Switzerland, October 23, 2024 – Temenos AG (SIX: TEMN), the banking software company, today announces its third quarter 2024 results.

Annual Recurring Revenue

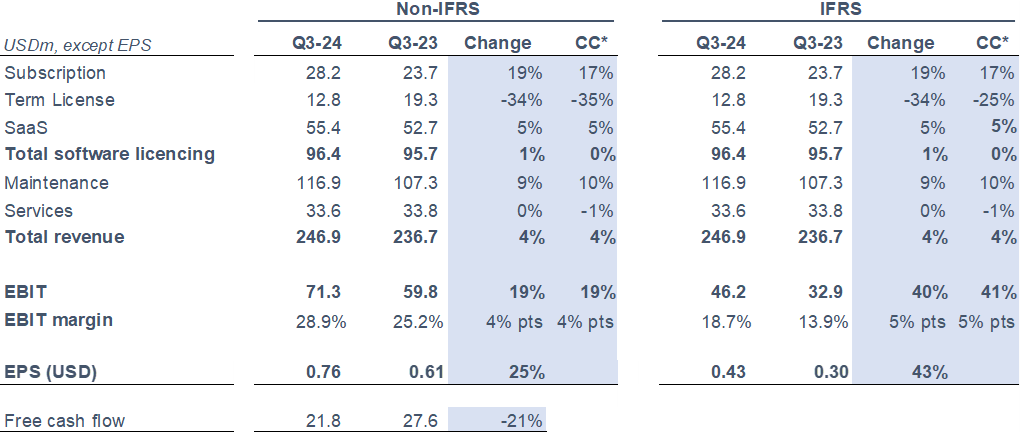

Income Statement and Free Cash Flow

The definition of non-IFRS adjustments is set out below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

* Constant currency (c.c.) adjusts prior year for movements in currencies

Quarterly update

- Senior Leadership Team defined, talent acquisition ongoing, organization review completed

- Initiated investment into US and Western Europe sales with incremental hires made in the quarter

- Commenced company efficiencies program; reducing management layers and removing organizational complexity

- New product and technology leadership with hiring of Barb Morgan as CPTO

- Focused review of strategic, operational and financial plan nearly completed, ahead of Capital Markets Day on 12 November, 2024, in London and virtually, including review of mid-term targets (register here to attend)

Q3-24 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) of USD 760.9m, up 9% c.c.

- SaaS Annual Contract Value (ACV) of USD 9.4m in Q3-24

- Non-IFRS SaaS revenue of USD 55.4m, up 5% c.c.

- Non-IFRS total software licensing revenues flat y-o-y c.c.

- Non IFRS maintenance revenue growth of 10% in Q3-24 c.c.

- Non-IFRS total revenue growth of 4% in Q3-24 c.c.

- Non-IFRS EBIT up 19% in Q3-24 c.c.

- Non-IFRS EPS up 25%

- Free cash flow down 21%; free cash flow grew 26% excluding payments related to independent investigation

- Share buyback of USD 200m completed in September, equal to 4.3% of registered share capital

- Leverage at 1.8x at end of Q3-24

Commenting on the results, Temenos CEO Jean-Pierre Brulard said:

“We saw good traction in most of our regions in the third quarter with a sales environment which remained stable across the geographies we operate in. However, despite this, we had sales execution issues in MEA. We have acted decisively to address the sales leadership issues in the region and conducted a detailed review of the Q4-24 pipeline.

On the operational side, we have made good progress on a number of fronts. We have defined our Senior Leadership Team for the company, as well as continuing to make new hires both at Exco and in the sales organization. In particular, I am delighted that Barb Morgan has joined as Chief Product and Technology Officer. She is an experienced technology and people leader with extensive knowledge and understanding of banking and financial services technology, a strong market focus from both a business and an engineering perspective, and a track record of developing solutions that incorporate data, AI and cloud technologies.

We initiated investments in US and Western Europe sales and made incremental hires in the quarter, and we also launched a company-wide efficiency program, designed to reduce management layers and organizational complexity. We have nearly concluded our review of our strategy roadmap and financial plan which we will present at our Capital Markets Day on November 12th, 2024, in London.”

Commenting on the results, Temenos CFO Takis Spiliopoulos said:

“While the overall trend in new business was positive in the quarter, with subscription licenses growing 17%, we had clearly expected a significantly stronger software license number than was delivered. The issues in MEA were not linked to any change in customer behavior or change in the overall sales environment but were specific to sales execution. ARR still grew 9% in the quarter, through a combination of subscription license growth, SaaS ACV of USD 9.4m in-line with Q2-24, and strong growth in maintenance which was up 10% constant currency.

Our cash generation remained healthy with USD 21.8m of free cash flow generated in Q3-24 despite the headwinds, and our leverage was at 1.8x net debt to non-IFRS EBITDA by quarter-end. We also completed our CHF 200m share buyback in September. I still expect our leverage to trend down further towards the low end of our target operating leverage of 1.5 to 2.0x net debt to non-IFRS EBITDA by year-end.

After having conducted a thorough review of our sales pipeline for the balance-of-year, we have announced guidance for Q4-24 and revised FY-24 guidance, which are non-IFRS and in constant currencies. For Q4-24, we expect total software licensing growth of about 5%. For FY-24, we are now expecting ARR growthof 11-12%, down from about 13%, and total software licensing to be flattish to FY-23, down from 3-6%. Our EBIT growth guidance remains unchanged at 7-9%, as does our EPS growth guidance of 6-8%. We now expect free cash flow growth of at least 12%, down from at least 16% growth. Our FY-24 EBIT will continue to benefit from the efficiencies program launched at the start of Q3-24, with the investments we are making in new hires only having a limited impact in FY-24.”

Revenue

IFRS and non-IFRS revenue was USD 246.9m for the quarter, an increase of 4% vs. Q3-23.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 96.4m, an increase of 1% vs. Q3-23.

EBIT

IFRS EBIT was USD 46.2m for the quarter, an increase of 40% vs. Q3-23.

Non-IFRS EBIT was USD 71.3m for the quarter, an increase of 19% vs. Q3-23.

Non-IFRS EBIT margin was 28.9%, up 4% points vs. Q3-23.

Earnings per share (EPS)

IFRS EPS was USD 0.43 for the quarter, an increase of 43% vs. Q3-23.

Non-IFRS EPS was USD 0.76 for the quarter, an increase of 25% vs. Q3-23.

Cash flow

IFRS operating cash was an inflow of USD 51.9m in Q3-24, a decrease of 6% vs. Q3-23, and representing an LTM conversion of 115% of IFRS EBITDA into operating cash. USD 21.8m of free cash flow was generated in Q3-24, a decrease of 21% vs. Q3-23.

Q4-24 and revised FY-24 non-IFRS guidance

The guidance for Q4-24 and FY-24 is non-IFRS and in constant currencies.

Q4-24 guidance

- Total software licensing growth of about 5%

FY-24 guidance

- ARR growth of 11-12% (previously about 13%)

- Total software licensing flattish to FY-23 (previously 3-6%)

- EBIT growth of 7-9% (no change)

- EPS growth of 6-8% (no change)

- FCF growth of at least 12% (previously at least 16%)

The Company has also assumed the following for FY-24 guidance:

- Cash conversion of 100%+ of IFRS EBITDA into Operating Cash

- FY-24 tax rate expected to be between 20-22%

Currency assumptions for FY-24 guidance

In preparing the FY-24 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.09;

- GBP to USD exchange rate of 1.30; and

- USD to CHF exchange rate of 0.88

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of October 23, 2024. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Such events may include adverse publicity from information put into the marketplace by a short seller, which the company believes to be inaccurate and misleading, as well as the time and efforts relating to the company’s response thereto. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST today, October 23, 2024, Jean-Pierre Brulard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortization of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-24 non-IFRS guidance.

FY-24 estimated restructuring/M&A related costs of USD 32m

FY-24 estimated share-based payments and related social charges of c.5% of revenue

FY-24 estimated amortisation of acquired intangibles of USD 50m

Investor & Media Contacts

Investors

Adam Snyder

Head of Investor Relations, Temenos

Email: asnyder@temenos.com

+44 207 423 3945

International media

Conor McClafferty

FGS Global on belhalf of Temenos

conor.mcclafferty@fgsglobal.com

+44 7920 087 914

Swiss media

Martin Meier-Pfister

IRF on belhalf of Temenos

meier-pfister@irf-reputation.ch

+41 43 244 81 40