Asset finance has long been a critical tool for businesses, particularly small and medium-sized enterprises (SMEs), enabling them to acquire essential equipment without the need for significant upfront capital investment. This allows businesses to preserve cash flow and working capital while spreading the cost of assets over time. The fixed payment structure provides predictability, making it easier for companies to manage their finances, while tax efficiencies in certain jurisdictions can further enhance the appeal of asset finance solutions.

The Finance and Leasing Association calculates that, in the UK, about 40% of business investment in machinery and equipment has been funded through asset finance. In addition, the smaller business asset finance market reported a 7% increase in new business in 2023 to GBP 23.5bn – following an 11% increase in 2022 to GBP 21.9bn.[1]

Clearly, asset finance is an important tool for SMEs. But as businesses evolve, so do their needs, and asset finance is undergoing a transformation, largely driven by technology. Modern asset finance software is automating processes and improving the efficiency and performance of finance providers.

This is helping businesses and lenders address a raft of challenges including asset depreciation, the complexity of assessing credit risk for SMEs, and the operational burdens associated with managing a variety of assets. Legacy systems have often struggled to cope with these issues, limiting flexibility and increasing costs.

The role of asset finance software

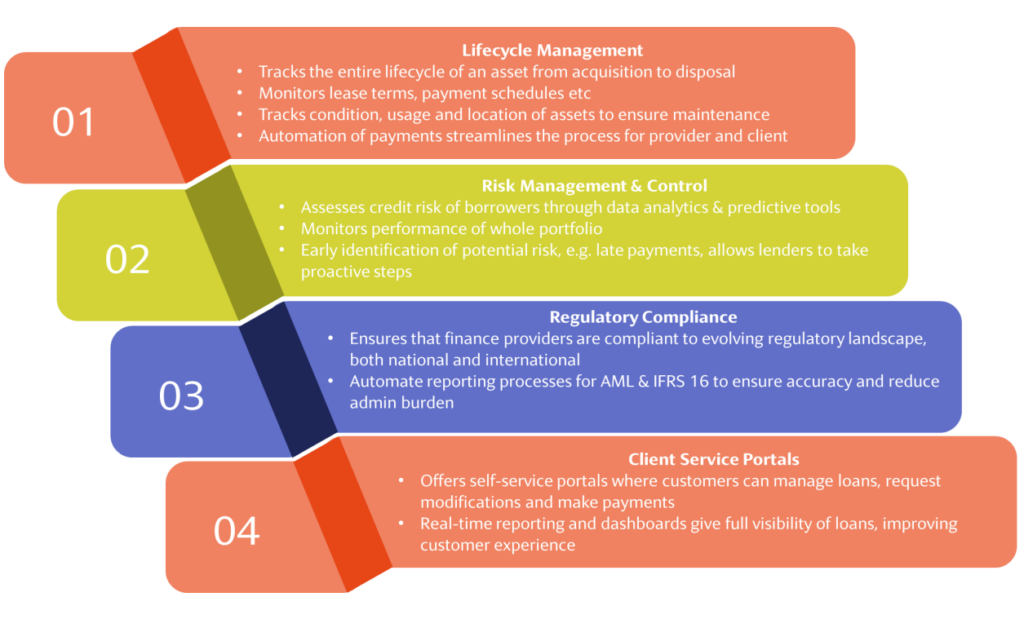

Modern asset finance software solutions address the complexities and risks associated with managing the asset finance lifecycle. By automating key processes, these platforms allow finance providers to manage their portfolios more efficiently while reducing operational overhead and risk.

Key features and benefits of asset finance software

Innovation in asset finance

The global asset finance industry is poised for growth, with an expected CAGR of 13% from 2023 to 2025.[2] This growth presents opportunities for businesses and finance providers alike, but staying competitive will require a focus on innovation and technology.

Here are the major trends driving innovation across the industry:

- Digitization and automation: Across the financial services sector, digitization and automation are transforming business operations. In asset finance, these trends promise improved efficiency, reduced errors, and faster processing times. For finance providers, automation allows them to scale their portfolios while maintaining service quality. Digitization is also enabling manufacturers to bypass traditional intermediaries and offer financing directly to customers, creating savings that can be passed along to the end user.

- Evolving regulatory demands: As regulations become more complex, finance providers must invest in systems that help them stay compliant without overburdening their operations. For example, recent developments in AML regulations demand more stringent due diligence processes, driving asset finance providers to enhance their monitoring capabilities.

- Sustainability and ESG: ESG considerations are gaining prominence in the asset finance industry. Starting in 2025 and 2026, SMEs will be required to comply with new regulations such as the EU Taxonomy, Sustainable Finance Disclosure Regulation and the Corporate Sustainability Reporting Directive. For finance providers, these regulations introduce challenges in assessing the sustainability of both their clients and the assets they finance. However, asset finance can also offer opportunities for sustainability, such as refurbishing and recycling assets.

- Data privacy: With the sensitive financial and personal information involved in asset finance transactions, data privacy is a critical concern. Compliance with regulations such as the General Data Protection Regulation in the EU and the Gramm-Leach-Bliley Act in the US is non-negotiable. New technologies like AI for anomaly detection are addressing these concerns.

- Subscription-based financing: Traditionally reserved for large assets such as aircraft, subscription-based financing is becoming more popular for smaller assets. Businesses are increasingly adopting flexible leasing models where an asset may be leased by different users during different periods of the year, reflecting the growth of the sharing economy.

Asset finance is evolving, and modern technology is at the heart of this transformation. By leveraging advanced asset finance software, finance providers can streamline their operations and reduce risk while staying competitive in a rapidly changing market. AI, blockchain, and ESG compliance will further shape the future of asset finance, enabling providers to meet the evolving needs of businesses and drive growth and efficiency in the years ahead.

Discover how Temenos is revolutionizing the way financial institutions manage their asset finance lifecycle. Our platform streamlines operations and as part of lending operations allows banks to stay in control of their entire credit portfolio.

[1] Small Business Finance Markets 2023/4; British Business Bank

[2] World Leasing Yearbook 2024, Temenos analysis