The case for embracing the G20’s goals on cross-border payments

Banks should aim to meet the G20’s targets, even though they are aspirational, to stay relevant in the evolving and increasingly competitive world of cross-border payments

Cross-border payments underpin trade, commerce, personal remittances, and more. Described as “the engine of the global economy”, current volumes of over USD 200trn are expected to increase by 5% a year until 2027.

However, the industry has been plagued by challenges including high fees, long settlement times, opaque processes, and complex compliance requirements. Today, it’s not unusual for a cross-border payment to take several days to reach settlement, with fees eating into the amount received.

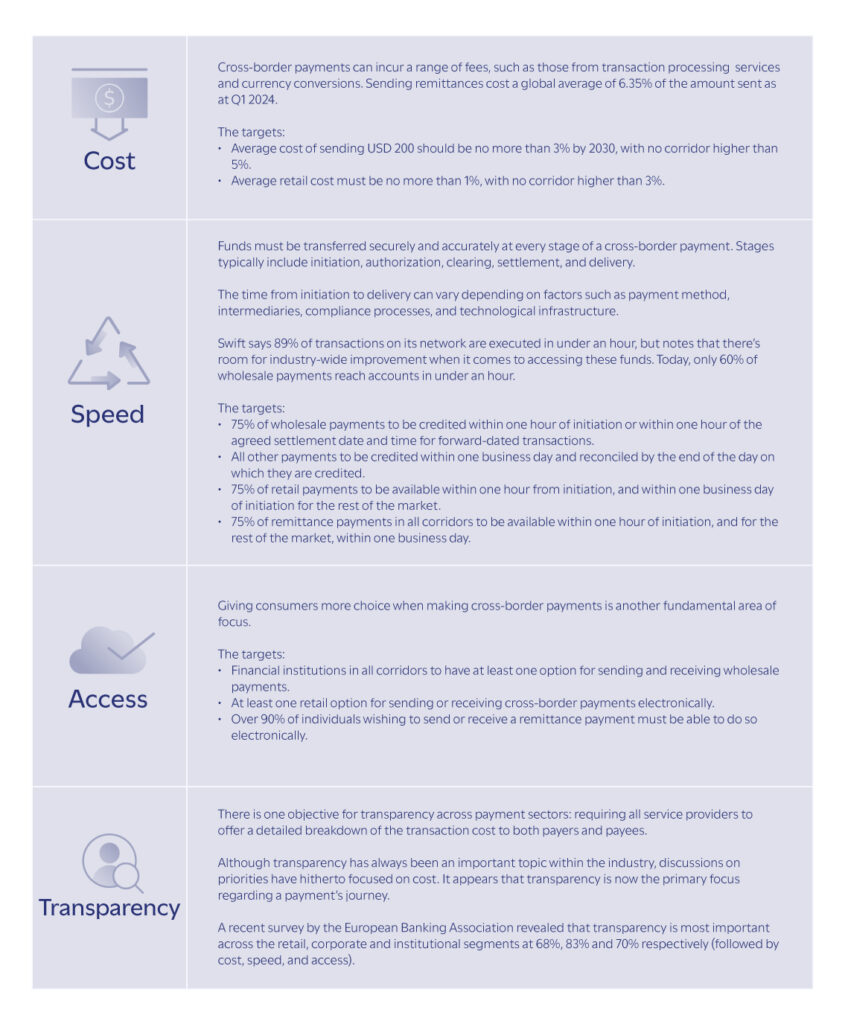

Yet these challenges are inherent opportunities for transformational improvement – opportunities that the G20 has endeavored to tackle by the end of 2027. The international group, representing approximately 80% of global GDP, has endorsed targets for cross-border payments related to cost, speed, transparency, and access.

Though non-binding, the targets provide a framework for reducing frictions in payment processes, as well as improving access, increasing transparency and visibility, and lowering costs. Ultimately, they will support economic growth and financial stability on a global scale. Below is an overview of the targets, which have a deadline of end-2027 unless stated otherwise.

G20’s cross-border payments impact and progress

Enhancing cross-border payments to meet the G20’s objectives will have widespread benefits for citizens and economies globally. For individuals, lower costs and faster transactions mean greater transaction ease and more money for those receiving remittances. SMEs will have more resources to invest for growth. Larger organizations will be better able to manage their supply chains, reduce costs, and optimize their operations. The targets, if met, will also help developing economies by improving payment access for local businesses and boosting household incomes.

We are seeing progress. According to the Financial Stability Board’s latest progress report, ISO 20022 harmonization, APIs, and the interlinking of fast payment systems were positive developments in 2024. As I mentioned in my previous blog, initiatives by Swift are also encouraging. However, “significant progress” is needed on a global level to meet the targets across all market segments.

So now is the time to assess where you are in relation to these targets. Although they are non-binding, there are important reasons why all banks should aim to align with them. By doing so, you’ll be better prepared for potential regulatory change in the areas discussed. It’s also vital for staying competitive at a time when the rise of fintech has led to technology innovations that offer fast, secure, and cost-effective solutions.

The targets are paving the way for a more efficient and transparent chapter in cross-border payments, setting the stage for new industry standards with better outcomes for all participants.

We’re here to help banks on that journey – to help you embrace the new technologies and market dynamics so that cross-border payment services become an engine for business growth. Check out the impact study we did with Finextra on the G20 targets, which includes an industry roadmap for change as well as case studies.

In the second part of this blog, I will highlight the specific technologies and services you can leverage to meet the targets.

End notes:

- J.P. Morgan, The race to rewire cross-border payments: https://www.jpmorgan.com/payments/payments-unbound/volume-3/cross-border-payment-modernization

- OECD, OECD and G20: https://www.oecd.org/en/about/oecd-and-g20.html

- Financial Stability Board, G20 targets for enhancing cross-border payments: https://www.fsb.org/work-of-the-fsb/financial-innovation-and-structural-change/cross-border-payments/g20-targets-for-enhancing-cross-border-payments-2/

- World Bank, Remittance prices worldwide: https://remittanceprices.worldbank.org/

- Swift, Beyond borders: Progressing towards the G20 targets for enhancing cross-border payments: https://www.swift.com/news-events/news/beyond-borders-progressing-towards-g20-targets-enhancing-cross-border-payments

- Inpay, Why transparency matters in cross-border payments: https://www.inpay.com/news-and-insights/why-transparency-matters-in-cross-border-payments/

- Deutsche Bank, G20 roadmap: forging a path to enhanced cross-border payments: https://corporates.db.com/files/documents/publications/DB-G20-Roapmap-WP-40pp-Web-Secured.pdf

- Financial Stability Board, G20 Roadmap for Enhancing Cross-border Payments: https://www.fsb.org/uploads/P211024-1.pdf