Buy Now Pay Later on the Temenos Banking Cloud

Driven by Explainable AI, our Buy Now, Pay Later solution is delivered as a service for banks and non-banks, to help businesses increase and accelerate their sales cycle by embedding variable instalment loans at the point of sale.

Smarter Buy Now Pay Later

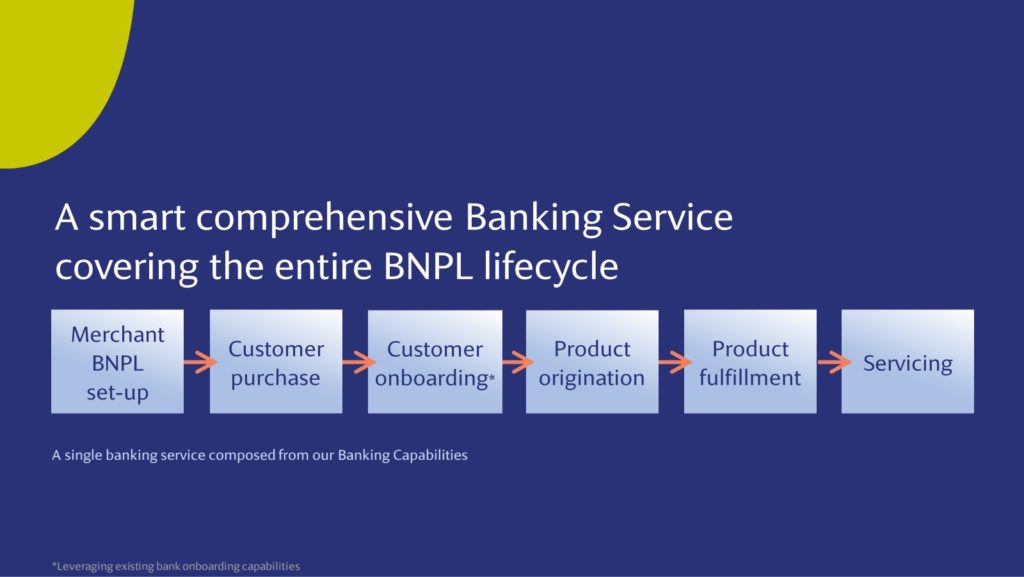

To seize the BNPL opportunity you need to rapidly deliver the embedded lending experiences that consumers demand. Temenos for BNPL enables you to extend variable instalment loans as an embedded service for merchant and retail customers, or to convert prior purchases into pay later agreements.

Reverse disintermediation

Banks are under growing pressure as specialist Buy Now, Pay Later (BNPL) players have entered the market, increasingly displacing them from the short-term consumer credit market. Banks can reverse this trend and win new business, both with merchants and consumers, if they act now. Temenos Buy Now, Pay Later, combined with our patented Explainable AI (XAI), helps create more responsible BNPL programs by providing transparency into automated decisions and by matching BNPL customers with appropriate credit offers based on their history.

Accelerate growth

Available as-a-service on the Temenos Banking Cloud, banks and non-banks can rapidly consume a market-ready Buy Now, Pay Later solution. APIs can be used to rapidly integrate with customer-facing channels so that facilities can be embedded into consumer checkout processes with ease. This means banks and fintechs reach new customers, fast and efficiently. All with a solution powered by battle-tested banking capabilities and a platform proven to scale to over 22 million loan applications in just nine months.

Adapt with regulation

In a rapidly changing lending environment, support prudent BNPL lending practices, with Temenos XAI to enable clients to pre-approve loan applications or propose variable instalments in real-time, based on pre-determined criteria, including soft and hard credit scoring. XAI provides transparency to decisions so banks and fintechs can lend ethically and provide transparency into recommended payment schedules – ensuring that consumers can afford the repayments and that providers can evolve with new market requirements.

The Temenos Buy Now Pay Later service is a banking service on the Temenos Banking Cloud. Elastically scalable, the solution provides credit processing capabilities and an eXplainable AI (XAI) driven credit decision engine to power origination processes and provide immediate recommendations about credit provision. This, on-the-spot decisioning is vital for the success of your BNPL solution, ensuring a frictionless experience for the customer, and reduced credit risk. An intuitive API and low-code extensibility allows the BNPL service to be seamlessly integrated with merchant point of sale systems.

or any part, of the journey.

Rapid time-to-market

Limitless scalability

Ease of integration and configuration

Fast and responsible credit decisions

Increased sales and loyalty for merchants

Convenience for consumers

Measurable success

15%

faster time-to-market for new products – retail banks with Temenos Product Builder*

65%

fewer non-performing loans – banks with Temenos Analytics*

53%

fewer write-offs – banks with Temenos Analytics*

22M

leading payment provider scaled with Temenos Buy Now, Pay Later across millions of accounts in 9 months.

*Comparison from Temenos CEO Navigator between banks live with Temenos capabilities and those who are not

Smarter BNPL

Two-thirds of adults have used embedded finance in the last 12 months. Services like Buy Now, Pay Later have seen over $10bn in revenue conceded by banks to big tech and fintech competition. This short demo explores the value and benefits of Temenos for Buy Now Pay Later. PayArrow Bank walks through the challenges of finding a suitable solution and the benefits of a modern solution, including seamless and fast merchant integration, responsible lending with XAI, a pay later solution for existing customers and fast time to market with the Temenos Banking Cloud.

“Now, due to the straight-through-processing and integration capabilities of the Temenos platform, a customer can submit their application online and open an account within minutes.”

Mark Sawyer

General Manager, My Life My Finance

“Temenos offered the ideal combination for reliability, scalability and affordability. What’s more, Temenos offered exceptional integration with the third-party solutions we needed to build a secure service. Running the platform in the cloud is also perfect as we do not have to worry about managing infrastructure, which helps to limit our IT costs.”

Guillermo Gomez del Campo

CEO, Prestanomico

See more success stories

Powering responsible lending

Leverage XAI to speed up underwriting, maximize financial well-being, ensure affordability and power more ethical lending practices.

Scale operations for business growth

Delivering the BNPL service via the Temenos Banking Cloud reduces the fixed costs of operations and allows BNPL providers to elastically scale as needed and on-demand. It also enables additional banking services to be embedded as part of Banking-as-a-Service propositions.

Modern retail banking

Innovate front-to-back with agility and speed using the latest cloud and API technology with our retail banking functionality.

Open Banking and The Rise of Banking-as-a-Service

Post-Pandemic Banking Trends: How To Weather The Perfect Storm

Open Technologies and BaaS Platforms Are Making Banking Invisible

Want to harness the power of BaaS? Then modernize your core with cloud and API

The Rise and Rise of Banking-as-a-Service

Explore Related TCF Sessions

Scale: The Network Effect in Banking – Cloud, BaaS, and Fintech Ecosystems

Drive unlimited scale with SaaS and increase your reach. See how banks are accelerating new propositions with fintech integration and BaaS.

Everyone's Banking Platform: Our Vision, Your Opportunity

Banking is moving beyond borders and boundaries. And through our open platform for composable banking, big opportunities are emerging. Hear the vision behind Everyone’s Banking Platform in this keynote address by Max Chuard, CEO, Temenos.

Grow: Creating New Opportunities with Smarter Products

See the latest in smart product creation and composable banking services and how to innovate at speed to win new business.