Turning SME Banking Around with Virtual COO

From Finding to Funding: Reimaging How We Serve the SME Sector

By Luis Pazmino, Innovation Director – Temenos Infinity

One of the key challenges for SMEs, as we all know it – is FUNDING. Sometimes due to a lack of information, the banks can’t lend. And sometimes they can, but the process is too slow. And in some instances, unfortunately, the SME’s needs are outside the bank’s risk tolerance.

On 3 Dec 2021, at LendingUp! – Turning Loans Around, Temenos shared the vision of the reimagined approach through which banks can now serve the small business sector, better!

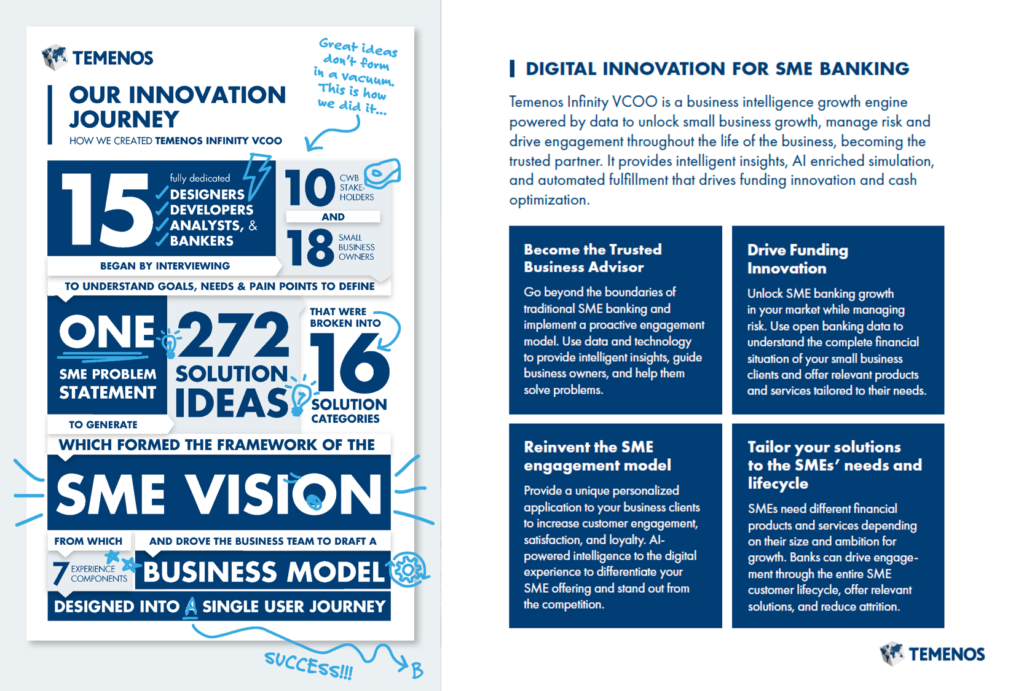

Turning SME Banking Around with Temenos Infinity Virtual COO

“We see an opportunity to fundamentally reimagine how to serve the SME sector, to implement innovative digital-centric, data-driven products and services that can transform the experience of SMEs in areas like onboarding, lending, cash flow management and trade finance. Digital is at the heart of the next wave of SME banking services. And we want the banks to be perceived as the SME partner, not a barrier.”

A COO in your pocket!

An Open Banking-Ready SME Solution, going Beyond Banking to drive Sustainable Growth

Temenos Infinity VCOO is a virtual advisor in the small business owners’ pocket powered by data, analytics, and AI. Its job is to empower the business owner to make intelligent decisions, solve problems and free up time to grow their business. It puts ambition, control, and confidence back into the hands of the SME.

There is a recognised need for SME banking services to move “beyond banking” with their SME value proposition to address the top-of-mind needs of SME owners. Holistic solutions involving collaborations with other (Digital) service providers will be needed.

Digital Innovation for SME Banking

Unlock the SME Growth Potential!

The SME sector is the largest underserved profit pool in the entire banking industry. According to McKinsey’s Dec-2021 Global Banking Annual Review Report, small and medium-sized enterprises (SMEs) represent one-fifth (about $850 billion) of annual global banking revenues. Comprised of deposits, lending, overdrafts, and payment, the SME figure is expected to grow by 7% to 10% annually over the next five years making the small business sector one of the largest, lowest-risk profit pools in the entire industry.

Nevertheless, “SMEs have been an underserved market due to its perception of being high-risk with low growth potential, especially due to lack of visibility of the SMEs financial situations”, says Luis.

Banks have been servicing this market segment with a blend of Retail and Corporate Solutions, and it is widely recognised that this does not fit the evolving needs of today’s SMEs. “While lockdowns brought a lot of limitations to SMEs, the situation also accelerated digital transformation and required the owners to be not only tech-savvy but also financially-savvy”.

If banks do not move quickly to engage with SMBs digitally, they risk losing as much as 60% of their overall profits to FinTech attackers over the next decade!