Temenos for Fund Administrators

A single, global platform to help the world’s leading Fund Administrators enter new markets, launch new services and win new business.

The leading platform for fund administrators

A complete solution to thrive in the digital age and deliver operational efficiency increased control and oversight and reduced operational risk.

Single, global platform

A single, global platform for middle office (IBOR), fund accounting (ABOR) and transfer agency/investor servicing. Temenos Multifonds covers the full investment lifecycle for both traditional and alternative funds across multiple jurisdictions.

Faster time-to-market

Achieve a faster time-to-market, by leveraging over 25+ years’ experience in the delivery of core fund administration solutions. We focus on providing global software with localized capabilities, to institutions of any size, anywhere in the world.

Leading scalability

With cloud-native, cloud-agnostic software and API frameworks, our clients can leverage on-demand, elastic cloud scalability, enabling them to process higher volumes of transactions with less infrastructure.

A single, global platform to consolidate fragmented, legacy systems, increase control and oversight, and reduce operational risk. Temenos Multifonds delivers the functionality, scalability and flexibility to address the demands of investors and the asset management industry today and tomorrow.

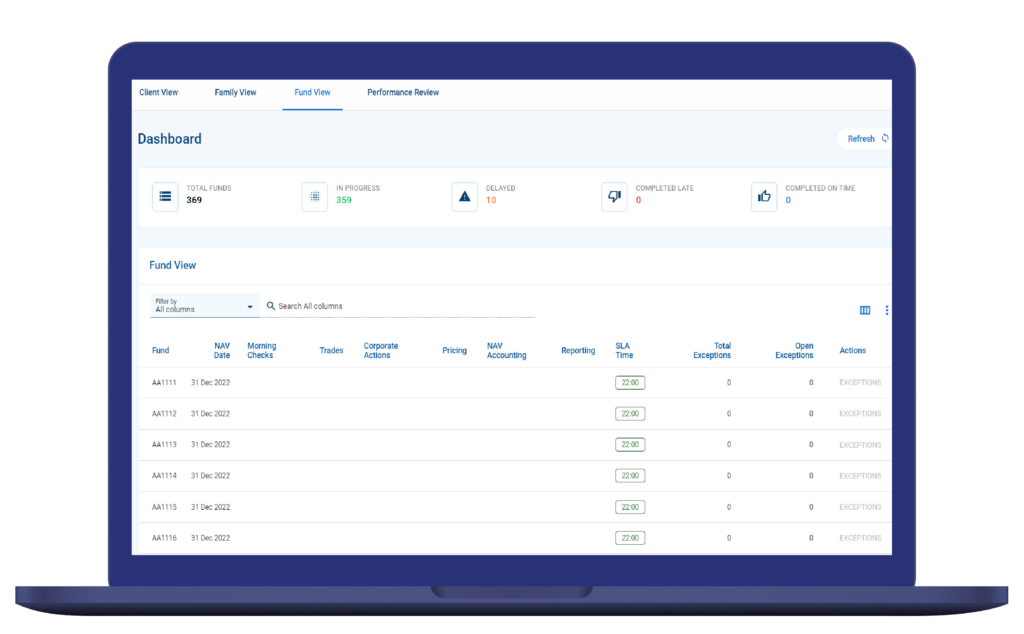

Workflow and exception-driven processing

Fully integrated IBOR and ABOR

Digital, data-driven solutions

Intelligent reporting

Broad asset coverage

Multi-jurisdictional support

Measurable success

9

of top 15 global fund administrators supported

30+

countries

30000+

funds

$10

trillion assets supported

Frequently asked questions

Yes. Temenos Multifonds’ integrated general ledger and investment ledger provide support for middle-office functions in the form of a dynamic, flexible, real-time Investment Book of Records (IBOR). It also supports a robust, highly scalable fund accounting engine for fund and portfolio valuations and NAV calculations.

Our unique Workflow and Exception Manager is what sets Temenos Multifonds apart. It enables fundamental improvements to the efficiency of fund operations, improving key metrics and ratios, delivering enhanced client service, and enabling organizations to respond quickly to market changes and demands.

Temenos Multifonds offers apps for distributors and retail investors that enable self or assisted onboarding, direct access to investments and the ability to review the evolution of their portfolio over time. Additionally, transparent data allows clients to gain insights and drive their digital futures.

Yes. Temenos Multifonds has fully integrated and sophisticated KYC and AML frameworks to guide users through the requirements for appropriate due diligence, not only on registration, but through the entire life of an investor’s holding.

Designed for the digital age, our software allows faster updates, lower provisioning, lower infrastructure costs, elastic scaling, active-active resilience, and security. All built using API-first and DevOps principles.

Temenos’ open APIs allow you to integrate quickly with a wide range of internal or external systems to help drive your product and service innovation.

Find out more

about our solution for Fund Administrators.

“We are delighted to continue this strategic, long-standing partnership with Temenos. Its investment in R&D means that we will continue to benefit from cutting-edge, next-generation banking software, to enhance operational efficiency and streamline our operating model to enable us to quickly onboard new jurisdictions and grow our business over time.”

Alain Pochet

Head of Client Delivery, BNP Paribas Securities Services

“As a committed bank user to Multifonds for almost ten years, we have leveraged the true globality of the system while still being able to support our client, product and asset needs of the 20 local on-the-ground markets in our Fund Services business. The system continues to be an enabler for the bank to support growing market share and ever-increasing client sophistication.”

Shikkoh Malik

Global Head of Funds Services Banking, Standard Chartered Bank

See more success stories

Unified investment accounting

On a single platform, support traditional and alternative funds and combine key asset servicing, position keeping, valuation and accounting functions for all structures of pooled vehicles and funds, across multiple jurisdictions.

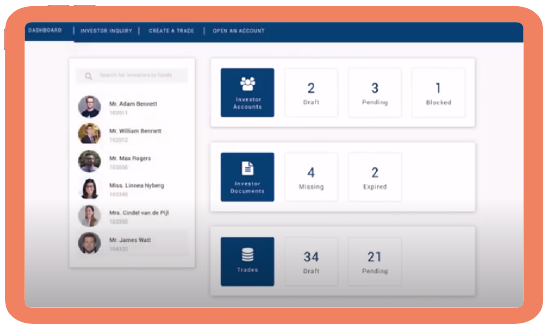

Transforming investor servicing and transfer agency

Streamline the distribution chain by digitizing the onboarding process with a modern technology platform. Leveraging our sophisticated Investor Servicing app, as well as the unique API framework which seamlessly integrates SWIFT and NSCC counterparties, to find new efficiencies and reduce risk.

Efficient investor onboarding

No lengthy paper forms, no faxes, no emails, no admin delays. Just seamless onboarding and task management, supported by real-time data connectivity, whenever and wherever it’s required.

Simplifying limited partnership accounting

Effortless support for limited partnership structures including business-rule driven income allocations, asset-based fees, incentive fees and performance return calculations. Reduce the risk with a solution that provides highly automated processing and complete transparency to you and your investors.

Next-generation ETF administration

With integrated management of the portfolio composition file (PCF) creation process for Exchange Traded Funds, Temenos Multifonds enables all parts of the PCF lifecycle to be highly automated and controlled. It is the only fund administration platform on the market with integrated PCF basket calculation.

The Future of Fund Administration

ETF Administration Webinar